IRS CP14 Notice – Everything About It

It is quite natural to feel excited or panicked when you get a notice from the International Revenue Service. Most of the time, these notices can be painful and inform you about your overdue or forgotten payments. Unfortunately, the IRS CP14 notice is sent to the taxpayers exactly for this purpose.

If you owe money to the IRS or have unpaid taxes, the organization will not miss sending you a notice. Besides these, this notice can be sent if you owe money because of penalties or interest too.

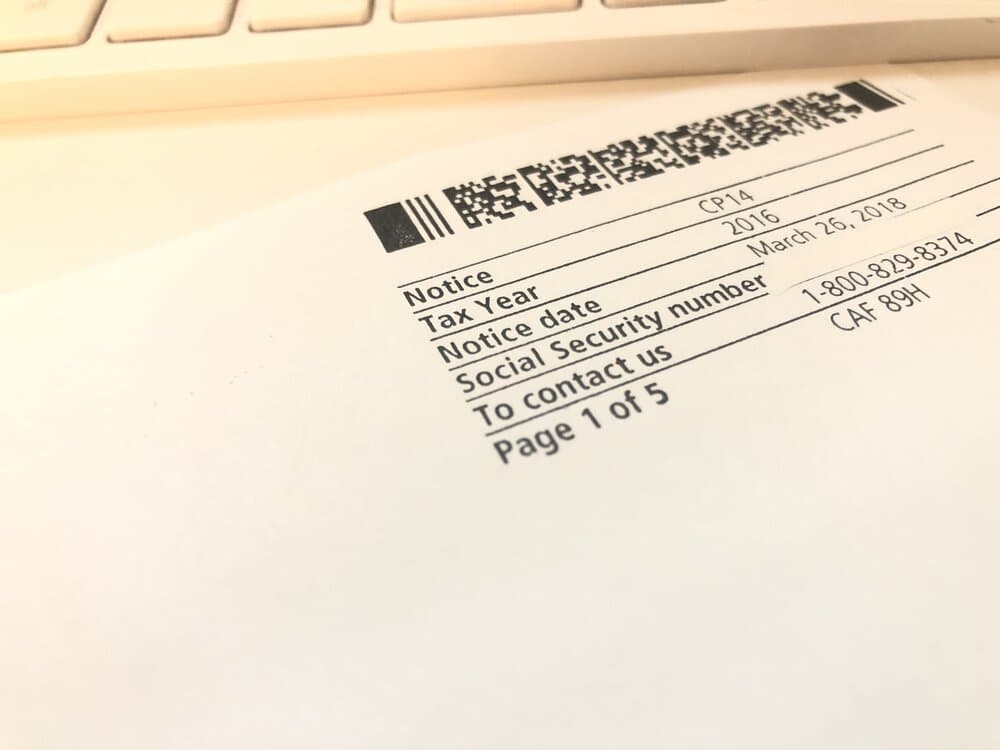

What to Do When You Receive a CP14 Notice?

Here are the things you need to do whenever you receive a CP14 notice:

First, take your time and read carefully what is written on the notice. There must be a special part that notifies you about the money you owe and how you can pay it.

If you believe that the IRS’ claims are true and you need to pay the money you owe, all you need to do is pay the amount until the date stated in the notice to avoid additional costs.

If you believe that the IRS’ claims are true but cannot pay the amount until the date specified on the notice, then pay as much as you can. Also, try to contact the IRS. You can negotiate a payment plan for the remaining part of the owed balance. However, you will have to pay penalties or interest for the unpaid balance.

In case you believe you don’t owe any money or you have an objection to the notice, then you need to seek professional assistance from a tax law professional. Contacting a professional earlier will save you time since you have only 60 days to object to the notice after you get it.