Form 3922 2023 - 2024

Form 3922 is a tax form used to report the transfer of stock acquired through an employee stock purchase plan (ESPP). This article covers everything you may want to know about Form 3922.

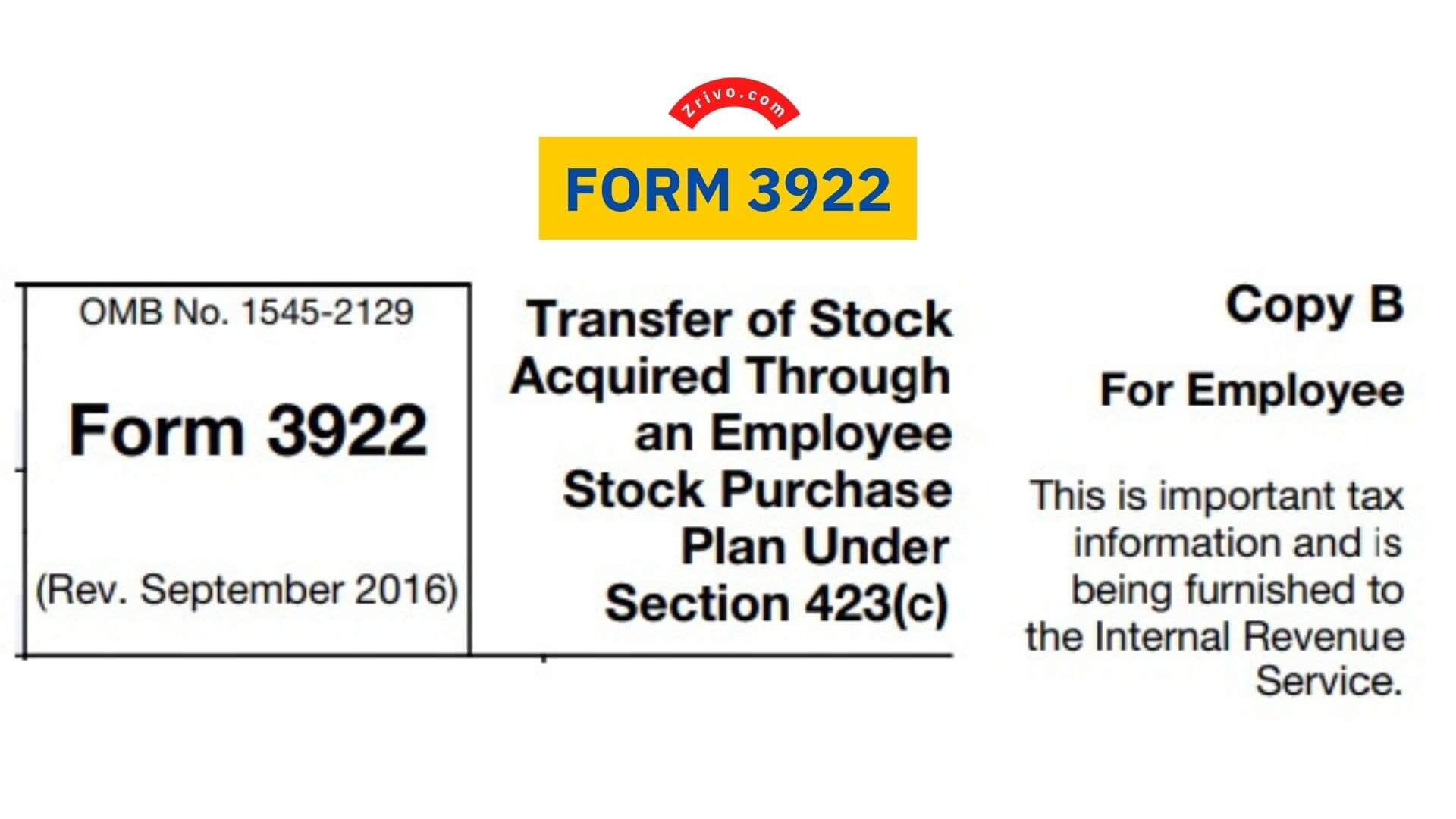

Form 3922 is a form that is used to report initial transfers of stock acquired by an employee (or former employee) pursuant to the terms of an employee stock purchase plan. This form must be filed by a company for each applicable stock transfer. It consists of three copies: Copy A, which is filed with the IRS; Copy B, which is furnished to the exercising employee; and Copy C, which is retained by the corporation for its records.

Form 3922 is commonly filed by corporations, and it should be submitted to the Internal Revenue Service every time a corporation transfers the legal title of shares to an employee. Companies must report the exercise of incentive stock options (ISOs) on Form 3921 and the transfer of ESPP shares to employees or former employees on Form 3922, as required by Section 6039 of the Internal Revenue Code. ISOs are stock options that grant the option holder the right to purchase a certain number of shares at a fixed price over a specified period of time.

What is ESPP?

An ESPP is an arrangement in which employees can buy shares of the company’s stock at a discounted price. These plans are attractive to employees, but they can also be confusing to understand and manage, especially when it comes to taxes. ESPPs allow companies to offer employees the chance to buy shares of their own company at a discount, usually between 5% and 15%. These plans are often accompanied by an ESPP agreement, which sets out the rules for how employees can participate in them and how much they can save under the program.

When a worker exercises an ESPP, they receive two copies of Form 3922-one from the employer and another from the securities broker who administers the plan. This form documents the transfer of shares and provides information about how much the person received from the ESPP. The due date for this form is January 31st of the following year, when the first stock transfer occurs. This is because it’s important for employees to receive information about the ESPP transfer before they file their taxes.

How to fill out Form 3922?

To fill out Form 3922, you’ll need to provide:

- The name, address, and federal identification number of the company that granted you the option to buy stock

- Your social security number or taxpayer ID number

- The date you exercised your ESPP option and the stock’s fair market value on that day.

The form includes boxes that outline the details of each transaction, including the date the option was granted and the date it was exercised. The form also details the stock’s fair market value on the grant date and the price you paid for the stock when you exercised your ESPP option.

In addition to containing these details, Form 3922 also requires that you include a statement to the person who received the option. This statement explains that you are the transferee of the stock and that you are entitled to receive any compensation or benefits that you might receive as a result of the option.

You can fill out Form 3922 on paper or electronically using tax preparation software. The IRS prefers e-filing for forms that contain sensitive financial information. However, if you don’t have access to a computer or don’t feel comfortable filing on your own, you can always use professional online services. Online tax preparation services are the best way to prepare and file Form 3922. It’s fast, easy, and secure. Plus, you can get real-time updates on the status of your form.