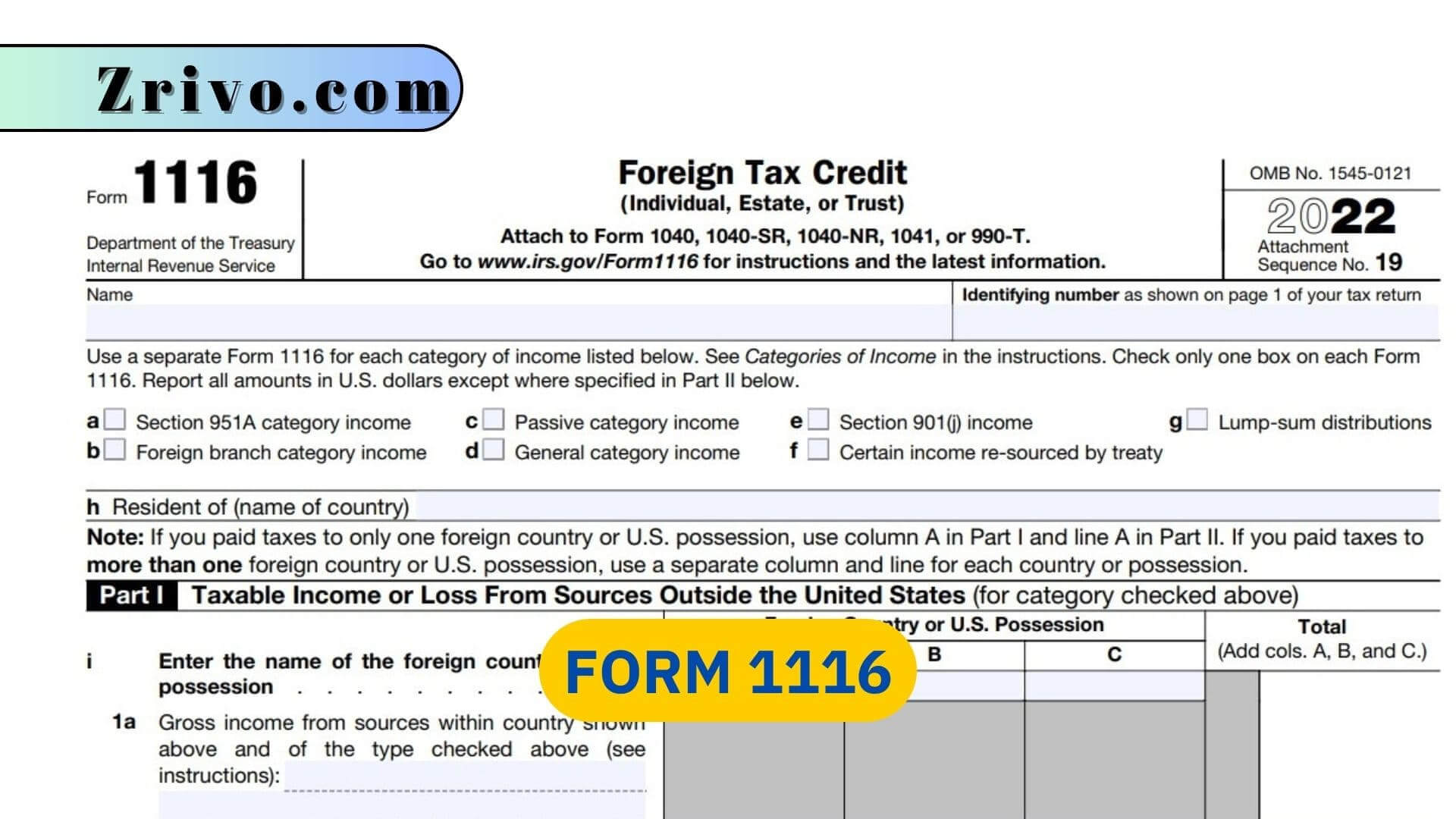

Form 1116

The IRS offers a money-saving Foreign Tax Credit to help offset the double taxation many US expats experience. To claim this credit, you must file Form 1116 in most cases. Here’s how to do it.

IRS Form 1116 is a form that allows expats to claim the Foreign Tax Credit. It’s a useful tool for those with foreign income who pay taxes in more than one country, but the process is complicated. Filers should keep in mind that they may need to complete a separate Form 1116 for each category of income they have. This includes passive income, Section 951A income, foreign branch income, certain income re-sourced by treaty, and lump-sum distributions. Those who receive these types of income must complete several forms to properly claim the Foreign Tax Credit (FTC).

The Foreign Tax Credit is a benefit that can help reduce double taxation for US expatriates. The IRS requires US citizens and residents to report their worldwide income on their federal tax return, but the Foreign Tax Credit allows them to claim a credit against their US taxes for all of the taxes that they have paid in a foreign country. If the amount credited is greater than the taxpayer’s total US taxes, they can carry it forward for future tax years.

How to file Form 1116?

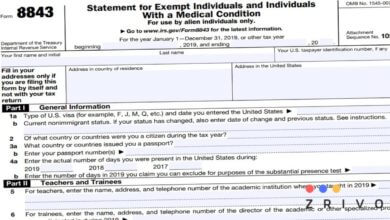

To determine if you need to file Form 1116:

- Start with your total itemized deductions from Schedule A (Form 1040) or Schedule A (Form 1040NR).

- Use the Itemized Deduction Worksheet in the Schedule A instructions or the Forms 2555 and 2555-EZ instructions to determine the percentage of your overall reduction attributable to the items you report on line 9.

- Divide this percentage by the overall amount of your itemized deductions on line 9 and multiply it by your total foreign taxes paid or accrued to find your reduction percentage.

- Apply this reduction percentage to each itemized deduction related or apportioned to your passive category or general category income to determine the amount to enter on line 6 of Form 1116.

Form 1116 is one of the most complicated forms issued by the IRS. If you want to fill it out smoothly, you will need the guidance of a CPA.

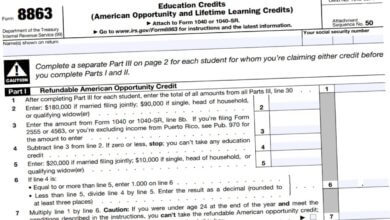

There are 4 parts in Form 1116.

- Part I Taxable Income or Loss From Sources Outside the United States: Enter your taxable income or loss from your sources outside the States.

- Part II Foreign Taxes Paid or Accrued: This is where you need to enter your foreign taxes paid or accrued.

- Part III Figuring the Credit: You must complete lines 9 and 24 to determine your foreign tax credit.

- Part IV Summary of Credits From Separate Parts III