W4 Form Example for Single 2024

Contents

Form W-4 is a tax form that employees fill out to adjust how much tax needs to be withheld from their income. Form W4 example for single filers can be found in the rest of this article.

First and foremost, if you don’t file Form W4, your employer will consider you as a single filer with only the standard deduction on the tax return. Having said that you should fill out Form W4 before your employer starts processing payroll.

For single filers, Form W4 is filled out the same way as any other employee with any other filing status.

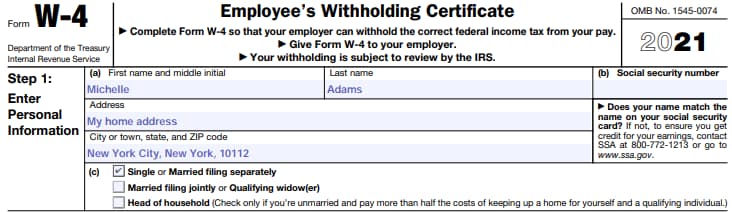

Form W4 Part 1

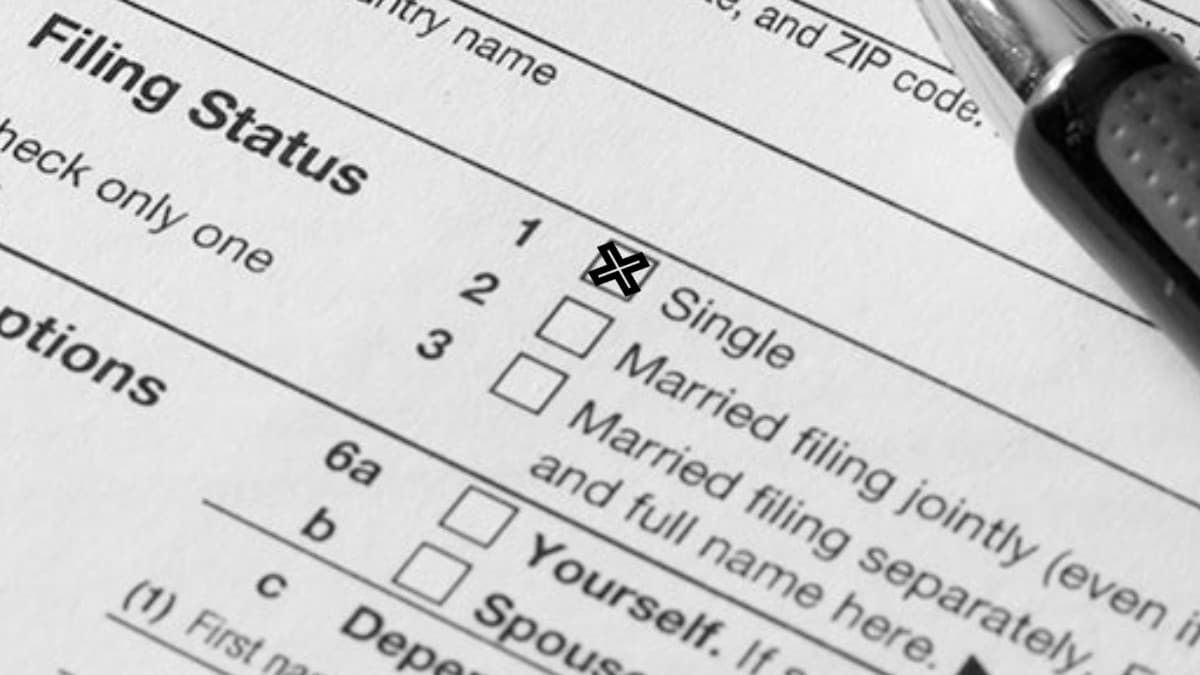

On Part 1 of 2023 Form W4, select your filing status as “Single or Married filing separately” and enter the rest of the personal information asked.

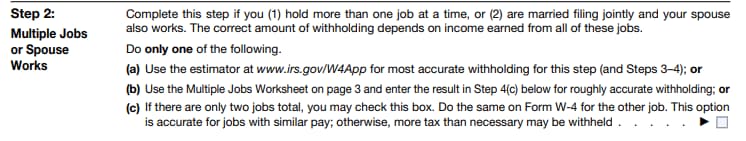

Form W4 Part 2 and Part 3 for Single Filers

Since you’re single, the parts where it concerns those who are filing a joint return doesn’t really involve you. If you’re holding a secondary job and both jobs pay you a similar amount, check the box on Part 2 (c). Check the box also for the secondary job you have.

In Part 3, you will claim dependents if you have any. Assuming you don’t, you can just skip this part. But, if you have dependents and you pay more than the half the cost of keeping up a home, you may qualify to file taxes as head of household. If you’re qualified, make sure that you do so since you get a lower tax rate and a higher standard deduction in 2021.

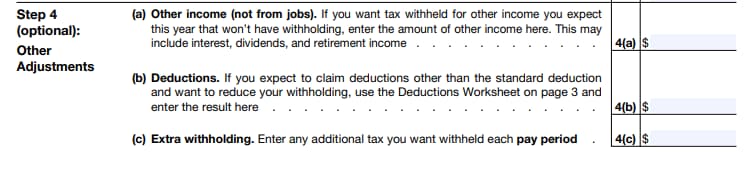

Form W4 Part 4 and Part 5 for Single Filers

Part 4 of Form W4 is where you make adjustments to income. If you earn income outside of your job and you want to withhold tax for that from your wages, you have the option to do so. You can enter the income you expect to earn through retirement, interest, dividends, etc. This is for Part 4(a).

On Part 4(b), you will enter the anticipated deduction amount for the 2024 taxes. If you’re itemizing, use the Deductions Worksheet on Page 3 of Form W4 2024 and enter the result on 4(b).

If you want to withhold extra tax in addition to what your employer would withhold regularly, you can enter the extra withholding amount Part 4(c). Since you’re a single individual, you will withhold at a higher rate than married individuals and heads of households. So extra withholding isn’t necessary in most cases.

Lastly, enter your signature, date of completion, and the rest will be filled out by your employer.