Schedule D (Form 1040)

The IRS requires taxpayers to file Schedule D (Form 1040) if they have realized capital gains or losses from property sales. This tax form includes special computations.

Investors who sell securities, real estate, options, futures, or cryptocurrency must report these transactions on Schedule D. Taxpayers can also use this form to report capital loss carry-overs from previous years. The IRS Schedule D is a tax form that can be filed by individuals or corporations to report capital gains or losses. This form is often used to report stock sales, but it can also be used for the sale of other types of assets or investments. It is normally submitted along with the individual or corporate tax return Form 1040. The calculations from Schedule D are reported on Form 1040, affecting the total amount of taxes owed.

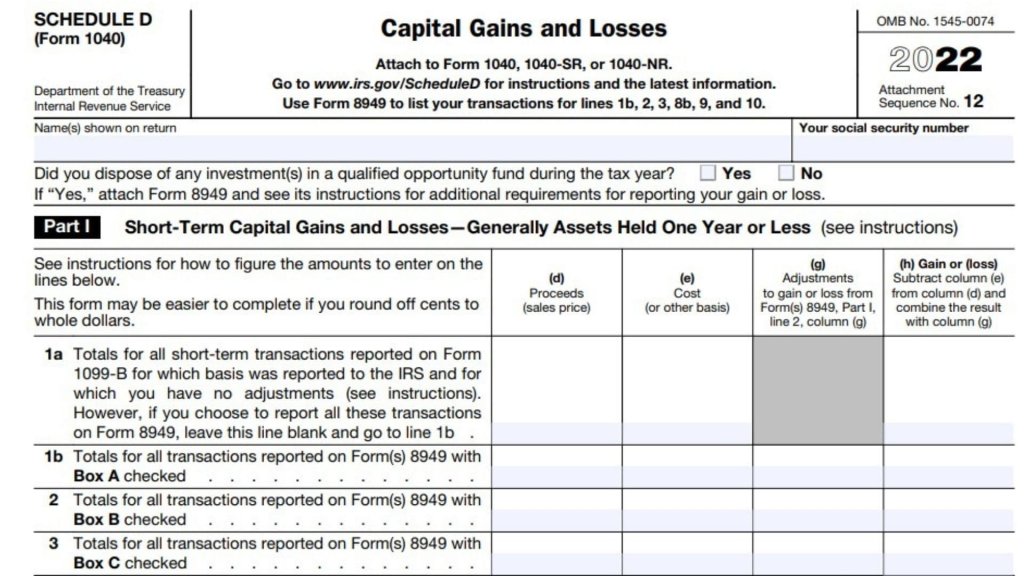

The form contains sections for short-term gains and losses and long-term gains and losses. It calculates the net proceeds from the sale of assets and then compares them with the cost bases of those assets. The differences are then used to determine the appropriate tax rates that will apply to the sale of the asset. The final result is then reported on the individual or corporate tax return.

How to fill out Schedule D?

To fill out Schedule D, individuals should reference information from other tax forms, such as Form 1099-B for brokerage transactions and Form 1099-S for real estate sales. The gains or losses computed on Schedule D will then be reported as part of the individual’s adjusted gross income on their tax return. The IRS also classifies gains and losses into two categories: short-term and long-term. Short-term gains are taxed at the individual’s ordinary income tax rate, while long-term gains are taxed at rates between 0% and 20%.

In addition to reporting capital gains and losses, Schedule D requires individuals to report the cost basis of their assets. This information helps the IRS determine how much capital gains or losses are taxable. Individuals must also note whether their gains or losses are long-term or short-term, as this will affect the tax rate that they are charged.

In some cases, taxpayers will need to file more than one Schedule D. For example, some securities are classified as Section 1256 contracts and are reported on a separate form, Form 6781. These types of securities are typically sold at a discounted price, which can result in higher gains or losses than expected. If you sell long-term investments, the IRS requires you to complete Form 8949, Sales and Dispositions of Capital Assets, first. The information from this form will then be used to complete Schedule D. The instructions for Schedule D recommend using Part I of the form to report sales of short-term investments, while Part II should be used to report sales of long-term investments.

When completing the form, record all of your capital gains and losses, including those for which you have receipts (like your brokerage statements). You must also report your cost basis in the assets sold on this schedule, which is the original purchase price you paid for each item. You can get the original cost basis from your brokerage statements or by entering the amounts in the boxes on the form.