IRS Section 1202

IRS Section 1202 offers one of the most compelling tax incentives in the world. In this article, we will explore what IRS Section 1202 covers, who is eligible to claim the exclusion, and how to take advantage of this tax benefit.

Contents

IRS Section 1202 is a tax provision that offers a significant tax benefit for investors in small businesses. It provides a tax exclusion for up to 100% of capital gains from the sale of qualified small business stock, which is designed to incentivize investment in small businesses and promote economic growth. While the provision has been in place for many years, it gained renewed attention in recent years due to changes in tax laws and the growing interest in entrepreneurship and small business investment. As a result, more and more investors are exploring the benefits of investing in qualified small business stocks and taking advantage of the QSBS exclusion. However, navigating the complex rules and requirements of IRS Section 1202 can be challenging, and investors must ensure that they meet all eligibility requirements and follow all applicable procedures to claim the exclusion.

What does IRS Section 1202 Cover?

IRS Section 1202 allows investors to exclude up to 100% of their capital gains from the sale of qualified small business stock (QSBS) from federal income tax. QSBS is defined as stock in a domestic C corporation that meets the following criteria:

- The stock was acquired directly from the issuing corporation (not on the secondary market)

- The issuing corporation is a domestic C corporation with aggregate gross assets of $50 million or less at the time the stock is issued

- The issuing corporation uses at least 80% of its assets in the active conduct of a qualified trade or business (excluding certain types of businesses such as professional services)

To be eligible for the exclusion, the stock must have been held for at least five years before it is sold, and the exclusion is limited to the greater of $10 million or 10 times the taxpayer’s basis in the stock.

Who is Eligible to Claim the Exclusion?

Individuals, partnerships, S corporations, and some trusts and estates are eligible to claim the QSBS exclusion. However, there are certain limitations and restrictions to be aware of:

- C corporations are not eligible to claim the exclusion.

- The exclusion applies only to federal income tax; it does not apply to state or local taxes.

- The exclusion does not apply to certain types of taxpayers, such as tax-exempt organizations, foreign individuals or corporations, and some financial institutions.

How to Take Advantage of the QSBS Exclusion

To take advantage of the QSBS exclusion, investors must follow certain procedures when acquiring and selling QSBS. Here are the steps to follow:

- Verify that the stock meets the criteria for QSBS, including the five-year holding period and the $50 million asset limit.

- Calculate the basis of the stock, which is generally the amount paid for the stock plus any additional costs incurred in acquiring the stock.

- When the stock is sold, calculate the capital gain and apply the exclusion limit of the greater of $10 million or ten times the basis in the stock.

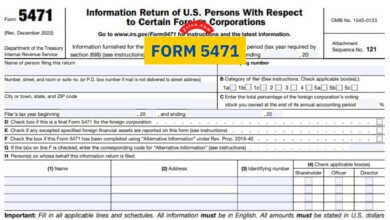

- Report the sale on your tax return using Form 8949 and Schedule D.

It is important to note that the QSBS exclusion is subject to certain limitations and restrictions, and investors should consult with a tax professional to determine their eligibility and ensure compliance with all applicable tax laws.

IRS Section 1202 provides qualified small business stock investors with a valuable tax benefit. By excluding a portion of their capital gains from federal income tax, investors can realize significant tax savings and promote economic growth by investing in small businesses. However, investors must meet certain eligibility requirements and follow specific procedures to take advantage of the QSBS exclusion. If you are considering investing in QSBS, consult with a tax professional to determine your eligibility and ensure compliance with all applicable tax laws.