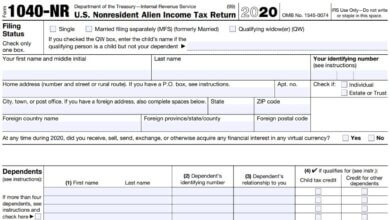

File Form 1040 on Paper or Electronically

As soon as the tax season arrives, most Americans are bound to file a tax return. There is two ways an individual or a business can file their federal income tax returns; file a paper Form 1040 and mail it to the IRS or file electronically online. Both options have their own pros and cons but for the most part, filing electronically is the best by far.

When filing taxes yourself, you are more prone to make errors. On the other hand, you can hire a tax professional to file your return. That said, we will only focus on filing federal income tax returns yourself.

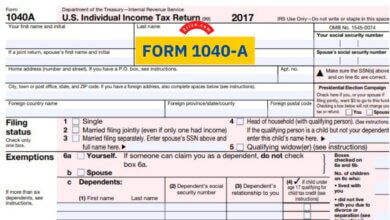

Filing Form 1040 on Paper

Filing Form 1040 on paper is not going to cost you any money. What it’s going to cost you is time. Compared to electronically filed tax returns, mailed Forms 1040 take significantly longer to process. Due to this, if you’re expecting a tax refund from the IRS, it will be issued to you at a later date. Again, this is only compared to filing taxes online.

In most cases, the IRS issues tax refunds in about three weeks—accounted for the time it takes for your return to reach the IRS, you can expect delays here and there.

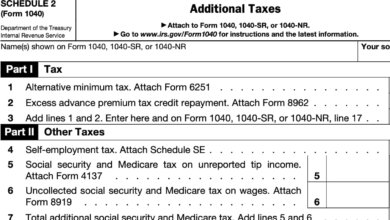

Perhaps, the biggest downside of filing a tax return on paper is doing everything yourself. Because of this, you need to have a strong understanding of the American tax code and keep up with the latest changes. We suggest taking a look at the changes that may affect the tax deductions and credits you would claim to see if there are any changes or not.

Other than that, filing a tax return can be an option for those with simple tax returns but you still can file taxes online if you don’t want to pay. Read more on that below.

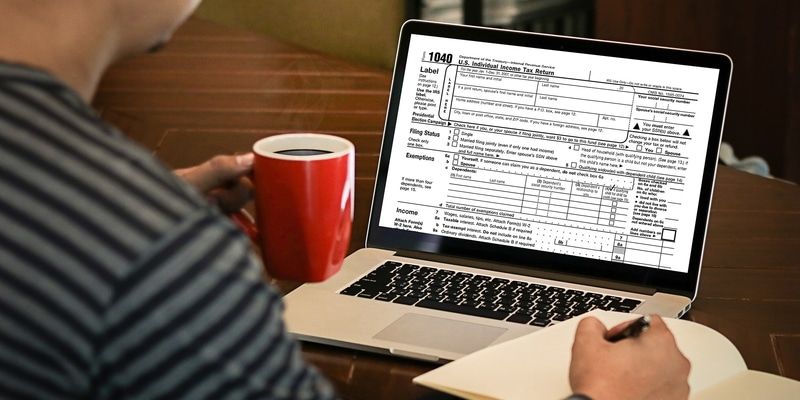

Filing Form 1040 Online

Unfortunately, you cannot file your return online on the Internal Revenue Service website. You must choose a tax software. The most popular tax software in the United States are TurboTax and H&R Block. All tax software has its own pricing. See the cost of filing a tax return online.

Although most people are going to pay for filing a tax return electronically, if your tax return is considered simple, you can file a return for free. The eligibility for a free file depends on the tax software but most require income from W-2, limited income from 1099-DIV and 1099-INT, and standard deduction.

So if you’re going to itemize deductions, you must pay to file tax return. You can learn how you can file a tax return electronically for free from the link above.

As for the pros of filing a tax return electronically, it takes considerably less time to process tax return, thus, you will have your tax refund at an earlier date.

Also, making any errors on your tax return is virtually impossible. Since you will be notified if there is an error on your return, the changes or any missing information or errors on Form 1040 online is slim to none. If you file taxes with a product, it will also show all the tax deductions and credits that are available to you. This alone makes filing taxes electronically worth it.

Surely, there are many pros to filing a tax return online. The only thing that may make you shy away from filing a return is the cost. Depending on your tax return, you can expect to pay between $30 to $100 on a single federal tax return.