Individual Taxpayer Identification Number (ITIN)

An Individual Taxpayer Identification Number (ITIN) is a nine-digit number used by the IRS for identifying taxpayers. This article covers everything you need to know about ITIN.

Contents

The Individual Taxpayer Identification Number (ITIN) is a nine-digit number issued by the IRS for individuals who do not have a Social Security number (SSN). ITINs are used for filing taxes and claiming insurance-premium tax credits. A TIN allows an individual to seek employment in the United States, obtain credit with banks and other lenders, and file annual tax returns with the IRS. It also enables individuals to obtain public benefits such as Medicare and Social Security. If you have children, you can use your ITIN to claim the Earned Income Credit and Premium Tax Credit for parents on US-born children’s health insurance. Filing your taxes also ensures that you are up to date on your tax obligations and helps protect your identity from identity theft.

An ITIN is nine-digits long and has a range of numbers from 50 to 65, 70 to 88, 90 to 92, and 94 to 99 for the fourth and fifth digits. The middle digit is always between “9” and “7.” For those without SSNs, the ITIN is the only way to report and pay taxes in the U.S. ITINs are also required by nonresidents who receive a taxable scholarship or fellowship through Student Fiscal Services/the University.

How to Obtain ITIN?

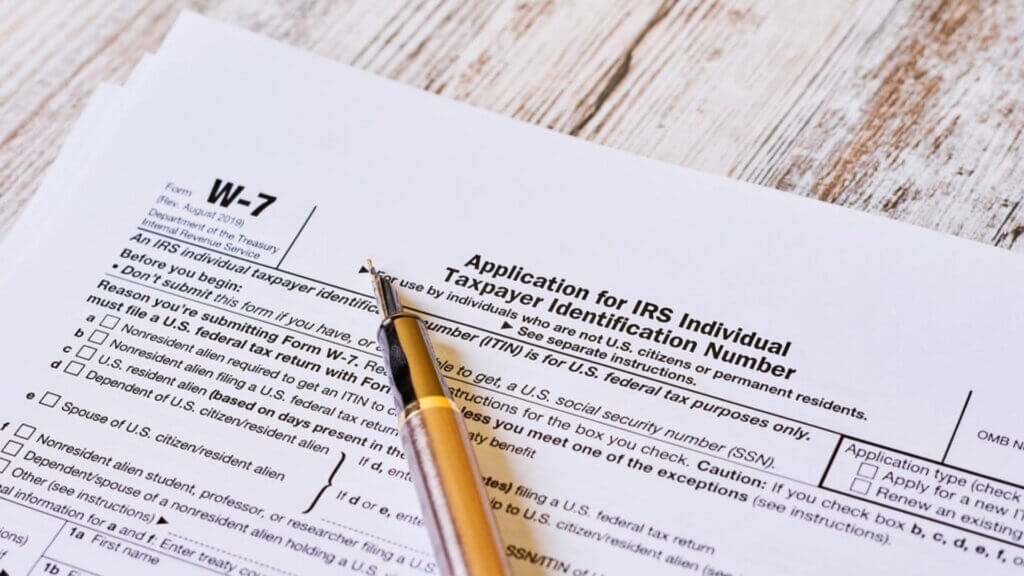

Obtaining an ITIN is quick and easy, but you do need to submit a Form W-7 Application for ITIN with the required documentation to the IRS. This process usually takes seven weeks. The Internal Revenue Service requires international students to get ITINs for tax purposes if they are ineligible to get a SSN from the Social Security Administration. This includes F and M students who are on J-1 status, GSI and FNIS scholars, and nonresident aliens.

To apply for an ITIN, you must complete your W-7 and submit it to the IRS with proof of your identity and foreign status. You can download the form from the IRS website. You may also need to provide documents proving your eligibility, including proof of non-residency, such as an I-20 or an F-1 student visa. Once your application is approved, you will get your ITIN through the mail. You may also apply in person at an IRS Taxpayer Assistance Center (TAC). TACs are staffed by individuals authorized by the IRS to authenticate applicants’ documents and return them to them.

After you have received your ITIN, you must use it when filing your taxes and claiming treaty benefits. However, you do not need to renew your ITIN when you use it for information returns only. If you need to file a US federal tax return in the future, you will have to renew it again.

FAQs

What is an ITIN?

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS) to individuals who are required to have a U.S. taxpayer identification number but are not eligible for a Social Security number.

Who needs an ITIN?

Individuals who are not eligible for a Social Security number but have a tax filing obligation in the United States, such as nonresident aliens, resident aliens, and their spouses and dependents, need an ITIN.

How do I apply for an ITIN?

To apply for an ITIN, you must complete Form W-7, Application for IRS Individual Taxpayer Identification Number, and submit it to the IRS along with your tax return or other documentation required by the IRS.

How long does it take to get an ITIN?

It typically takes the IRS about 7 weeks to process an ITIN application. However, it may take longer if the IRS needs more information or if you submit an incomplete application.

Is an ITIN the same as a Social Security number?

No, ITINs are issued by the IRS for tax processing purposes only, while Social Security numbers are issued by the Social Security Administration for a variety of purposes, including employment, benefits, and identification.

Do I need to renew my ITIN?

If you have not used your ITIN on a federal tax return at least once in the last three years, or if your ITIN has a middle digit of 88, 89, 90, 91, 92, or 94, you will need to renew your ITIN before filing a tax return. You can renew your ITIN by submitting Form W-7, tax return, or other required documentation.

Can I use my ITIN to work in the United States?

No, an ITIN is not a work authorization and does not provide permission to work in the United States. If you want to work in the United States, you will need to apply for a work visa or work authorization through U.S. Citizenship and Immigration Services (USCIS).

Can I open a bank account with an ITIN?

Yes. Many banks and credit unions accept ITINs as a form of identification for opening accounts.