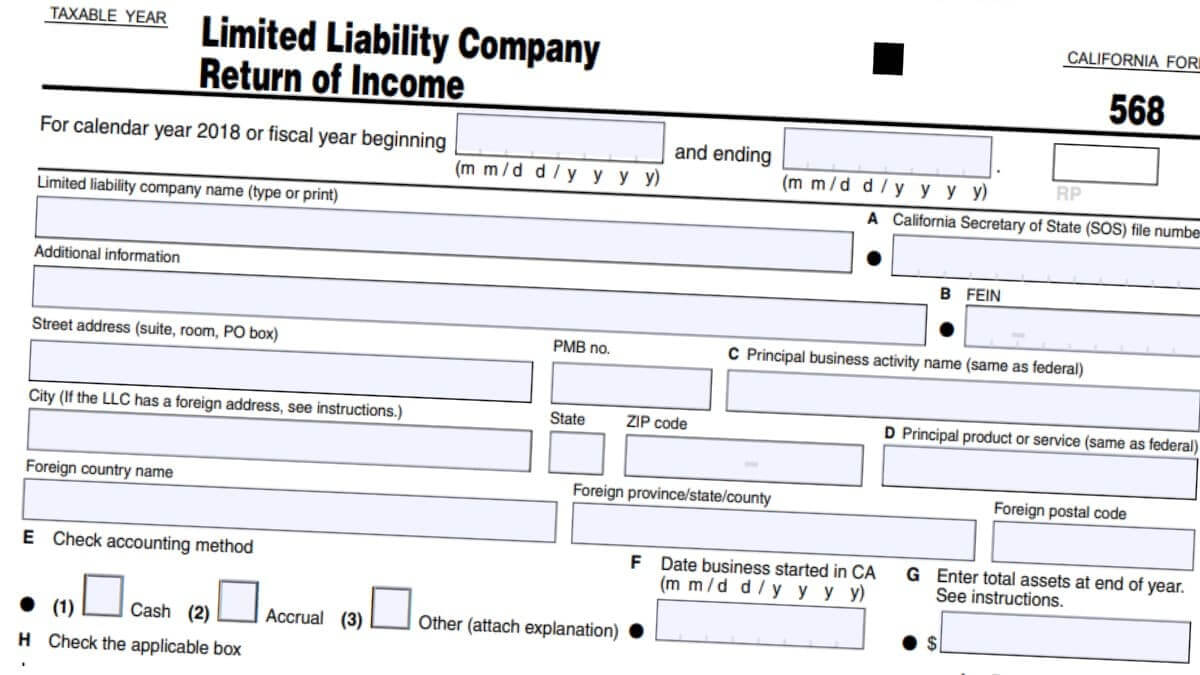

How to Prepare Form 568 Instructions

Whether you are filing your Form 568 for your business or if you are a nonresident business that has a tax liability, there are many things you must consider. These include the tax fee, the tax liability, and the non-consenting nonresident member. This article discusses each of these topics and will help you learn how to prepare your tax return.

Fee and tax

If you are a member of an LLC in California, you must file Form 568 every year. This form contains instructions meant to help you with the tax return. The information contained in this document needs to be a complete guide to the California tax code. You should consult an accountant for more legal advice.

You should file Form 568 by the 15th day of the fourth month after the close of the LLC’s fiscal year. After filing, you will receive a bill for the annual tax and fee. You can go to the California Secretary of State’s website and follow the links to pay the payment.

An important point to remember when filing CA form 568 is that all supplemental schedules must be filed. Additionally, you should include all members’ addresses in the Additional Information field.

Nonconsenting nonresident members’ tax liability

A Limited Liability Company in California with members from outside the state has a tax bill to pay. That’s not all. In addition to the tax, the LLC must show its tax-paying partners a business plan that makes sense. Among other things, it must show how the money was spent and how it was made.

The nonresident members’ tax is the last resort tax, and it must be paid on time, or a penalty will be applied. If the taxable entity can prove it has been producing the tax, it will likely be granted an extension. The annual tax payment date is the fifteenth day of the fourth month of the taxable year. It’s also the only time of the year the state can audit the state-paid portion of an LLC’s income tax.

Limitation of SMLLC’s credits

Raising capital is one of the more challenging tasks for a new business owner. Thankfully, there are a few ways to raise a few bucks, including a small business administration loan. Of course, the best way to determine whether you are prequalified is to visit a financial institution. The good news is that most lenders are happy to work with you and often provide better rates than banks and other traditional lenders. If you have a stellar credit score, you may be eligible for a loan of up to $35,000 with an interest rate as low as 4.5%. Alternatively, you can opt for a cash advance, a hybrid, or an unsecured credit card.

If you want to get your money’s worth out of your business, consider opening a limited liability company or LLC. This business structure provides the best of both worlds: a corporation’s legal protections and the tax advantages of a sole proprietorship.

Filing electronically or on paper

If you operate a limited liability company (LLC) in California, you must file CA Form 568 annually. Consider filing a short-period return if you create or terminate your LLC in a taxable year. These are available online, and you can pay a convenience fee.

Typically, you will also need to file federal Form 8825 and a statement that reconciles the federal and California amounts reported on Form 568. If you operate a series of LLCs, each series will have its filing. This is because each holder of a series interests shares in the income of the series. However, when the string is liquidated, the holder of each series is only allowed to use the assets of the series.

Limited Liability Companies in California are required to file Form 568, Similar to other California income tax returns, Form 568 isn’t updated every year. The latest revision of the form came in 2015. The instructions to file Form 568 since then can be still used for the 2024 tax season.

The state of California follows the Internal Revenue Code changes but not all the changes that are effective at the federal level are effective at the state level. California Franchise Tax Board doesn’t bring all the tax changes that can affect Form 568 right away. The changes are usually optimized for the state.

Visit the Franchise Tax Board of California to see the instructions to file Form 568 – Limited Liability Company Tax Booklet.

Click here to view Form 568 instructions to file.

After the Tax Cuts and Jobs Act of 2017, there have been significant changes to the federal income taxes as well as to the state income taxes. The change in 2018 didn’t bring significant changes to the California taxes but Form 568 had remained the same. From 2018 and onwards (potentially until 2025) Form 568 will stay the same.

If any further changes happen on Form 568 for California LLCs, our instructions to file as well as the form itself will be updated. Until then, the above instructions are relevant to the 568 an LLC will file in future tax seasons.