971 Notice Issued 2023 - 2024

Dealing with taxes can be complex, and deciphering IRS notices and codes can be confusing. In this article, we will take a closer look at transcript codes, focusing on Code 971.

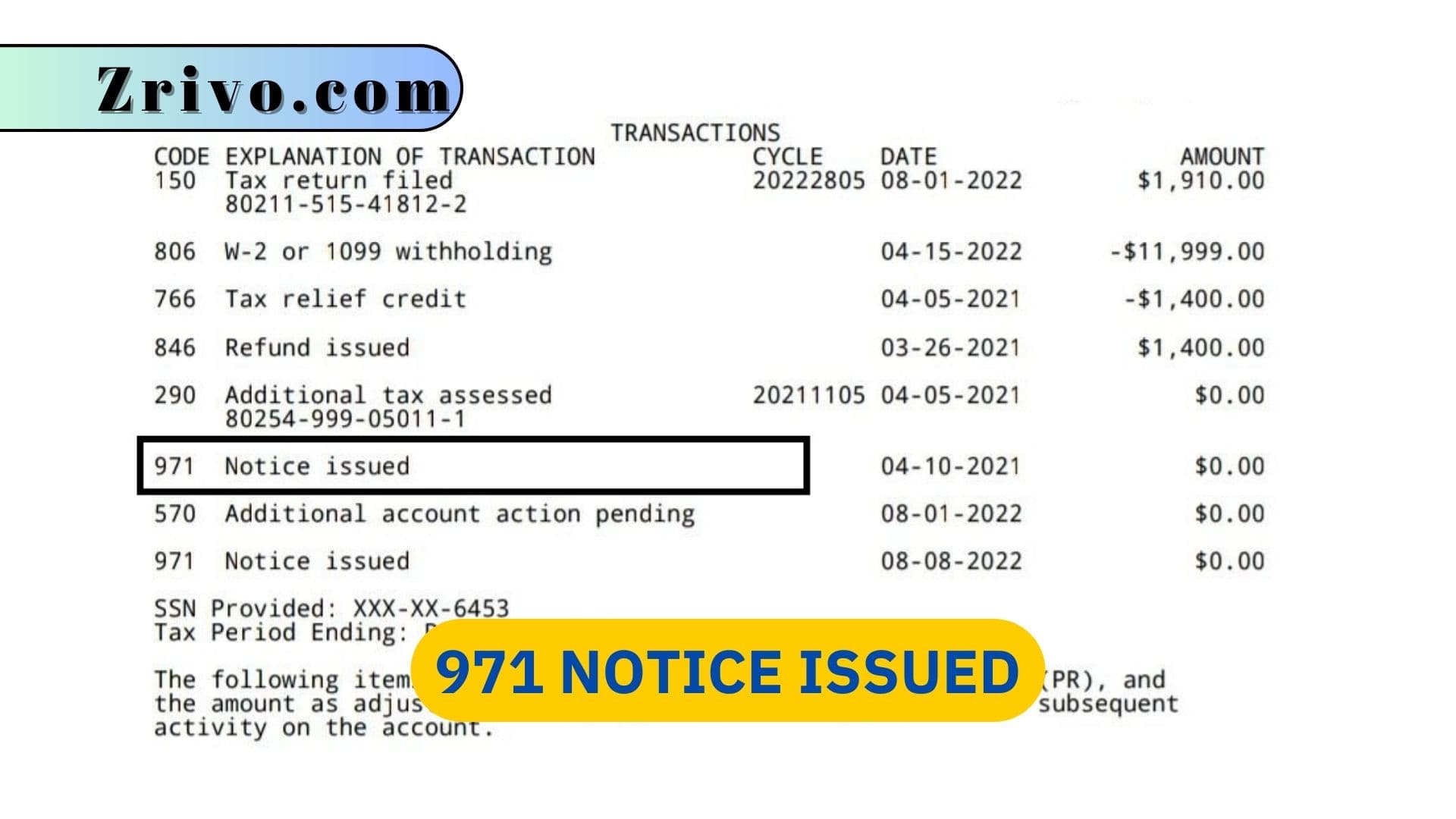

IRS transcript codes are a system of alphanumeric codes used by the Internal Revenue Service (IRS) to categorize and summarize information contained in an individual’s tax return, tax account, or other related documents. These codes are listed on various IRS transcripts, which are records of a taxpayer’s account activity. They help the IRS employees quickly identify and process specific tax-related information. 971 Notice Issued is an IRS notice or letter providing additional information on the matter or informing you of future IRS delays.

What to Do After Receiving 971 Notice Issued?

A “971 Notice Issued” refers to a notice sent by the Internal Revenue Service (IRS) to taxpayers that contains information related to a specific tax matter. The notice is typically labeled with the IRS Code 971, which signifies that the communication pertains to restitution-based assessments. It is important to note that the content and purpose of a 971 notice may vary depending on the individual’s circumstances and the specific details outlined in the notice. As the first thing to do, familiarize yourself with your rights as a taxpayer. The IRS has a specific Taxpayer Bill of Rights that outlines your entitlements, such as the right to appeal decisions, representation, and clear explanations of any IRS actions.

It is important not to ignore or delay responding to a 971 Notice Issued. Taking prompt action, such as contacting the IRS and addressing any concerns or discrepancies, is essential to resolving the matter effectively. The notice will provide contact information for the IRS office handling the case, and it is advisable to initiate communication as soon as possible to seek clarification and understand the steps required to address the assessed amount.

Difference Between 971 Notice Issued and Publication 971

The key difference between a “971 Notice Issued” and “Publication 971” lies in their nature and purpose. While both are related to IRS Code 971, they serve different functions in the context of tax matters. Let’s explore each one in detail:

971 Notice Issued: A 971 Notice Issued refers to a specific notice sent by the Internal Revenue Service (IRS) to taxpayers. This notice is labeled with the IRS Code 971 and is typically related to restitution-based assessments. It is sent when the IRS identifies outstanding amounts owed as a result of court-ordered restitution or other criminal offenses. The notice provides details regarding the assessed amount, the reason for the assessment, and instructions on how to address the situation. Taxpayers who receive a 971 Notice Issued should review it carefully, gather supporting documents, and take appropriate action by contacting the IRS and addressing any concerns or discrepancies.

Publication 971: Publication 971, titled “Innocent Spouse Relief,” is an informational document published by the IRS. It provides guidance and information to individuals who may be eligible for relief from joint and several liability on a joint tax return due to their spouse’s or former spouse’s erroneous items or underreporting of income. This publication specifically addresses the Innocent Spouse Relief provisions of the tax law and provides detailed explanations, examples, and instructions on how to apply for this relief. Publication 971 aims to help taxpayers understand their rights and options when seeking relief from tax liabilities associated with joint returns. It provides insights into the eligibility requirements, available relief types, and the necessary steps to pursue innocent spouse relief.