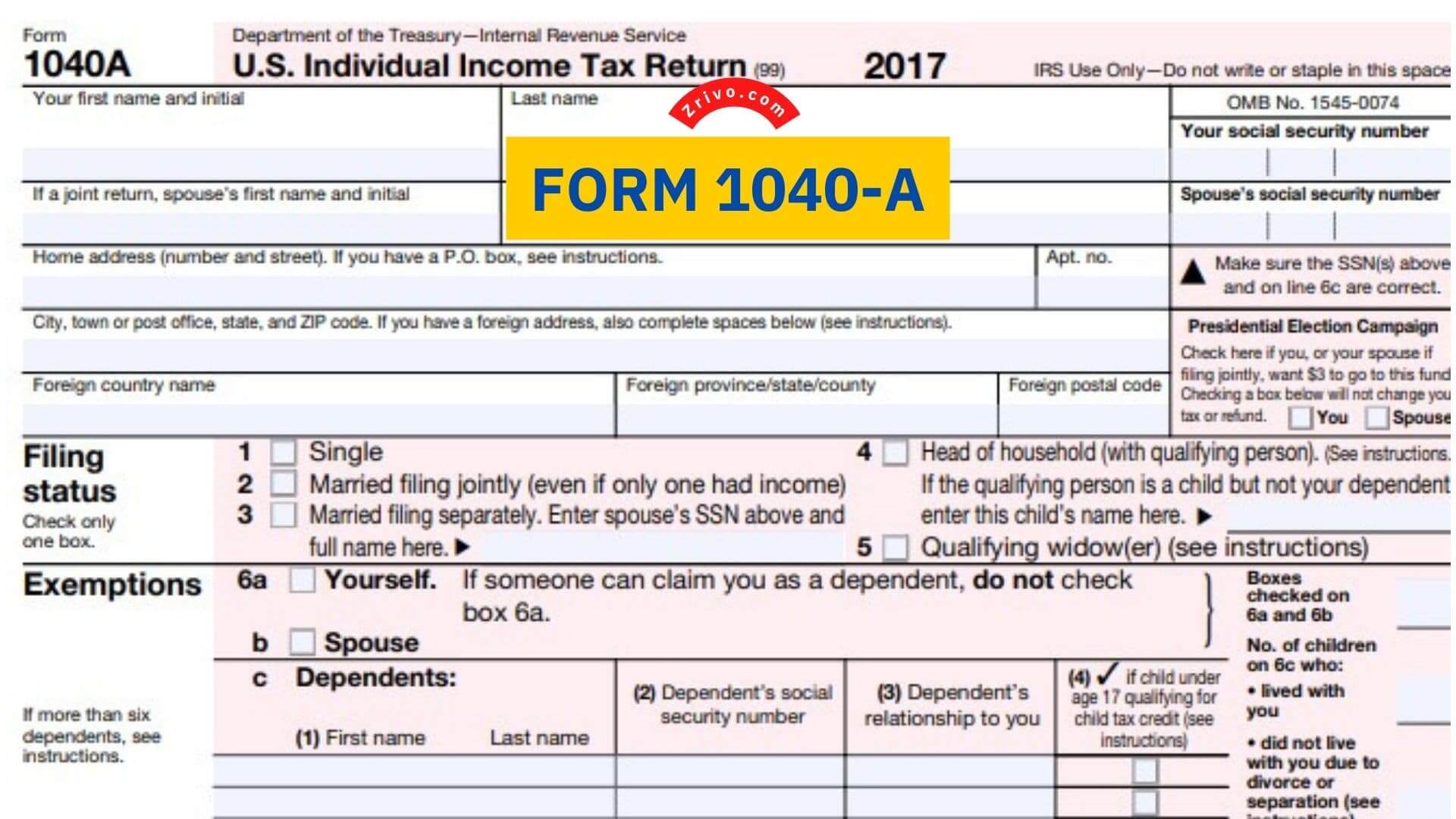

Form 1040-A 2023 - 2024

Form 1040-A is a simplified version of the standard Form 1040 used to report your income and file federal taxes. Here's everything you need to know about this IRS form.

Form 1040-A is one of the most common federal income tax forms people fill out yearly. It helps you report your income, expenses, and tax credits. It will also tell you how much you owe in taxes and what your refund is likely to be. Form 1040-A eliminates some of the deductions and tax credits offered on Form 1040 but offers more flexibility when it comes to reporting income. It’s important to understand the differences between the two forms before you decide which one to use for your tax return. Choosing the right form can save you a lot of time, stress, and money.

Form 1040A is the shorter version of 1040, and it is used by people with taxable income that is less than $100,000. It’s also the easiest version to use if you don’t have many deductions or credits. It is also used by people who qualify for the Earned Income Tax Credit (EITC).

What is Form 1040-A?

For tax years beginning in 2018, President Trump signed a new law that consolidated all three types of tax forms into one redesigned Form 1040 that all filers can use. This means that you can no longer use shorter forms like Form 1040-A, which was eliminated in 2018. However, there are still some benefits to using the short version of Form 1040. For instance, it can help you reduce your taxable income by allowing you to deduct some of the interest you pay on student loans and contributions you make to an IRA.

You can also subtract some of your Social Security and Medicare tax payments from your taxable income by choosing to report these on Form 1040-A. You can also claim the child tax credit if you have children. Alternatively, you can choose to report your unemployment compensation on Form 1040-A. This is especially helpful if you have a job that is temporarily interrupted by a layoff. In addition, you can claim the refundable portion of the EITC on Form 1040-A if your taxable income is below $110,000. When you figure out your tax liability, this amount will be subtracted from your taxable income.

How to File Form 1040-A?

For tax years beginning in 2018, President Trump signed a new law that consolidated all three types of tax forms into one redesigned Form 1040 that all filers can use. This means that you can no longer use shorter forms like Form 1040-A, which was eliminated in 2018. If you are required to file Form 1040-A for some reason, you can get help from a professional or follow the instructions for the regular 1040 Form.