Form 8582 2023 - 2024

The IRS requires individuals to submit Form 8582 to determine the amount of passive activity losses they can deduct. This article covers the purpose of Form 8582 and its filling instructions.

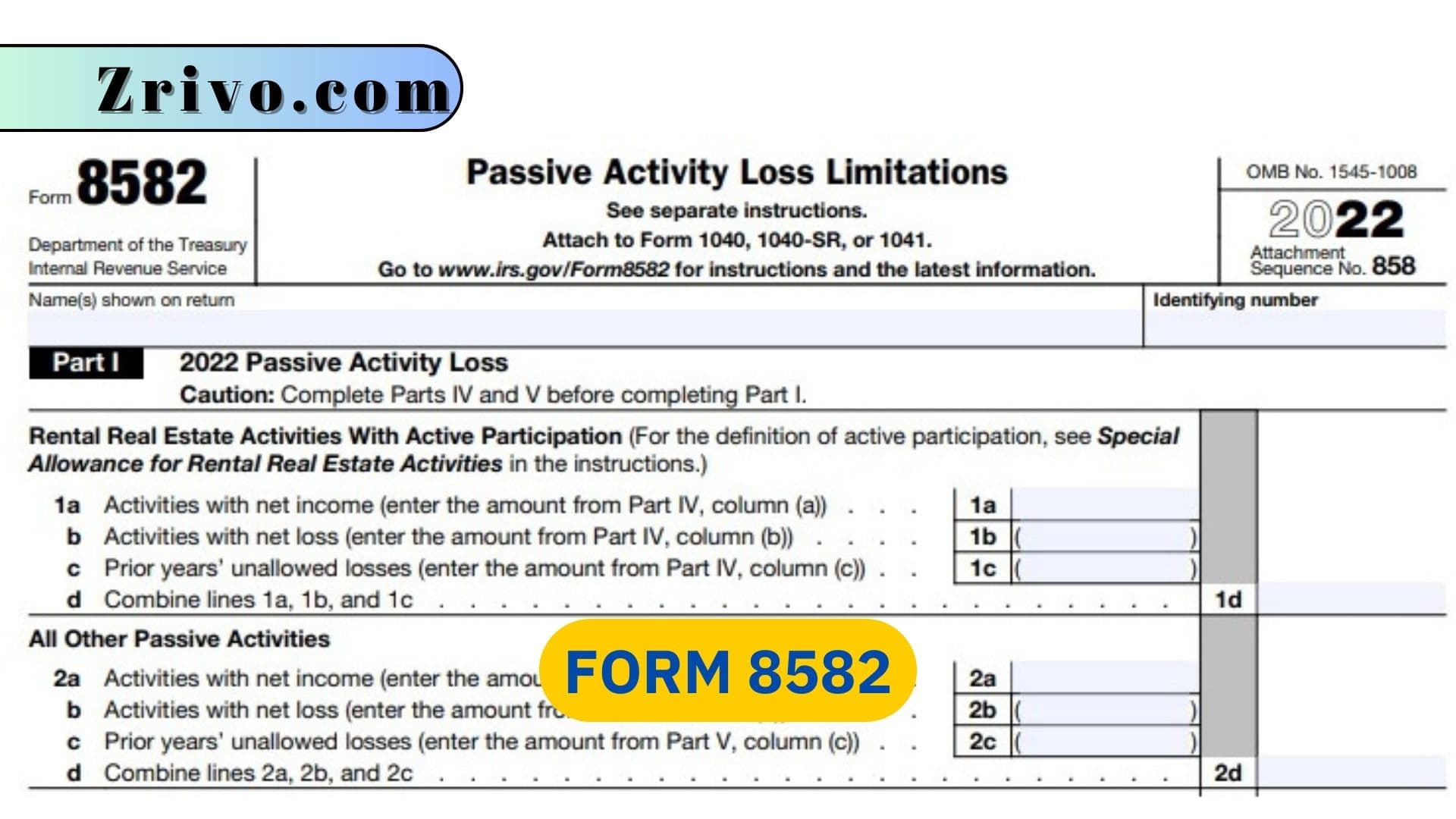

For each tax year, you may deduct passive activity losses up to certain limits. The limit is determined by the amount of current year net income from the passive activities plus prior-year unallowed losses (if any). Noncorporate taxpayers, including individuals, estates, and trusts, must file Form 8582 to compute the net loss or income from each passive activity deduction. In addition, this form is used to report new groupings or regroupings of activities and to determine the basis of property disposed of in a taxable year.

Form 8582 also contains rules and regulations that govern the allocation of passive losses to each of a taxpayer’s passive activities. This includes a rule that states that a taxpayer cannot use more than 50 percent of his or her total passive activity losses from one activity to offset any passive activity gains from another activity. It is important to note that these limits are not cumulative and must be met in each year to avoid losing passive status.

To complete Form 8582, you will need information about your rental real estate and other passive activity losses and your active participation in each activity. You may also need certain other supporting documents, such as Schedule D, Form 4797, or Form 6252. The instructions for Form 8582 include a worksheet designed to help you fill out the form. The worksheets contain specific rules and regulations on how to calculate a taxpayer’s limited losses and carryforwards.

How to Fill out Form 8582?

Form 8582 is one of the most complicated IRS forms. There are 9 parts to complete in the form, and each must be completed carefully if you don’t want to face possible penalties or audits.

- Part I is where you must fill out lines associated with your Passive Activity Loss.

- Part II is where you must enter amounts related to Special Allowance for Rental Real Estate Activities With Active Participation.

- Part III: Figure your Total Losses Allowed as you’re instructed in the form.

- Part IV: You must complete this part before Part I, Lines 1a, 1b, 1c. Enter amounts for each activity: net income, loss, unallowed loss, gain, and loss.

- Part V: Complete This Part Before Part I, Lines 2a, 2b, and 2c

- Part VI: Use This Part if an Amount Is Shown on Part II, Line 9

- Part VII: Allocation of Unallowed Losses

- Part VIII: Allowed Losses

- Part IX: Activities With Losses Reported on Two or More Forms or Schedules