7004 Form 2024

If you are running a business in the United States, then you have probably heard about the 7004 form before. This is one of the practical forms that are quite helpful for business owners in their taxing operations. Every year, the forms required and published by the IRS change, and if you are planning to request an extension, you may need to look for the 7004 form.

In this guide, we have shared detailed information on the 7004 form, its instructions, where to file the form, and more about the extension conditions and dates. Although your accountant can take care of the extension request, you do not have to pay extra to anyone.

This form can be filed by the business owners as well, and you will not have to worry about any costs. All you need to do is to follow a certain procedure, which we will cover in the following sections.

Form 7004 Instructions

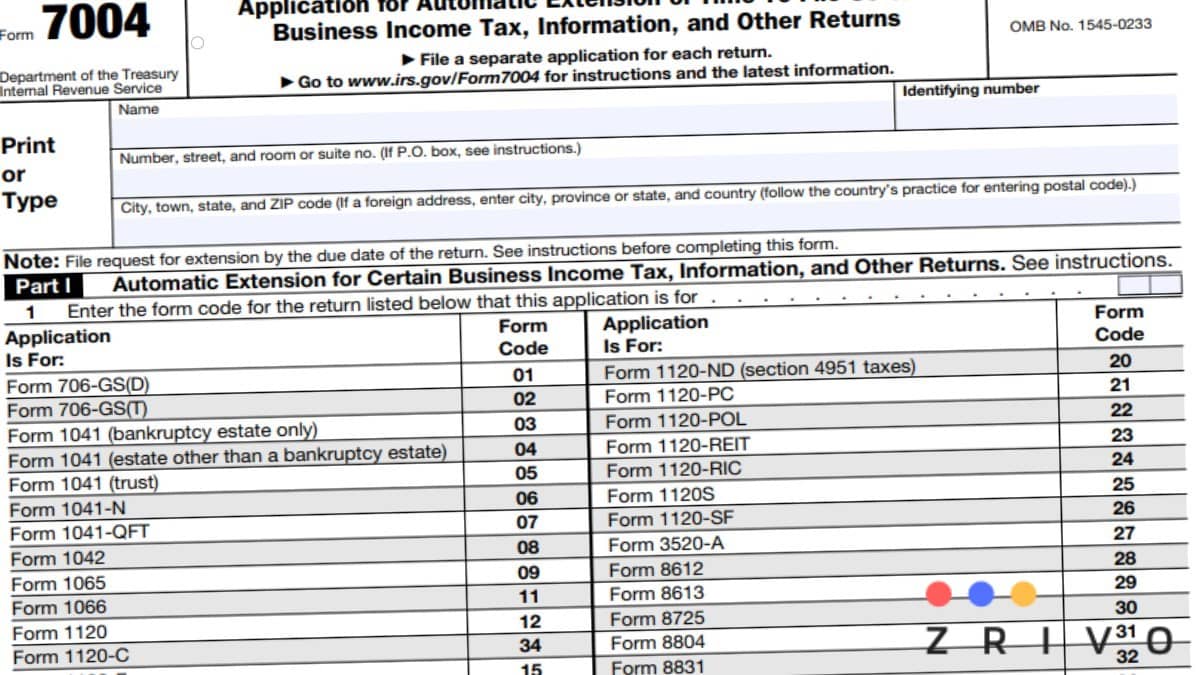

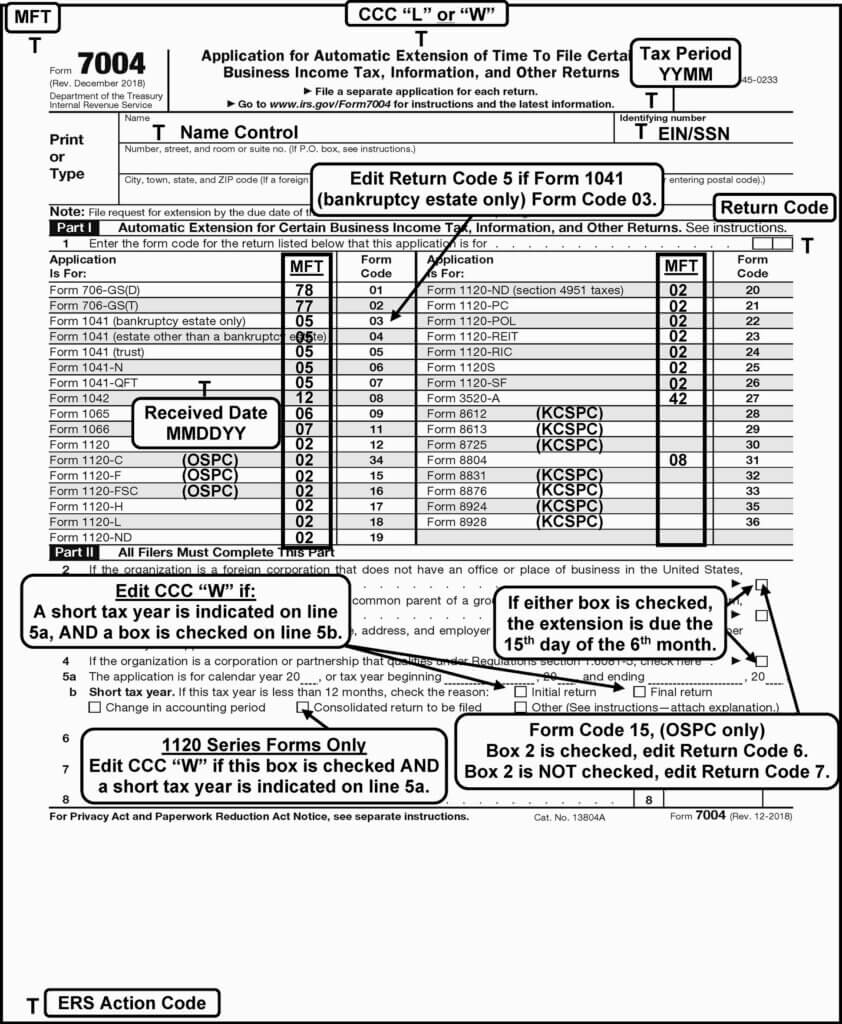

As we noted before, 7004 Form is designed for business owners, and it helps them request an automatic extension of time. This extension is requested for any kind of return, information, or business income tax. However, you need to fully complete the form to benefit from this opportunity.

Moreover, if applicable, you also need to provide a proper tax estimate and submit form 7004 before its due date for the requested extension. Due tax obligations also apply to business owners. Another important issue that you need to consider is that you can use only one 7004 Form for each return. If you are planning to apply for multiple extensions of time, you will need to file multiple forms.

As a business owner, you also need to provide your full name and address on the form. If your name has changed since the previous year when you filed your tax return, you need to write down your previous name.

Where to File Form 7004?

As you might guess, depending on the tax return type or the location of your current business, the address you need to mail your 7004 Form varies. However, most of the time, you can file form 7004 electronically. However, there are some exceptions as well. If you are going to file form 7004 for forms such as 706-GS, 8876 form, 8831 form, 8725 form, 8613 form, and 8612, you should not file it electronically.

Those who have to mail or deliver their form 7004 should mail or bring it to the Department of the Treasury, Internal Revenue Service Center. You can find the addresses of these centers at the end of the form’s “where to file” section.

If you are going to mail your 7004 Form, you need to use the modernized e-file system to send your form. There are also third-party software solutions you can choose from on the internet for the operation. On the other hand, if you are working with a tax professional, you can request that they handle the filing process on your behalf.

Form 7004 Extension

Form 7004 guarantees an extension of time for business owners to file certain returns, business income tax, and information. Any business owner has the right to take advantage of this opportunity.

One thing you need to be sure of to benefit from this opportunity is that you fully fill out the form depending on your unique conditions. If you have never filed such a form before and really need the extension of time, you may want to consider working with a tax professional.

He or she can handle all the operations on your behalf and let you enjoy the benefits provided by the government. However, this is a process that any business owner can handle on their own without any assistance or cost.