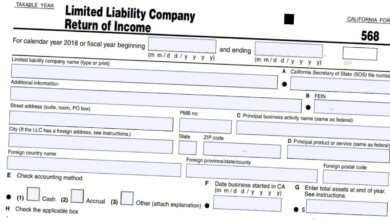

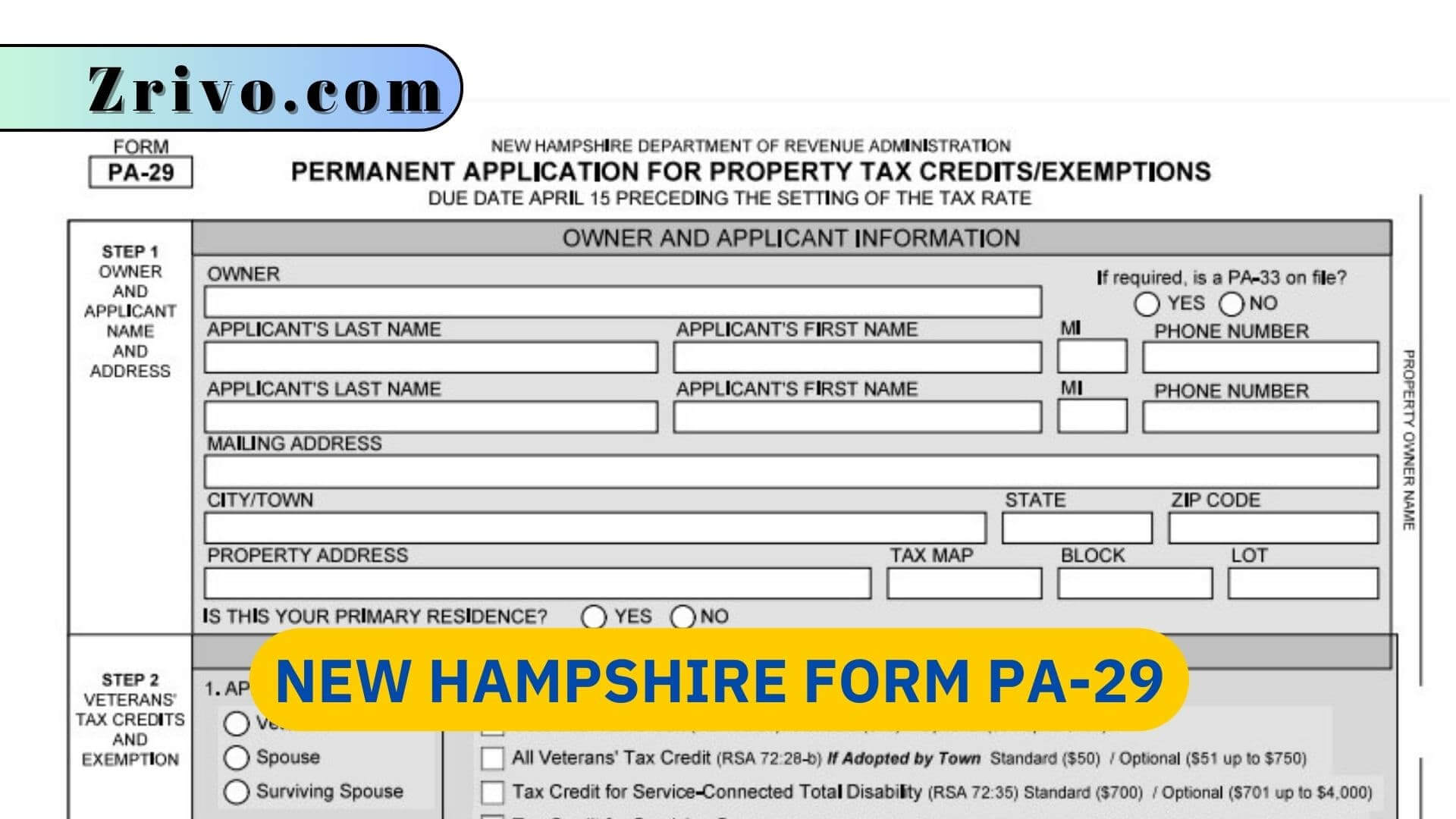

New Hampshire Form PA-29

New Hampshire Form PA-29 is an official document that must be filed by anyone who wishes to claim a property tax credit or exemption.

New Hampshire Form PA-29 is a property tax exemption application that must be filed by April 15, and not later, for the current tax year. The application is permanent, but it must be reviewed each year to determine if you remain eligible. The state form requires applicants to fill in personal information such as name, birth date, and address. They also must provide proof of residency and ownership of the property in question. Depending on the type of credit or exemption being sought, the form may require further information, such as a list of assets (tangible and intangible) minus all good faith encumbrances and the property’s assessed value. In addition, certain types of exemptions may also have income and asset requirements based on relevant state law.

For example, the Elderly Exemption requires that the applicant be 65 years of age or older on April 1 of the application year. Similarly, veterans who wish to apply for a military service-connected disability or homestead energy credit must submit a letter from the Department of Veteran Affairs stating that they are permanently & totally disabled as a result of their military service. Other types of credits and exemptions include preservation of historic barns, which are awarded a 25-75% reduction in their property taxes through the Agricultural Structures Preservation Easement program.

Who Must File Form PA-29?

A person must file PA-29 if they want to claim the Veteran’s Property Tax Credit. The application must be filed prior to April 1 of the year the credit is claimed. Applicants must also provide an income and asset statement (Page 1) and a list of assets minus any good faith encumbrances.

If you are a veteran, it is important to make sure that you have your DD214 form with you when filing this form. The DD214 will show the date you entered military service, the branch of service, and your date of discharge or release.

If you are applying for the elderly property tax exemption, it is important to note that you must be at least 65 years old on April 1 of the year in which you are filing the application. You must also own and occupy the property for which you are applying. Documentation of all income and assets must be provided with your application.

How to File New Hampshire Form PA-29?

The first section of Form PA-29 asks you to provide your name, date of birth and address. You will also need to confirm that your property tax bill was not reduced in the previous year, and you are claiming the credit or exemption for this current year only.

The next sections require you to fill in your income and assets. You will need to provide information about your social security income, statements from pensions or retirement distributions, and your most recent federal tax return if you are still filing one. You will also need to provide your net assets minus the value of your residence and good faith encumbrances. You will then need to sign the form and date it.

If you are applying for the elderly exemption, you must have reached 65 years of age on or before April 1. You must also be a resident of New Hampshire for three consecutive years before that date. If you are married, both you and your spouse must have been residents of the state for five consecutive years to qualify. To support your claim, you must submit copies of your Social Security income statement and statements from retirement or pension plans. You must also submit a copy of your federal income tax return if you are still filing one.