IRS Code 846

IRS Code 846 is a specific section of the Internal Revenue Code that deals with the process of refunding overpayments, and this article will cover everything taxpayers need to know about it.

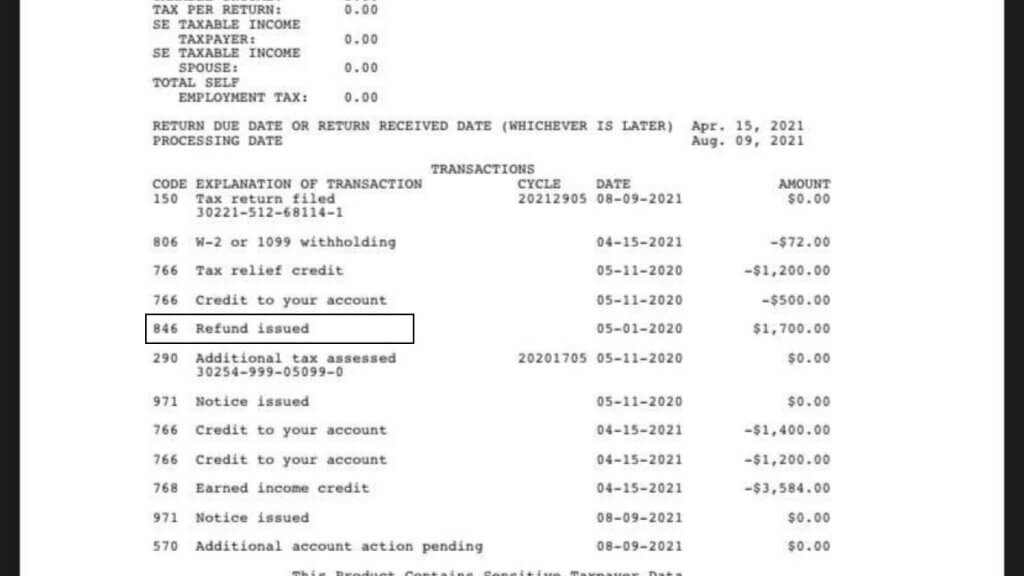

IRS Code 846, also known as “Refunds of Overpayments,” is a section of the Internal Revenue Code pertaining to refunding overpaid taxes to eligible taxpayers. This code plays a crucial role in ensuring fairness and accuracy in the tax system by allowing individuals and businesses to reclaim excess tax payments they may have made.

Key Definitions:

- Overpayment: Occurs when an individual or business pays more in taxes than they owe based on their tax liability.

- Refund: The process of returning excess tax payments to eligible taxpayers.

Eligibility for IRS Code 846

To qualify for a refund under IRS Code 846, individuals and businesses must meet certain criteria, such as:

- The taxpayer must have made more tax payments than their actual tax liability.

- The taxpayer must have filed their tax return within the specified deadline, including any extensions.

- The taxpayer should not have any outstanding federal tax liabilities, such as unpaid taxes or penalties.

- The taxpayer’s tax return should be accurate and free from errors.

IRS Code 846 Receiving Process

When the IRS determines that a taxpayer is eligible for a refund under IRS Code 846, the following process typically takes place:

- The IRS reviews the taxpayer’s tax return and supporting documents to validate the claim for refund.

- Once the claim is verified, the IRS initiates the refund process and calculates the amount to be refunded.

- Taxpayers can choose to receive their refund through direct deposit to their bank account or as a paper check sent via mail.

- The refund process can take several weeks to complete, with the exact timeline depending on various factors such as the complexity of the return, IRS workload, and filing method (e.g., e-filed returns tend to process faster than paper returns).

- In most cases, taxpayers receive their refunds within 21 days if they file electronically.

- Paper returns may take longer, typically around four to six weeks.

Important Notes

- Interest on Refunds: In some cases, the IRS may also provide interest on refunds, especially if the overpayment is due to an error or delay on their part.

- Amended Returns: If a taxpayer discovers errors or omissions on a previously filed tax return that results in an overpayment, they can file an amended return to claim a refund under IRS Code 846. However, a statute of limitations exists for filing amended returns, usually three years from the original filing deadline.

- Offsetting Debts: The IRS has the authority to offset refunds against any outstanding federal tax debts, state tax obligations, or other federal debts owed by the taxpayer.

- Communication with the IRS: Taxpayers can contact the IRS directly to inquire about the status of their refund or seek assistance in case of delays or issues.