Form 1099-S

Form 1099-S is a tax form used to report the proceeds from real estate transactions. In this article, we will cover the purpose of Form 1099-S, who must file it, how to file it, and provide a step-by-step guide on how to fill out the form accurately.

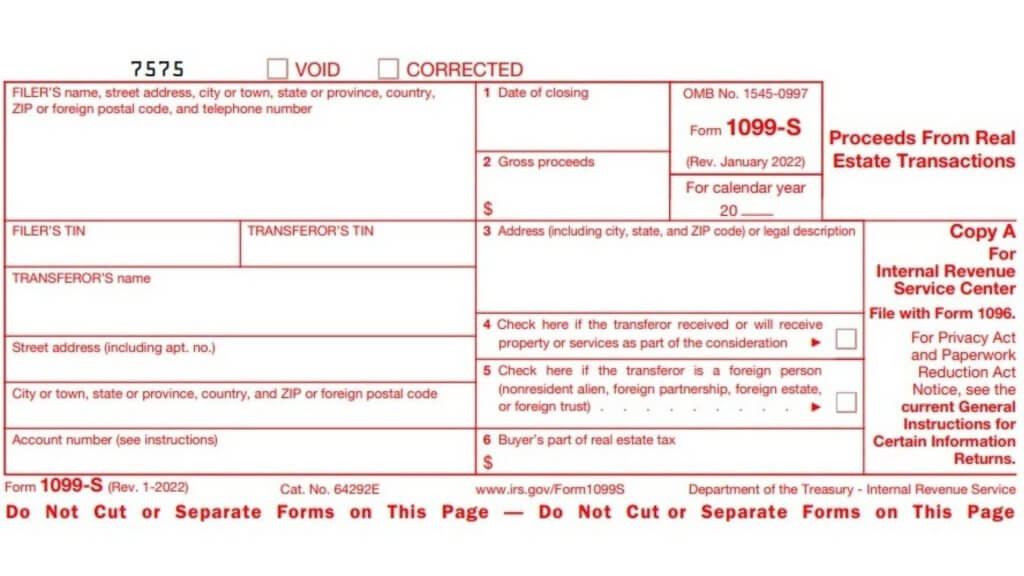

Form 1099-S, officially known as the “Proceeds from Real Estate Transactions,” is a tax form issued by the Internal Revenue Service (IRS) in the United States. The purpose of this form is to report the proceeds from real estate transactions, such as the sale or exchange of real property. It is generally used to report the sale of residential, commercial, or investment properties.

The primary purpose of Form 1099-S is to provide the IRS with information about the proceeds from real estate transactions. By reporting this information, the IRS can ensure that taxpayers accurately report any taxable gains or losses associated with selling or exchanging real property. Additionally, Form 1099-S helps the IRS enforce compliance with tax laws and regulations related to real estate transactions.

Who Must File Form 1099-S?

The responsibility of filing Form 1099-S lies with the person or entity responsible for closing the real estate transaction. This person or entity is usually the settlement agent, which can be a title company, an attorney, a real estate broker, or the buyer or seller of the property. The settlement agent is responsible for reporting the transaction to the IRS and providing copies to the seller and buyer involved in the real estate transaction.

It’s worth noting that not all real estate transactions require the filing of Form 1099-S. The general rule is that you must file Form 1099-S if you are the settlement agent involved in a reportable transaction. A reportable transaction is a transaction where the Seller is an individual, estate, partnership, or corporation, and the gross proceeds of the sale equal or exceed $600 during the calendar year.

How to file Form 1099-S?:

To file Form 1099-S, you must follow the specific instructions provided by the IRS. Here’s a step-by-step guide on how to file Form 1099-S:

- Start by obtaining a copy of Form 1099-S from the IRS website or a reputable tax software provider. You can also request a physical copy from the IRS by calling their toll-free number.

- Collect all the necessary information for the form, including the Seller’s name, address, taxpayer identification number (TIN), the Buyer’s name and address, the closing date, and the transaction’s gross proceeds.

- Carefully fill out Form 1099-S. Make sure all the information provided is accurate and complete. Double-check the data to avoid any errors or discrepancies.

- After completing Form 1099-S, you need to make copies for distribution. Provide one copy to the Seller involved in the real estate transaction and keep one for your records.

- Send the original form to the IRS. The filing deadline for Form 1099-S is typically at the end of February, following the calendar year the transaction took place. However, it’s essential to consult the IRS instructions or a tax professional to confirm the exact deadline, as it can vary.

- In addition to filing with the IRS, you may also have state-level filing requirements. Some states have their own version of Form 1099-S or may require additional reporting. Be sure to check the state’s specific requirements where the real estate transaction occurred.

How to fill out Form 1099-S?

Form 1099-S consists of several sections, and each section requires specific information. The following will help you fill out Form 1099-S without any trouble.

- In Seller’s information section, you will enter the Seller’s name, address, and TIN. If the Seller is an individual, their Social Security Number (SSN) is used as the TIN. If the Seller is an entity, such as a corporation or partnership, their Employer Identification Number (EIN) is used.

- Enter the Buyer’s name and address in Buyer’s information section.

- Provide the complete address of the property that was sold or exchanged.

- Indicate the date on which the real estate transaction was closed (Date of closing)

- Enter the gross proceeds from the sale or exchange of the property. This amount represents the total amount paid to the Seller before any deductions. (Gross proceeds)

- Check the appropriate box to identify the type of Seller involved in the transaction. Depending on the situation, you may need to provide additional information or attach additional forms.

- If the Buyer assumed or took the property subject to an existing mortgage or contract, enter the assumed or contract price.