Employer Identification Number (EIN)

A federal tax ID number- an EIN or FEIN- is a unique nine-digit number for businesses. It works like a personal Social Security number for companies instead of individuals. This article will cover everything you need to know about your Employer Identification Number.

An Employer Identification Number (EIN) is a unique nine-digit number the IRS assigns to businesses for tax reporting purposes. It is sometimes referred to as a Federal ID Number or Tax Identification Number, similar to an individual’s Social Security Number. Business owners use their EIN to identify their company for tax purposes, and it is also required when applying for business licenses or opening a bank account.

Most types of businesses need an EIN, including corporations, partnerships, and some trusts. However, a single-member limited liability company that has no employees does not need an EIN. Although an EIN is not necessary for every business, getting one as soon as possible is a good idea. It can help establish credibility and professionalism and make it easier to open a bank account or apply for credit cards. Additionally, it can help protect personal assets from lawsuits by separating business and personal finances.

How to Get an EIN?

An EIN is the unique nine-digit number that the IRS assigns to businesses. It is like a Social Security number for a business, and it helps the IRS keep track of business activity. You can get an EIN by filling out a simple form on the IRS website. It is a good idea to apply for an EIN as soon as you start a new business or change the legal structure of an existing one. You can do this online or by phone, and the IRS will usually process the application within a few days.

Depending on the type of business, you may also need to get state tax ID numbers and licenses. Generally, all businesses should get an EIN, but the IRS makes exceptions for some types of unincorporated organizations. For example, a sole proprietorship that does not have employees should use the owner’s Social Security number as its EIN. This helps reduce identity theft risk by keeping personal and business finances separate.

You can apply for an EIN by submitting a form called SS-4. The form asks for basic information about your business, including its name and location. You will also need to provide the contact information for a responsible party, which is typically the owner or general manager of the business. You can fill out the SS-4 form online or by phone.

Once you have your EIN, you should use it on all official documents and transactions with the IRS. You can also use it to open bank accounts and to obtain credit cards for the business. You should not use it to report income or pay taxes; you must file your taxes using your own Social Security number.

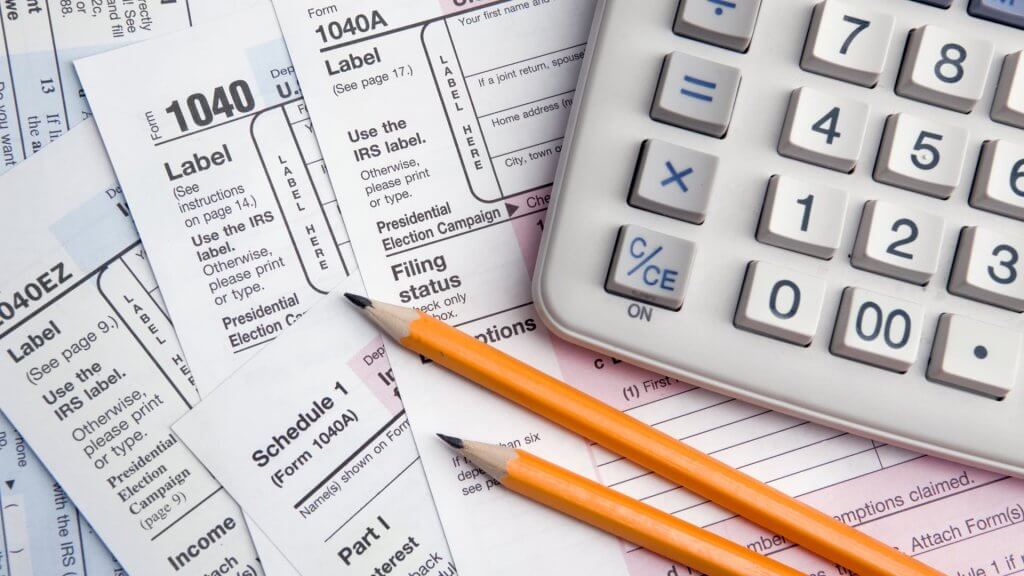

EIN on Tax Forms

Most businesses need a federal tax ID number (EIN), a FEIN, or an E-ID. However, some types of businesses, such as sole proprietorships and partnerships with no employees, don’t need an EIN.

Your FEIN is needed for all tax-related paperwork and is required by many banks, financial institutions, and credit card companies. You will also need it if you hire employees or file payroll reports. At the end of the year, you must issue a W-2 to each employee and a 1099 to any independent contractors you paid more than $600.

In addition to a federal EIN, some businesses require state tax ID numbers. In Massachusetts, for example, businesses that are registered to collect sales tax or meals and hotel tax must have a MassTaxConnect account. You can register for a MassTaxConnect account online, by phone, or by mail.