How to Calculate Debt to Income Ratio?

The debt-to-income ratio, or DTI, is a measure of how much of your income goes toward debt payments.

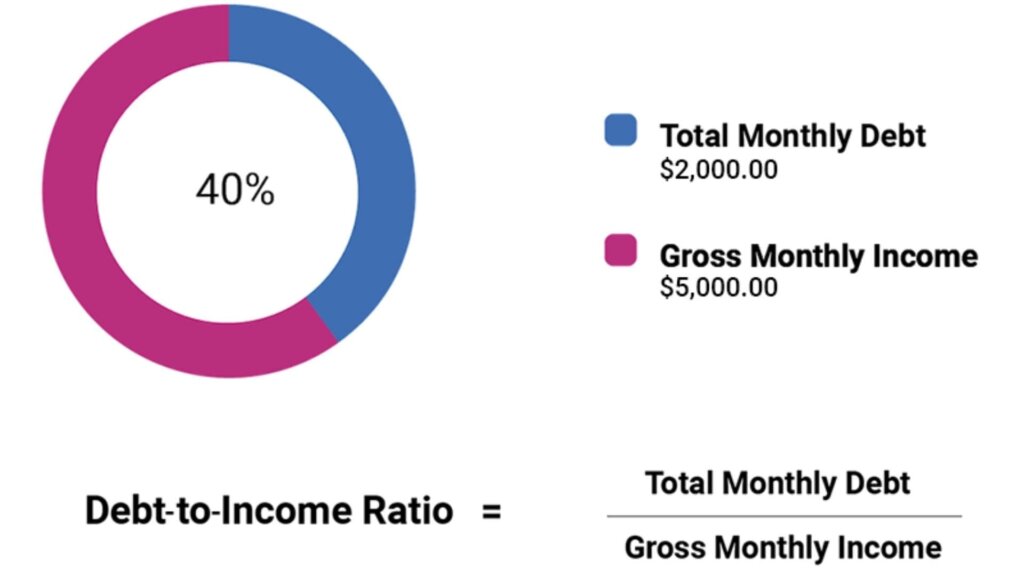

The debt-to-income ratio, or DTI, is a number lenders use to gauge whether you can afford your loan payments. Generally, the lower your DTI, the more likely you are to be approved for credit or loans. The DTI formula is simple: add up your monthly debt payments and divide that amount by your monthly gross income. This figure will give you your front-end DTI, which reflects the percentage of your income that would go toward your mortgage principal and interest, homeowners’ insurance, and property taxes (PITI).

Your back-end DTI considers all of your monthly debt payments, including credit card bills, car loans, student loans, child support, and other revolving debt, and your PITI. It’s important to note that lenders only consider expenses on your credit report — utility bills, gym memberships, and food costs aren’t counted in your DTI.

If you want to lower your DTI, you must reduce your recurring debt payments or increase your income. Start by looking at your budget and identifying areas to cut expenses. Then, work on increasing your income through a side hustle or finding another source of revenue. It’s also helpful to recalculate your DTI on a regular basis and track your progress.

Debt to Income Ratio Calculation for Mortgage

Lenders evaluate your debt-to-income ratio when you apply for a mortgage, auto loan, or other types of loans. This is a calculation that compares your monthly debt payments to your gross monthly income, which is your take-home pay before taxes and deductions. The higher your DTI, the less likely you are to be approved for a new loan.

To calculate your DTI, add up your monthly debt payments, including student loans, auto loans, and credit card payments. Then, divide that total by your monthly gross income and multiply by 100 to convert it into a percentage. A mortgage is a big commitment, and lenders want to make sure you can afford the repayment terms. If your DTI is too high, it can lead to delays or even denial of a mortgage.

You may be able to lower your DTI by paying off existing debt or increasing your income. However, you should avoid using short-term strategies to lower your DTI, such as applying for a forbearance or opening additional credit cards, as these can negatively impact your debt-to-income ratio in the long run. Instead, focus on long-term financial goals to build wealth and improve your DTI. This way, you can make smarter decisions about how to manage your debt.