9465 Form 2023 - 2024

You can file IRS Form 9465 to request an installment agreement if you have a large tax debt and cannot afford to pay it in full. Here's everything.

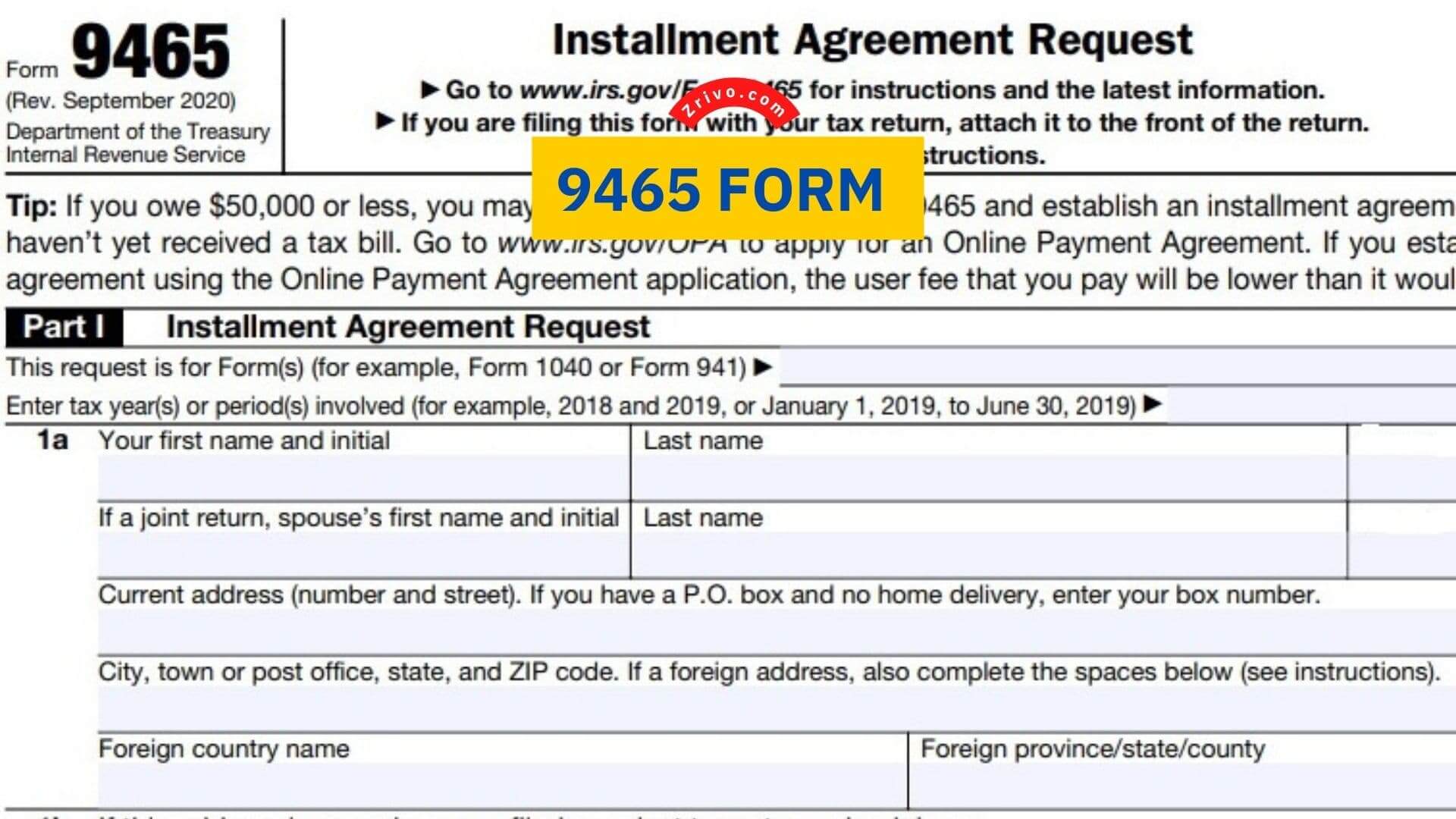

9465 Form is an IRS form that allows you to request a monthly payment agreement for taxes you owe. This option is good for those who have difficulty paying the full amount they owe the IRS all at once. However, you should note that it is a good idea to pay a portion of your tax debt first before asking for payment assistance for the remainder.

Form 9465 can be filed online with the IRS Online Payment Agreement tool, but you should know that there are certain conditions that must be met before you can file it electronically. If you meet these requirements, the IRS will automatically approve your Form 9465 and begin the process of setting up an installment agreement.

How to File Form 9465?

If you have a large tax debt that you are unable to pay in one lump sum, then you may want to consider using Form 9465 to request a payment plan with the IRS. This form will allow you to pay your taxes in monthly installments instead of having to make a large, one-time payment.

This form is available to individual taxpayers and businesses that no longer operate, and you must file it if you owe more than $50,000 in back taxes. The IRS will automatically approve your application if you meet certain criteria, but you should always speak to a tax professional before completing this form.

Those who owe less than $10,000 can also complete this form online using the IRS’s Online Payment Agreement tool. This option allows you to submit your request faster and more conveniently than filling out a paper copy of the form. You should complete this form as soon as possible if you have an unpaid balance on your tax return. Otherwise, you may have a higher interest rate and penalties.

Once you submit your Form 9465, you will receive a notification that the IRS has received it. You will then have 30 days to respond and establish an arrangement with the agency. The IRS will then process your payment plan and notify you of the payment amount and due date. You can then make your monthly payments through direct debit from your bank account or by withholding them from your paycheck.

If you choose to pay your taxes through a payroll deduction, you must include Form 2159 (Payroll Deduction Agreement) with your application. This form will have sections for you and your employer to complete. This form is the most convenient way to establish an installment payment plan with the IRS. However, it is important to note that the IRS will only approve your request if you can afford the minimum payment.

The IRS will need to receive a detailed financial statement from you before approving your installment plan. You must provide them with as much information as possible. This will give the agency a better sense of your income and expenses, which can help them decide whether to approve your request.

Form 9465 Instructions

To fill out Form 9465, you must provide information about your income and expenses. The IRS will use this information to determine how much you can pay each month on your tax bill. If you are unsure about your financial situation, it is a good idea to contact a qualified tax professional to help you determine whether or not you can qualify for an installment agreement. You will need to enter any adjustments or charges that aren’t reported on your tax return or notice. If you owe employment taxes, for example, it is best to include those on Form 9465. Once you have completed Form 9465, attach it to your tax return or notice and send it to the address in the booklet.

You can also fill out Form 9465 manually, but you should consider doing so only if your balance is less than $50,000. If you owe more than $50,000, the IRS will require that you complete Form 433-F (Collection Information Statement). This form requires detailed information about your finances so that the IRS can decide whether or not you can qualify for another arrangement. Contacting a qualified tax attorney if you need clarification on your financial situation is best.