W-4 Forms

IRS tax withholding form. Fill out Form W-4 accurately to adjust the taxes withheld from your paycheck. Online fillable and printable versions of Form W-4.

-

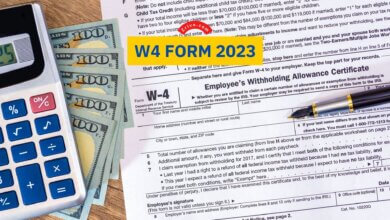

W4 Form 2023 - 2024

Who Needs to Fill Out a W4 Form? Eligibility: Anyone who is employed in the United States and earns income…

-

Form W4 Spanish 2023 - 2024

Form W4 Spanish, also known as Form W4 SP is the employee’s withholding certificate in Spanish. Employees can fill out…

-

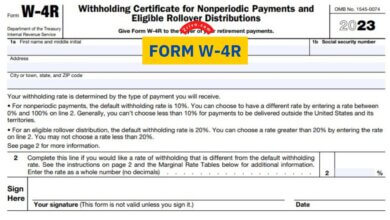

Form W-4R 2023 - 2024

If you work at a company that pays out nonperiodic payments or eligible rollover distributions from an employer retirement plan,…

-

How to Get the Right Amount of Tax Withheld?

Getting the right amount of tax withheld might be challenging, especially when you are not working with a tax professional.…

-

W-4 Penalties

Form W-4 isn’t mandatory to file as an employer can just withhold at the highest single rate, but there some…

-

W4 Spanish Instructions 2023 - 2024

The Internal Revenue Service has the Spanish version of Form W-4. This version of Form W-4 used to be only…

-

W4 Exempt Status – Stop Federal Tax Withholding

Federal income tax withholding is mandatory, but what if you’ve withheld enough taxes so far? There isn’t really a point…

-

W4 Mailing Address

Form W4 is the tax withholding form to let employers know by employees about their anticipated federal income tax returns…

-

W4 Form Instructions 2023 - 2024

Form W4, Employee’s Withholding Certificate, or formerly known as the Employee’s Withholding Allowance Certificate has been updated for the tax…

-

W4 Extra Withholding 2024

The federal law requires employers to take a portion of their employees’ wages and forward them to the Internal Revenue…