Why are taxes withheld from paycheck?

Why are taxes withheld from paycheck? The income taxes and other taxes are withheld from employee’s paychecks by employers when processing payroll.

This is how employees pay their taxes in general. As far as the income taxes go, this is definitely the best way to pay these taxes as you will pay gradually rather than making one large payment.

The bottom line is the reason why taxes are withheld from your paycheck is to pay for your taxes. Your employer withholds taxes from your paycheck every pay period and forwards it to the IRS. This is mandatory under federal law so there is no way around it.

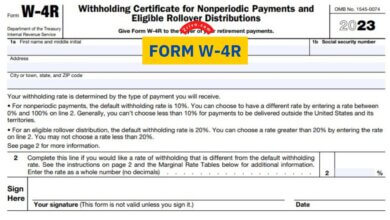

To adjust the taxes withheld from income, employees should file a Form W4, Employee’s Withholding Certificate. This allows employees to provide necessary information about taxes withheld from their income. Employees detail a few information about their anticipated tax return. Based on what’s provided on Form W4, employers withhold tax accurately.

Withholding Tax Accurately

It is important to withhold tax accurately. Since this is how you pay taxes, underpaying or overpaying too much is something you should avoid. If you underpay, you will owe the IRS. This doesn’t necessarily mean that it’s bad though. You will have until April 15 to pay unpaid taxes.

On the other hand, withholding too much tax is definitely something you must avoid. You will surely get the excess amount in your tax refund but you will basically be giving extra money to the government.

Any tax professional would suggest that you should pay taxes at a rate where it’s not too much or less. Instead of forwarding more money to the IRS to increase your tax refund, you can invest it in a savings account. By doing this, you will ultimately get more out of your money.

Having all this said, you should withhold tax at a rate where you pay off all the taxes owed but won’t end up with thousands of dollars in tax refunds. The final point here is that tax will be withheld from your income anyways. So you should allow this to happen with balance and not pay way more tax than you need to.