How to Get the Right Amount of Tax Withheld?

Getting the right amount of tax withheld might be challenging, especially when you are not working with a tax professional. We highly encourage you to receive professional support for seamless transactions and operations. However, this doesn’t mean you can’t handle all these procedures on your own. Thus, we have compiled this guide to show you how to get the right amount of tax withheld.

If you follow the instructions and procedures stated by the IRS, you can get the right amount of tax withheld without having any problems. All you need to do is just be more careful while filing the forms. You should also submit your IRS forms on time.

How to Check Your Withholding Amount

You can use the tax withholding estimator offered by the IRS. All you need to do is visit the official website of the IRS and locate the relevant estimator. It is especially beneficial for employees in deciding whether they need to give the new Form W-4 to their employers or not.

You can also get help from this estimator while filling out your forms and accurately calculating your income tax withholding. However, sometimes things may not be that easy, and you may have things to consider, which makes everything more complex.

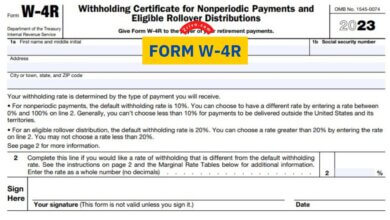

In these times, you can prefer to use Publication 505 instead of the tax withholding estimator on the IRS website. This publication helps employees with all kinds of exceptions, such as when they owe tax, have alternate minimum tax, or have unearned income from their dependents. Moreover, if you have income from sources such as royalties, rents, capital gains, or dividends, Publication 505 will be quite helpful for you.

The publication also provides examples and worksheets for different scenarios to guide taxpayers in accurately calculating their tax withheld.

When Is the Best Time to Check Your Withholding?

There are certain times and events that are best in terms of checking your tax withholding. Experts recommend checking it under the following conditions:

- If it is early in the year,

- If the tax law changes

- When you marry, divorce, have or adopt a child, purchase a home, retire, or file Chapter 11 bankruptcy.

- When you have medical expenses, dependent care expenses, earned income tax credit, child tax credit, gifts to charity, interest expenses, taxes,

- If you have taxable income which is not subject to withholding, such as IRA distributions, the gig economy, self-employment income, capital gains, dividends, and interest

- When you or your spouse quits his/her job or starts working in a second job,

These are the best times to check your withholding to make sure everything is as it should be.