W-4 Form Printable

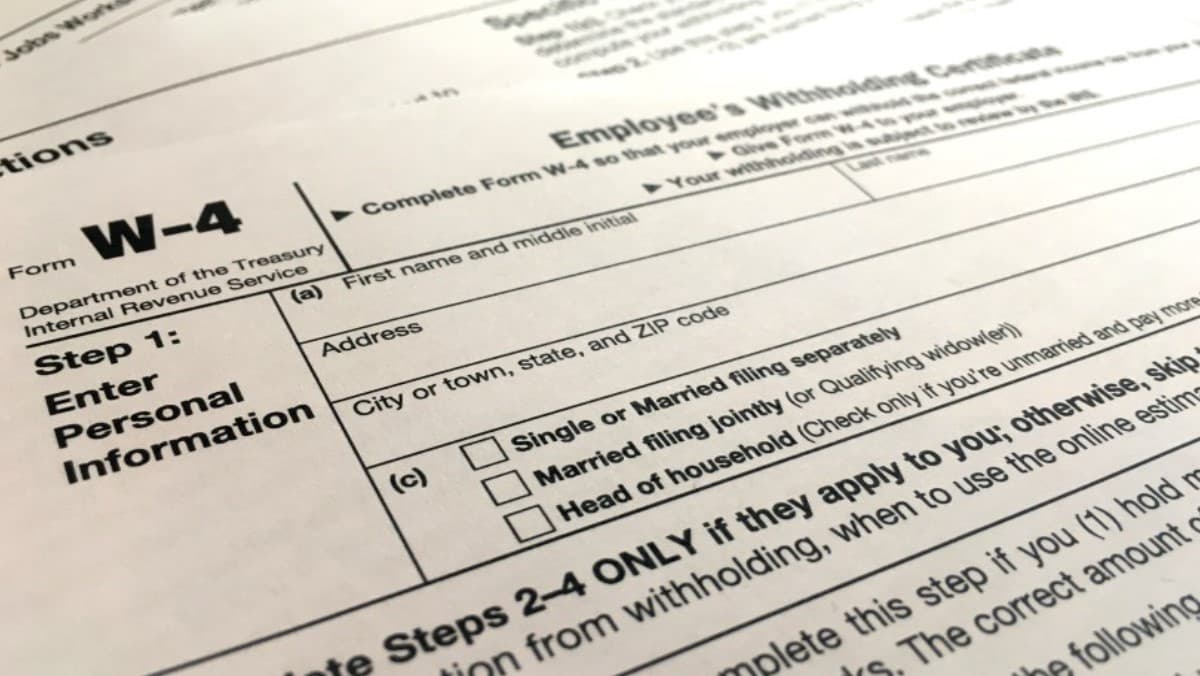

Form W-4 printable for the 2024 tax year is the tax form employees to give tax information to employers. Known as the Employee’s Withholding Certificate, Form W-4 isn’t mandatory but it should be filed by all employees.

Without Form W-4, the employer won’t be able to withhold tax at the accurate rate which will result in federal income tax withholding more than necessary. Although this will surely avoid under-withholding penalties, you’ll get the excess amount paid in your tax refund. In a way, this is thought of as loaning away your money to the government only to get it back later.

Printable Form W-4

What happened to allowances on Form W-4?

Form W-4 underwent some changes for 2023, and these changes are still existent on the form in 2024. The allowances are removed and rather than claiming allowances based on your anticipated tax return, you’ll enter the information used for figuring out the number of allowances to claim. This comes out to a more accurate rate of federal income tax withholding as your employer has your direct tax information.

On the Form W-4 2024 printable, you will need to enter:

- personal information

- anticipated tax deduction amount

- anticipated child tax credit and credit for other dependents amount

- extra withholding

- other income that isn’t subject to federal income tax withholding

The above will determine the needed amount of federal income tax withholding. For employees who don’t file a Form W-4 by the time they get their first paycheck, the employers are responsible for withholding tax at the highest single rate. This means the regardless of the employees’ anticipated tax return, the employee will be accounted as someone who’s single with only the standard deduction on tax return without any tax credits.

Fill out and print out Form W-4

Form W-4 2024 printable is also fillable online which enable the filer to complete the form online and print out a paper copy once finished. This also enables the filer to save a copy of their W-4 as a PDF file which can be used for sending it electronically to the employer or the payroll department.

We’ve also covered plenty of other topics about the employee’s withholding certificate form for 2024 and other tax years. Read on Form W-4 to learn more about it.