Where to file Form 843?

When it comes to filing taxes for your company, you need to know the requirements and procedures. One of these requirements is where to file Form 843.

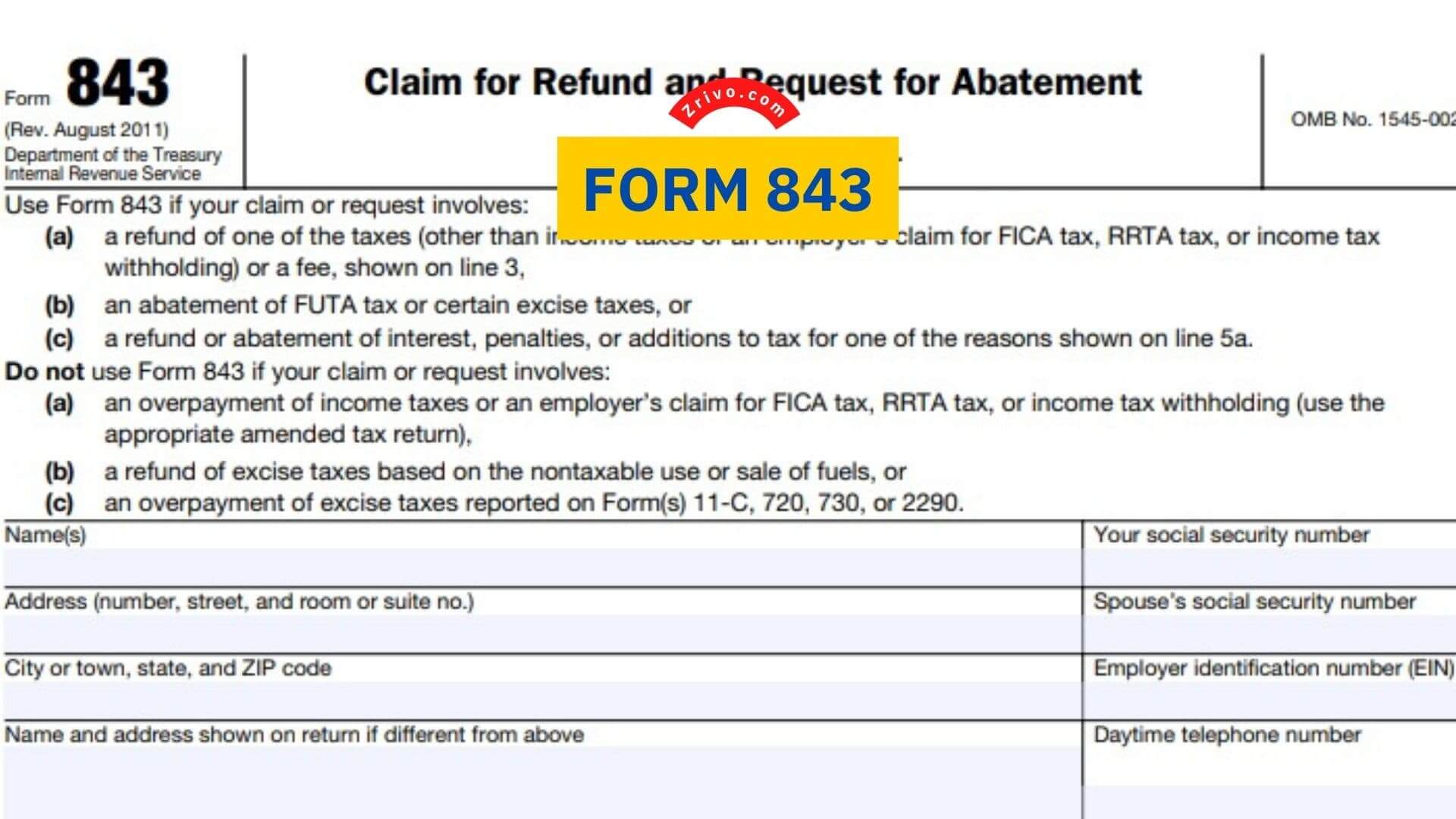

Form 843 is a tax form issued by the Internal Revenue Service that allows a taxpayer to request a refund or abatement. Depending on the type of tax you’re claiming, you’ll need to fill in specific information. Not all IRS forms are filed to the same address. You may face penalties from the IRS if you fail to address where to file Form 843.

You may be eligible to request a refund or abatement if you have been assessed additional taxes, fees, or penalties that are not owed. For instance, you may have overpaid your social security or Medicare taxes, or your employer withheld too much. If you’ve made an error on your tax return, you can file Form 843 to get a refund.

Mailing Addresses for Form 843

The IRS will usually respond to Form 843 within a few months. However, some cases take longer. If you have a complicated case, it is a good idea to contact an experienced tax professional.

If you are a first-time applicant, you can submit your Form 843 by phone. Otherwise, you must send it to the nearest IRS service center. Alternatively, you can send a letter.

The address you will need to file Form 843 depends on why you’re filing it. A couple of situations may require you to file Form 843 form to different addresses. Here is the list, including all the locations needed for filing Form 843:

| The Reason for Form 843 Filing | The Adress Where the Form Must be Mailed to |

|---|---|

| After an IRS notice regarding a tax or fee related to certain taxes ( income, employment, estate, gift, excise…) | The address given in the notice |

| For Form 706/709 tax refund claim | Internal Revenue Service Center Attn: E&G, Stop 824G 7940 Kentucky Drive Florence, KY 41042-2915 |

| For penalties, or for any other reason other than an IRS notice (see above), an estate tax claim for refund (see above), or Letter 4658 (see below) | The service center where you would be required to file a current year tax return for the tax to which your claim or request relates. See the instructions for the return you are filing. |

| In response to Letter 4658 (notice of branded prescription drug fee) Note. To ensure proper processing, write “Branded Prescription Drug Fee” across the top of Form 843. | Internal Revenue Service Mail Stop 4921 BPDF 1973 N. Rulon White Blvd. Ogden, UT 84404 Caution. Use this address only if you are claiming a refund of the branded prescription drug fee. |

| For requests for a net interest rate of zero | The service center where you filed your most recent return |