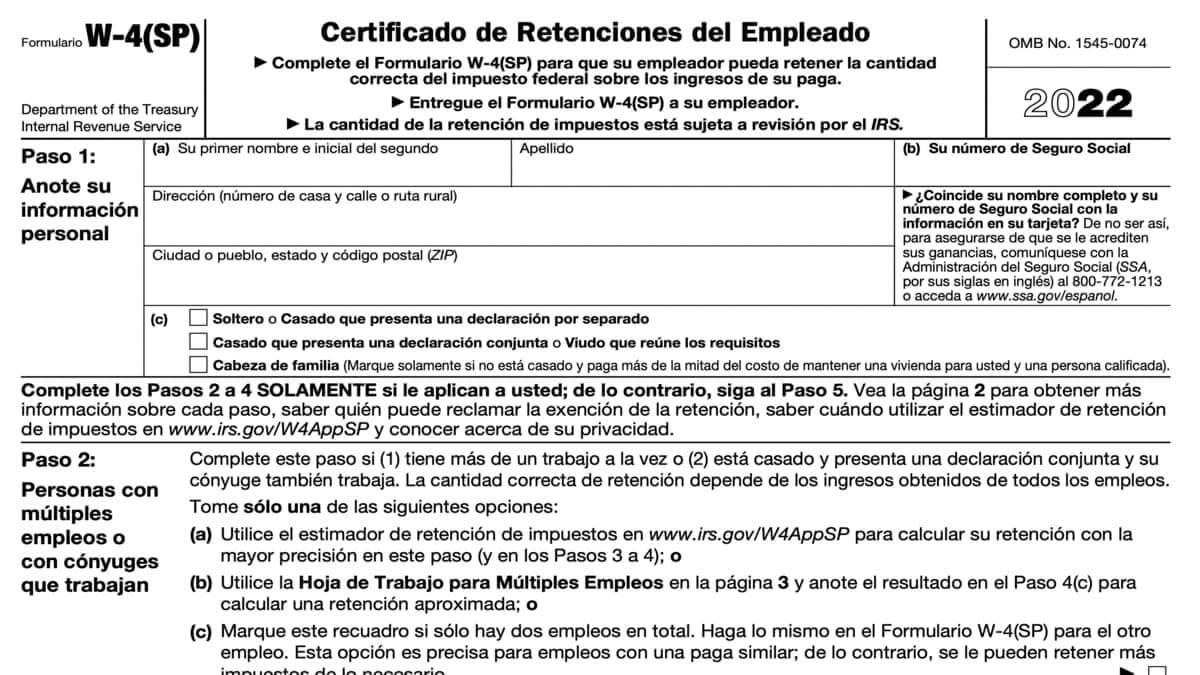

The Internal Revenue Service has the Spanish version of Form W-4. This version of Form W-4 used to be only for employees in certain US territories, like Puerto Rico.

According to tax topic 753, all employees can start filing the Spanish version of Form W-4 as they desire. So the law has been changed, and any employee can file the Spanish W-4. As both the Spanish and the English versions of Form W-4 are identical, you can use the money amounts and other information provided on the form to calculate the necessary federal income tax withholding.

For Spanish speaking employees:

The instructions to file Form W-4 Spanish for the 2024 tax year are the same as the English version of the Employee’s Withholding Certificate. You don’t need to do anything special. To get the IRS instructions to file, click here.

This page also has the Form W-4 Spanish as PDF, but some users may have trouble filling it out online. Start filling out Form W-4 Spanish for the 2024 tax year from here instead.

This version of Form W-4 SP is identical to the regular form, but it’s fillable online, meaning that you can fill out a copy on your computer and print a paper document later. You can also save it as a PDF file with the information entered on the form and email it to your employer. Either way, it’s a much more efficient way to file Form W-4 compared to filling out a paper copy.