Form 843 is a multifunctional tax form that you can use when requesting a refund or abatement of some taxes, penalties, and interest. The form is used to claim a refund for certain types of taxes and fees, and it can also be used to request an abatement for other types of tax and fee debts that were wrongly assessed by the IRS. It is also used to ask for a refund of Social Security or Medicare tax that was withheld by an employer. It can also be used to ask the IRS for an abatement of interest or penalties due to IRS error or delay, incorrect written advice from the IRS, or unreasonable cause. It also can be used to request a refund of certain excise taxes or FUTA tax. You can also use it to request a refund of certain taxes, such as FICA or Railroad Retirement Tax Act (RRTA) taxes that were improperly withheld from your paychecks by employers.

How to file Form 843?

The Form 843 instructions can be confusing at best, so it is important to read them carefully. It can help you better understand what the IRS is looking for in your request. Generally, you must file this form within three years of the filing date for your original return or two years after your taxes were paid, whichever is later. You cannot use it to claim a refund of gift tax overpayment, estate tax overpayment, additional Medicare taxes, or excise taxes that result from nontaxable fuels.

You may also file this form if you need to ask the IRS for an abatement of interest, penalties, or tax additions due to error or delay. These could include errors on your tax returns, incorrect written advice from the IRS, or penalties for unreasonable cause.

Another reason to file this form is if your employer withheld income, Social Security, or Medicare tax in error and will not make any adjustments. You may be able to receive a refund of these tax amounts if you have a good record with the IRS and can provide supporting documents.

This is a time-sensitive matter, so starting the process as soon as possible is important. You should also submit a copy of the penalty notice you received along with Form 843.

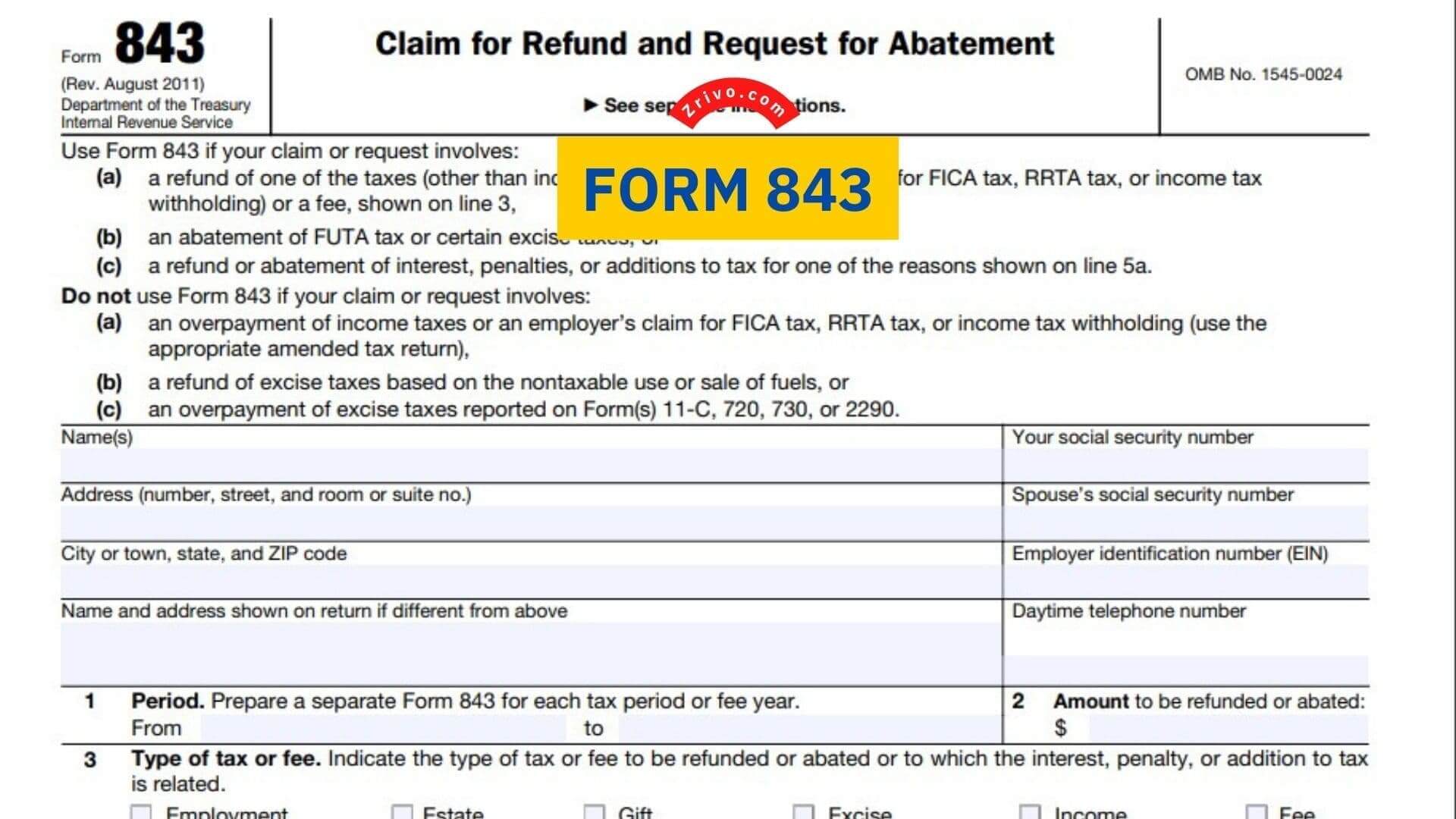

- To complete Form 843, you need to include your name, address, Social Security number, and the tax period. You also need to state the reasons you are asking for an abatement and, if necessary, attach any relevant documentation.

- Lastly, you need to write the Internal Revenue Code section number on Line 4. This is the number of the penalty that you are requesting an abatement for.

You should complete the form and mail it to the IRS as completely as possible, including all the required information. This will help the IRS understand what you are asking for and why it is appropriate for them to give you a refund or abatement.