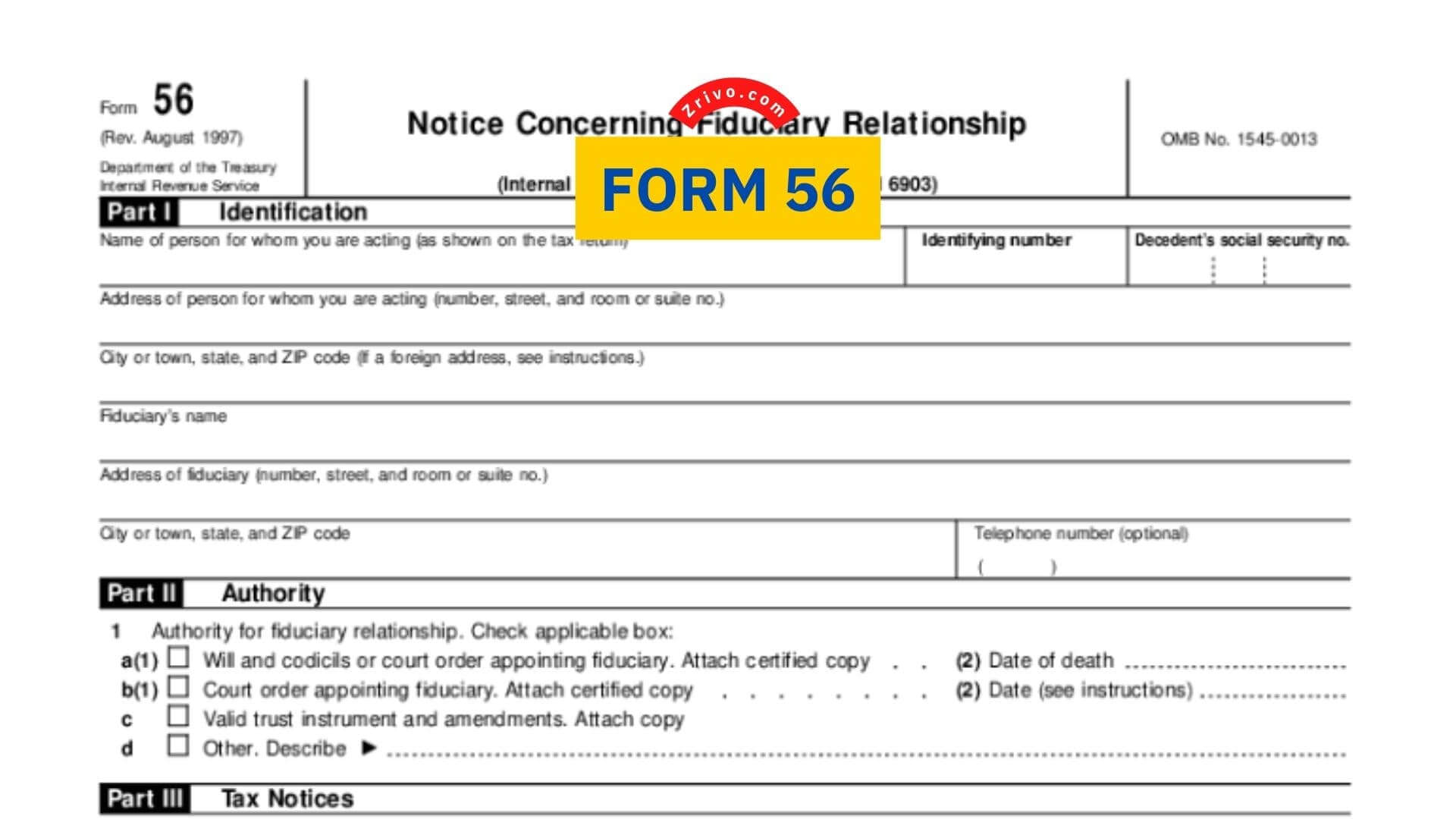

Form 56

If you are a Fiduciary, You may be asked to file Form 56 to notify the Internal Revenue Service (IRS) of your fiduciary relationship. This article will show you what this form is and how to fill it out.

Form 56, also known as a Notice Concerning Fiduciary Relationship, is used to notify the Internal Revenue Service (IRS) about a fiduciary relationship. This relationship is when one person takes on the duties of another, such as paying taxes on behalf of an individual. If there is a change in a fiduciary’s status, a new Form 56 must be filed.

A fiduciary can be anyone, including an individual, a corporation, a trust, or an estate. The person acting in the fiduciary capacity assumes all the powers of the person for whom the fiduciary is acting. However, the fiduciary’s authority may not cover all tax periods and years.

Filing Form 56 is important because it establishes a legal relationship between the fiduciary and the IRS. It allows the IRS to know the status of the fiduciary and any related court proceedings. In addition, it notifies creditors and federal agencies of the fiduciary’s status.

How to File Form 56?

You can fill out Form 56 online, print a copy, and mail it in. Either method requires that you accurately enter the correct information. To do this, you must identify the following:

- The person who is a fiduciary

- The date the proceeding was initiated

- The agency’s name

- The court’s address.

While completing Form 56, it is important to remember that the person acting in a fiduciary capacity is legally responsible for the actions they take on your behalf. Therefore, it is in your best interest to have a professional help you with this process.

Form 56 is available on both our website and the IRS’ website. Once you have retrieved the form, you can begin filling it out. You need to fill out a separate form for each estate. If you plan to act as a trustee for multiple estates, you should file a separate form for each one. You will need to include the name and address of the person for whom you are acting. These details must match the person’s name on your filing return. In addition, you will need to provide a city, state, and room number.

When filling out Form 56, remember that you will be liable for any errors. If you need help with the form, you should contact a qualified tax professional for assistance. Whether you are a bankruptcy trustee, receiver, or other fiduciary, it is important that you file the form in a timely manner. Failure to do so could result in the rejection of Form 56.