IRS Form for Payment Plan

Did you know that you can apply to the IRS for an individual or business payment plan? If you owe money to the IRS and cannot pay it in full right now, you can contact them to request a payment plan. This will help you to avoid paying extra interest and possible future penalties. Needless to say, it will also contribute to your creditability.

Can Anyone Benefit from the IRS Payment Plan?

This mainly depends on your tax situation and the available payment options for that specific tax situation. Qualified taxpayers can choose between three payment plan alternatives, and these are:

- Full Payment

- Short-term Payment Plan (paying the full balance in less than 180 days).

- Long-term Payment Plan (also known as an installment agreement)

The IRS offers a full payment alternative to all taxpayers. On the other hand, if you owe less than $100,000 in interest, penalties, and combined taxes, you are qualified to apply for a short-term payment plan. If you owe less than $50,000 in interest, penalties, and combined taxes, and if you have filed all your required returns, you can also apply for a long-term payment plan.

What Can You Do to Apply for the IRS Payment Plan?

All you need to do is create an account using ID.me and upload the required documents for photo identification. If you apply for a direct debit payment plan, then you also need your bank account numbers and routing.

In some cases, you will also need to show your balance due on your return. This is required when your recently filed tax return is examined, but you have not received any notice from the IRS.

Another important thing you need to know is the cost. When you apply for the short-term payment plan, you will not be charged any costs. On the other hand, if you apply for the long-term payment plan with automatic withdrawals, you will be charged a $31 setup fee. You are also going to be charged a $130 setup fee when you apply for the same plan with a non-direct debit.

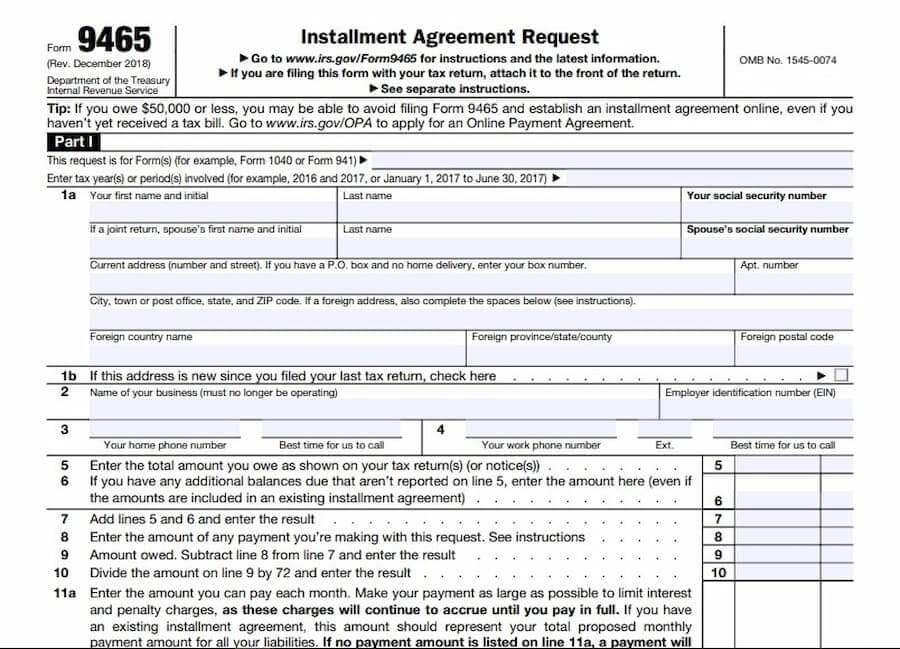

You can also file IRS Form 9465 to apply IRS Payment Plan. This IRS form is also known as an Installment Agreement Request.