How to Fill Out a W-4 Form in

Contents

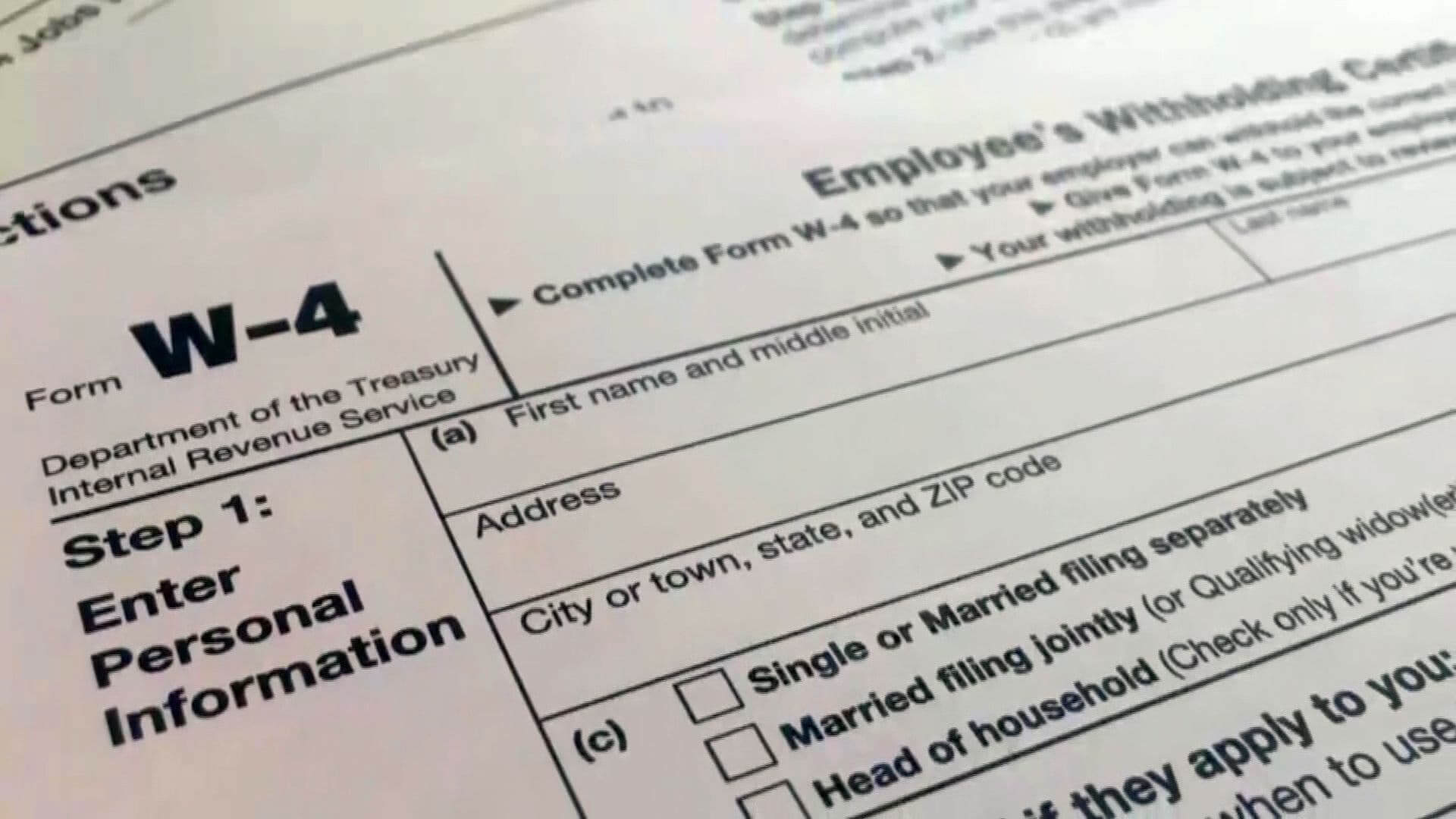

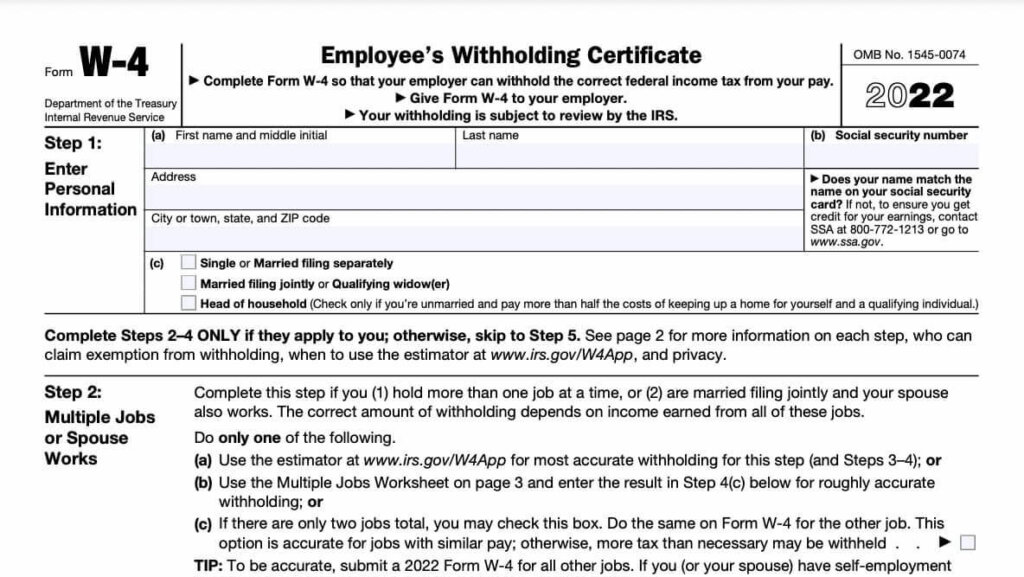

Do you have a complicated W-4 form? It will not be a problem; this guide will explain how to fill out W-4 Form in 2023. The W-4 form is used by the government to account for additional income or deductions. In addition to reporting your annual income, you can also record any extra withholding amounts. Some of these deductions are specific to certain types of income. For example, you can only claim child-related deductions if you are married. However, it is important to fill out the W-4 form in 2024 if you have changed jobs or if you have changed your employment status.

Follow the instructions on the W-4 Form

It can be a breeze to fill out the W-4 form for those who are single and don’t have dependents. Even someone with one job can complete the form in five minutes. On the other hand, people filing jointly and having multiple jobs will have a more complicated form. If you’re not sure how to fill out a W-4 form, here’s some advice: Follow the instructions on the W-4 Form.

The good part is that you are not obligated to complete the same W-4 form each year. We are warning you that it would be a great idea to file your taxes early so that you don’t have to worry about late fees. Even if you are late sending the file, do not worry because you still have time.

Make sure your personal information is accurate

Before filling out the W-4 form in 2024, you should remember to make sure your personal information is accurate. You need to know how much income you make, how many deductions you have made, and whether or not you have dependents. Having a copy of last year’s tax return helps make this process easier. You should also know how much income tax your employer must deduct from your salary, so you do not get confused about the deduction.

The best way to complete a W-4 form is to check off the box for the highest-paid job and leave the rest blank. Ensure that your total income is less than $200,000 or $400,000. If you have multiple jobs, fill out Steps 3 and 4 for the highest-paid job and leave the rest blank. Then, you should add your social security number and your full name. You can also write off your income as a couple.

IRS has changed W-4 Form

But please be careful that the Internal Revenue Service has changed the W-4 form for the previous year. This change is meant to improve the accuracy of the withholding system and simplify the process of filling out the form. Those hired after 2020 must use the renewed form. In addition, new hires who have not changed jobs need to enter their Social Security number and claim dependents on the new form. This change will not affect those who already have Form W-4 on file.

The new Form W-4 has multiple job and deduction worksheets. The new form has new names and a new layout. The steps have changed, but the basic information remains the same. You need to complete steps 2–4 and checkboxes for dependents. If you’ve worked at two jobs, you may want to check this box to ensure your federal income tax withholding is consistent.