Form 1120 2023 - 2024

Form 1120 is the tax return corporations and business owners use to report income, gains, losses, deductions, and credits.

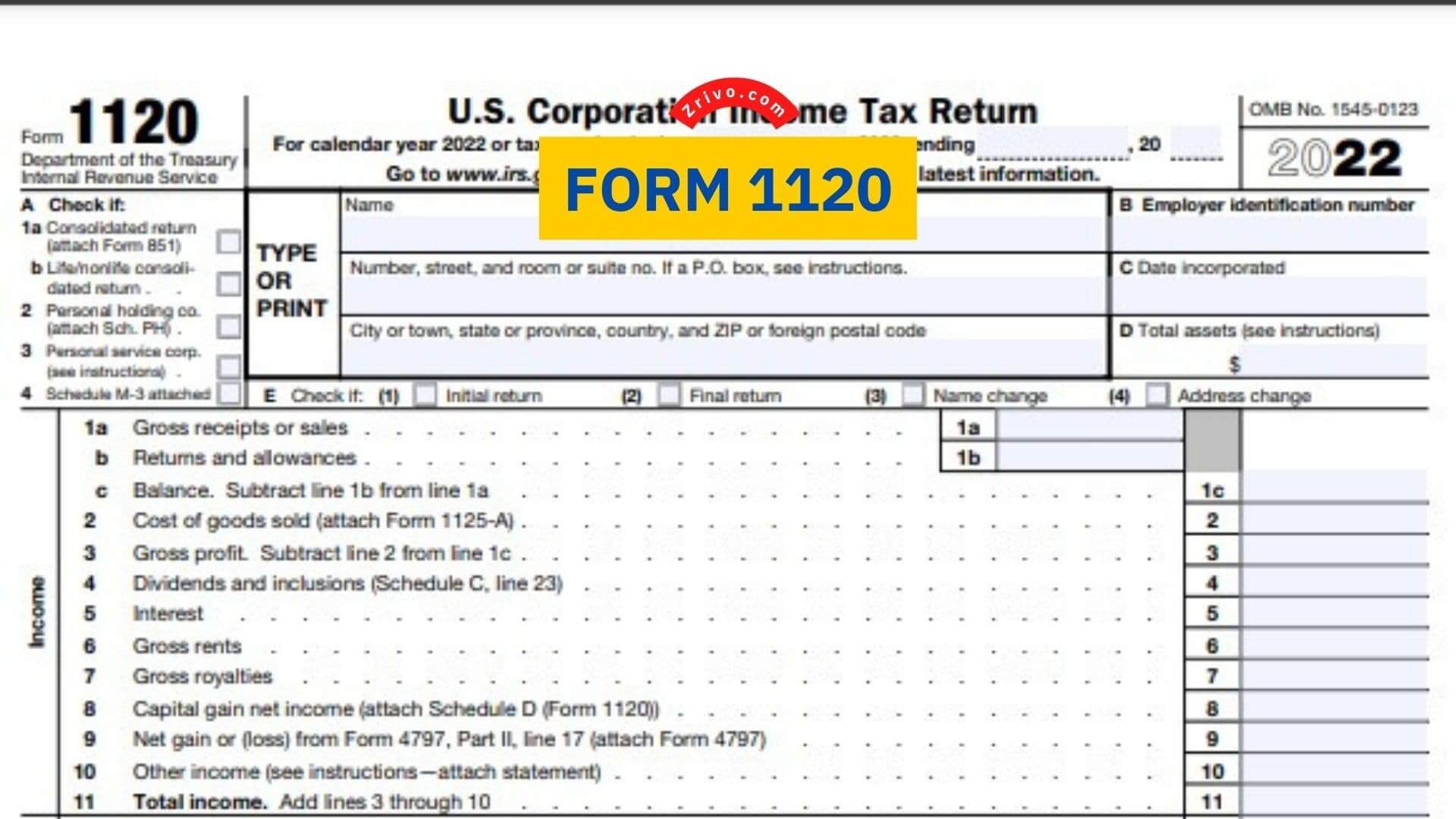

Form 1120 is an income tax form corporations must use to report their profits, losses, deductions, and credits. Corporations also use Form 1120 to determine how much they must pay in taxes. Unless exempt under IRC section 501, all domestic corporations must file Form 1120 each year to determine their income tax liability. These taxes are typically paid as quarterly estimated payments. Corporations can electronically file forms, schedules, and attachments using the IRS e-filing system.

The form is required for any corporation that is incorporated or a multi-member LLC (a limited liability company) that elects to be treated as a corporation. It is due by the 15th day of the third month following the end of the corporation’s tax year. For example, if the company’s fiscal year ends on June 30, it must file its Form 1120 by March 15.

How to file Form 1120?

When preparing an 1120 tax return, keeping detailed records of your business’s transactions is helpful. These include receipts and assets from your operations, cash and credit refunds, allowances made to customers, and sales of products or services.

Once you’ve entered these items in Form 1120, enter the income and deductions for your business in the next step. You’ll enter the gross income and sales from your trade or business activities and any cash or credit refunds or rebates your corporation made to its customers on Line 1c of Form 1120.

- If you’re a C Corp, your net income is the total of all your business earnings divided by all your expenses. Use this figure to calculate your corporation’s tax liability on Form 1120. You then transfer this amount to your personal income tax form and include it with all of your other income items.

- In addition, you must include any deferred foreign income or global intangible low-taxed income on your return if you own certain foreign corporations. For example, if you own a controlling stake in a foreign company that has a branch in the United States, you need to report the value of its shares on your Form 1120.

- You will also need to enter your gross profit, other income, and any deductions that were made. These include officers’ compensation, salaries and wages, repairs and maintenance, bad debts, rents, taxes, depreciation, advertising, pension, profit-sharing plans, employee benefit programs, and other deductible items.

- These are all detailed on page one of Form 1120. As the final thing to do, At the bottom of the page, you will need to sign and date your return.

You can then print out the return and attach it to your company’s annual tax return or mail it. If you choose to mail your return, make sure that it is mailed on a day when the post office is open. This will ensure that your return arrives at the correct address and is not delayed.

Using Form 1120 to report your taxes will make filing simple and easy, but having the right information is important. This will help you determine how much tax you owe or need to pay and will make sure that your corporation gets the proper credit for all its contributions to the economy and society.