Form 8933

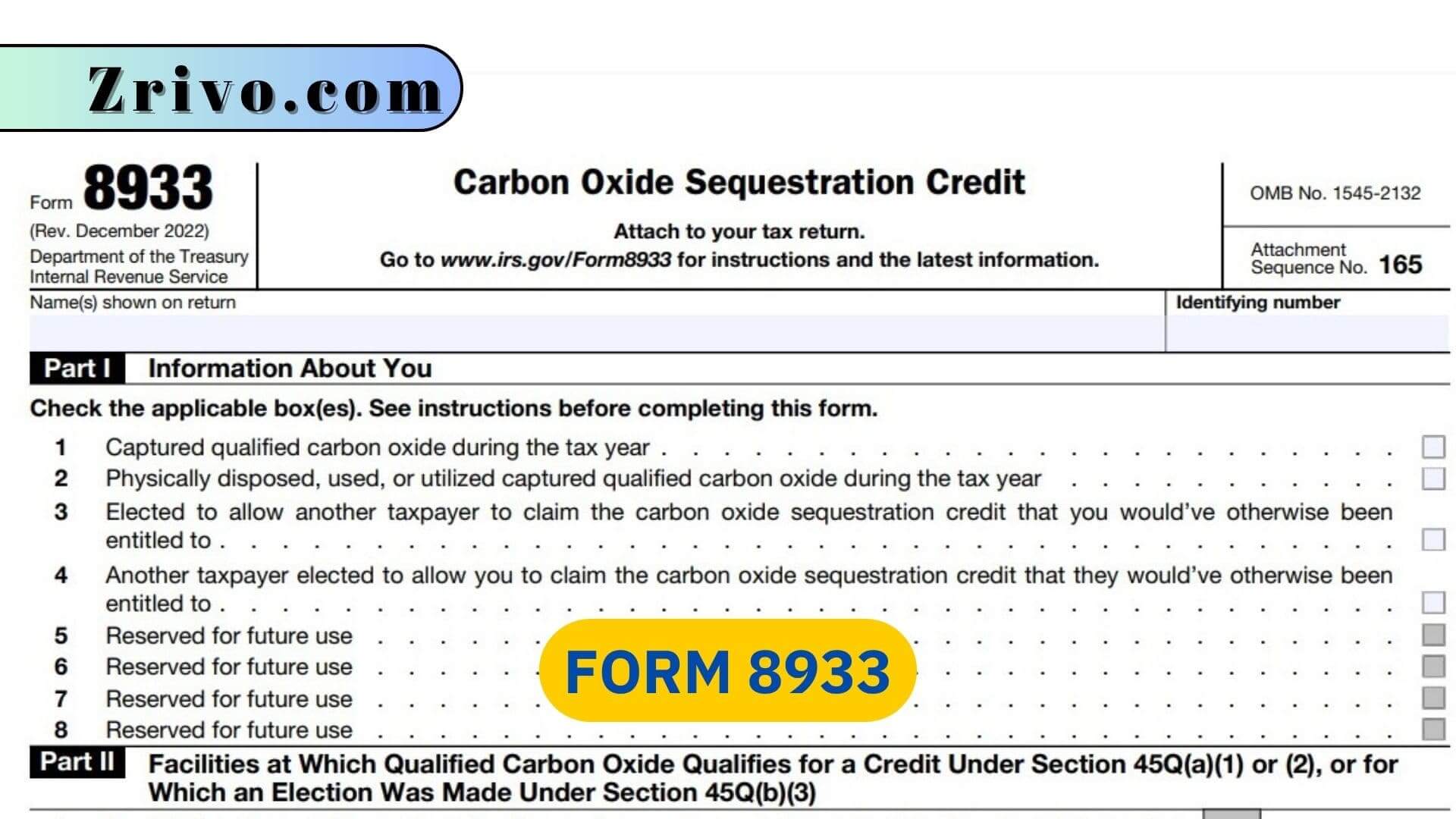

Form 8933 is the annual reporting document required to claim the section 45Q carbon oxide sequestration credit.

Form 8933 must be filed annually by both the entity that captures the CO2 and the entity that disposes of the CO2. The IRS requires each party to certify on the form a number of items, including the number of metric tons of CO2 captured, securely stored, or injected into the ground for EOR. This certification must be made under penalty of perjury. The Form 8933 instructions also provide several “Model Certificates” that describe formats for how different types of tax credit claimants may report their CO2 sequestration data. However, the instructions state that taxpayers are not required to use these forms and can use other reporting formats.

In addition, the regulations require both the electing taxpayer and the contractor to report their contract information on a Form 8933. In order to comply with this reporting requirement, both parties must provide each other a copy of their own Form 8933 and attach each of those copies to the tax credit claimant’s own Form 8933. Failure to strictly comply with these requirements results in complete disallowance of the credit (except for the non-credit claimant party’s failure to attach a Form 8933 received from the electing taxpayer).”

How to File Form 8933?

The IRS regulations require that all entities that own capture equipment, sequester CO2, and utilize carbon in a commercial process must file Form 8933 with their tax returns. The rules also specify that contractors working on these projects must file a separate Form 8933 and provide the IRS with a set of Model Certificates. This will likely create a massive administrative burden for the IRS as it is required to review thousands of tax filings and Model Certificates from a broad range of 45Q credit claimants with complex corporate, partnership, and joint venture structures. Moreover, it appears that the IRS will not perform any physical verification of these reported tons and instead relies on reports to the USEPA and self-certification by claiming that the numbers are accurate.

Even though the Form 8933 and Model Certificates have OMB control numbers, they are not considered a mandatory submission under the Paperwork Reduction Act, and claimants can use any attachments that meet the requirements of the instructions to the Form. This means that even though the Form 8933 has 16 boxes for numbers, many of them may be left blank. However, a lot of important information must be included in these filings, such as total tons captured at multiple facilities owned by a single claimant; amounts of tax credits transferred between capture and disposal facilities; and the amount of carbon used for EOR.

The IRS does not make that data public because the information on Form 8933 is attached to a taxpayer’s tax return. Instead, it treats that information as private and confidential. Even so, it is not difficult to imagine that citizens could track the credit claims made by these entities and press for compliance with the rules. In fact, the IRS requires that all tax credit claimants certify that their reported numbers are accurate under penalty of perjury.