Form 3921

Form 3921 is used by companies to report when a specified employee exercises an incentive stock option (ISO). Read this article to know more about the purpose of Form 3921 and its filing instructions.

Form 3921 is a tax form used to report specific information about stock incentive options that a corporation offers during a calendar year. If your startup gives an incentive stock option (ISO) to employees, it’s important that you file a Form 3921 Form after each employee exercises the ISO. Failure to do so can result in a significant penalty.

Moreover, this form helps determine the gain or loss the employee will incur when they sell their stock. It also helps the IRS identify who received an ISO so that they can later determine whether an individual owes capital gains or alternative minimum tax (AMT) when they sell their stock.

Who Must File Form 3921?

Companies that grant ISOs should file this form with the IRS in the same year in which the stock option is exercised before the deadline. In addition, a copy of this form must be sent to the employee who has exercised the stock option. A company that has more than 250 employees and exercises an ISO must file this form electronically. This filing is due no later than March 31 of the year in which the exercise occurs. In the event that a company fails to file this form by the due date, it may be subject to a penalty. The penalty ranges from $50 per form if the company files within 30 days of the deadline to $280 if the company does not file at all.

This makes it crucial that companies who issue ISOs stay on top of their filing obligations and take steps to make sure they are done right. It is essential to have a system in place to keep track of all the filings that must be made. A cap table management platform can be a great way to keep this information organized and up-to-date.

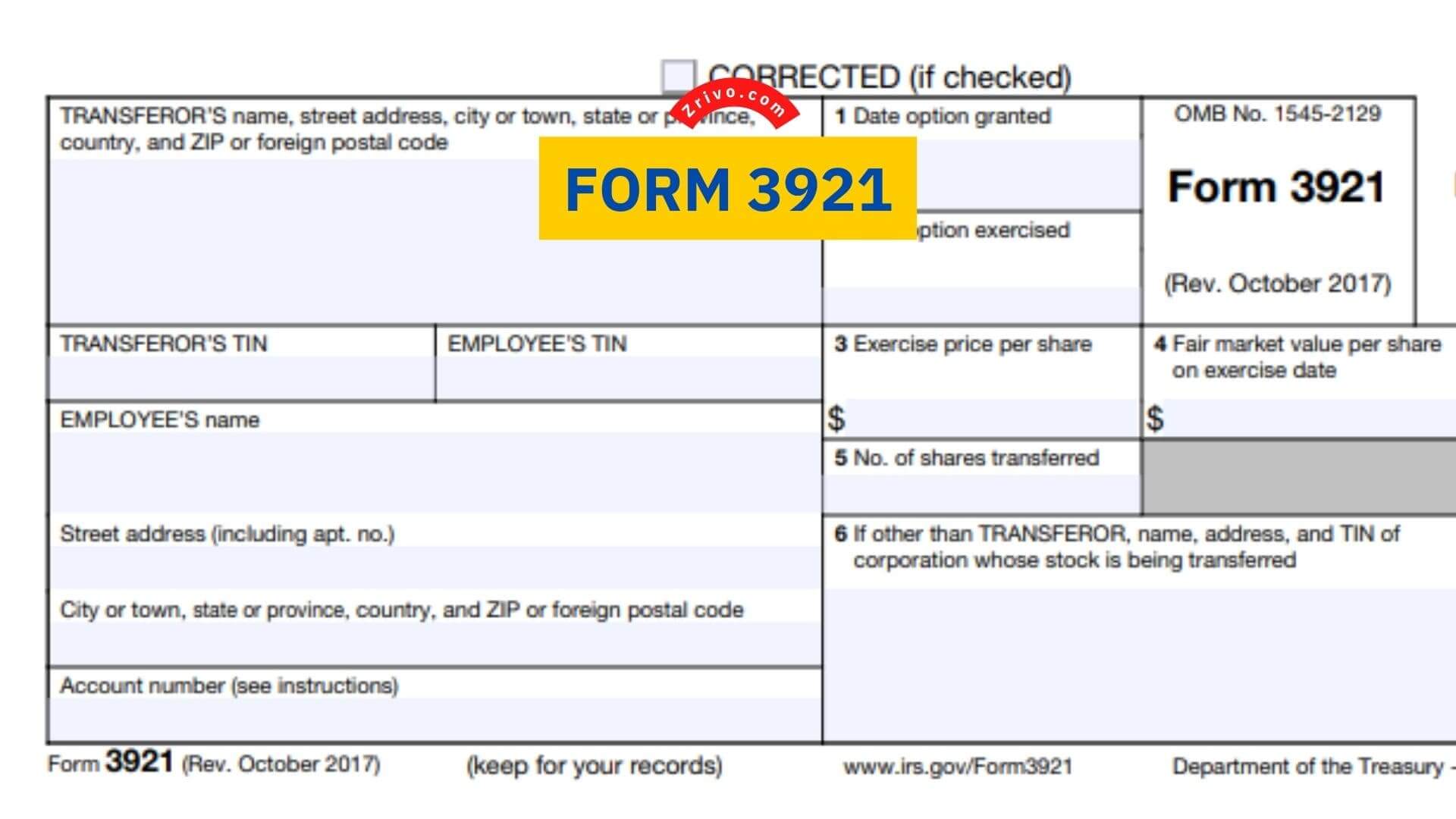

How to fill out Form 3921?

A key part of filing Form 3921 is a report of the difference between the strike price and the company’s share price on the date that an employee exercises their ISOs. This is known as the spread between the strike price and the fair market value of the shares on the exercise date, and it’s added to an employee’s income when they calculate their Alternative Minimum Tax (AMT). Similarly, if a company sells its shares to an employee who exercises ISOs, this form is also filed by the same deadline to report the amount of stock that was transferred. This information is also used to calculate the spread between the strike price and the fair value of the shares, as well as the income tax withheld from payments made for estimated taxes.

Businesses that give employees stock options often have complex accounting and finance needs that can be difficult to keep track of. The good news is that several cap table management platforms make it easy to maintain your stock option records. If an employee exercises their ISO, then the company must file Form 3921 with the IRS and provide a copy B to each affected employee. It’s important to file on time so that you don’t run the risk of fines from the IRS for failing to report an ISO exercise before the deadline or for making mistakes on Form 3921.

The information on Form 3921 is mainly for informational purposes and should not be entered onto your tax return unless you sold the stock at the end of the year or you might be subject to alternative minimum tax (AMT). However, it can also help you determine the basis for any gain or loss when selling the stock. It’s important to enter the correct amount for your stock sale because the difference between the exercise price and the fair market value will be included in the income reported for AMT calculations. If you’re not sure of the correct amount, you can ask for help from your accountant or get a 409A valuation.