Georgia Tax Brackets 2024

The Georgia tax system is progressive, meaning you'll pay taxes on your income at different rates.

Contents

The Georgia state income tax has six tax brackets, each representing a different rate range. The top tax bracket is a whopping 5.75%. This is one of the highest marginal tax rates in the country. The tax system is designed to encourage a healthy economy by helping individuals and businesses invest in their future. This is achieved by a series of incentives, including a refundable Earned Income Credit, a tax credit for low-income households, and a state-funded childcare subsidy program.

There are also some tax benefits for business owners, such as a tax credit for employers that provide medical insurance and an exemption on some employee-related expenses like childcare and transportation. Additionally, Georgia’s unemployment tax break is among the lowest in the nation.

Georgia Sales Tax

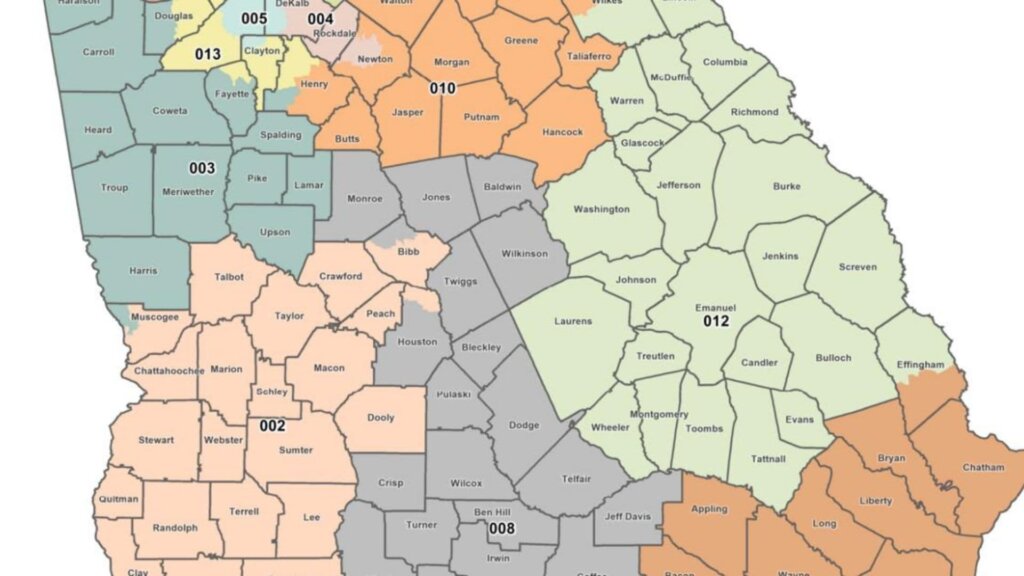

Sales taxes in Georgia are levied on most goods and services. These rates vary from city to city but are generally in the 4% to 9% range. In addition to the state levy, many local governments collect an additional 1% or 2% in local sales tax. The best way to track this is to use an online calculator to get an idea of how much you might be paying in your area.

It’s also good to check the Georgia state sales tax website for information on how your business can take advantage of sales tax laws. This will help you ensure that your customers pay the right amount of tax when they buy from you. For instance, if you are an e-commerce store, you may want to set up a recurring sales tax charge to reduce your tax liability each quarter.

Is Georgia a high-tax state?

Georgia tax rates vary, but the state’s statewide sales and income tax are near the national average. Additionally, the state and local government may impose additional taxes on items such as gas, alcohol, cell phone usage, estate, and gifts. However, it is important to keep in mind that a state’s overall tax burden often depends on individual taxpayers and the amount of their income. For example, owning a large business or a home in Georgia may be more difficult to avoid paying taxes.

The State of Georgia offers several tax deductions to help lower your total tax liability. These include a standard deduction, an itemized deduction, a disaster assistance credit, and a low-income tax credit. Another way to save money is by claiming a property tax exemption for your home. The homestead exemption can reduce your annual property taxes by up to 5%.

In addition to the aforementioned tax deductions, Georgia also offers a low-income tax rate, which can help offset your higher federal tax bill. The state also offers tax credits for charitable contributions and education. Many people are considering moving to Georgia for a variety of reasons. Whether it’s for work or to enjoy the southern charm, Georgia is an excellent place to live.

One of the best things about living in Georgia is that it’s relatively affordable compared to other highly populated states. The cost of housing, food, and energy are much less expensive here than in other parts of the country. Georgia is an excellent choice if you’re looking for a state with great schools, a good job market, and a lower tax rate. The state is also a great place to raise a family.

Georgia Income Tax Brackets 2024

If you’re planning on moving to Georgia or buying a home in the state, it’s important to know your tax brackets. As a rule, Georgia’s tax brackets are based on your income and marital status, with married couples filing jointly having wider brackets than single or married individuals. Here are the Georgia Income Tax Brackets:

Single Filers

| Income | Tax |

| 0-$750 | 1% |

| $751-$2,250 | 2% |

| $2,251-$3,750 | 3% |

| $3751-$5,250 | 4% |

| $5,251-$7,000 | 5% |

| $7,000+ | 5.75% |

Married Filing Jointly

| Income | Tax |

| 0-$1,000 | 1% |

| $751-$2,250 | 2% |

| $1,001-$3,000 | 3% |

| $3001-$5,000 | 4% |

| $5,001-$10,000 | 5% |

| $10,000+ | 5.75% |

Head of Household

| Income | Tax |

| 0-$1,000 | 1% |

| $751-$2,250 | 2% |

| $1,001-$3,000 | 3% |

| $3001-$5,000 | 4% |

| $5,001-$10,000 | 5% |

| $10,000+ | 5.75% |