2441 Form 2023 - 2024

Contents

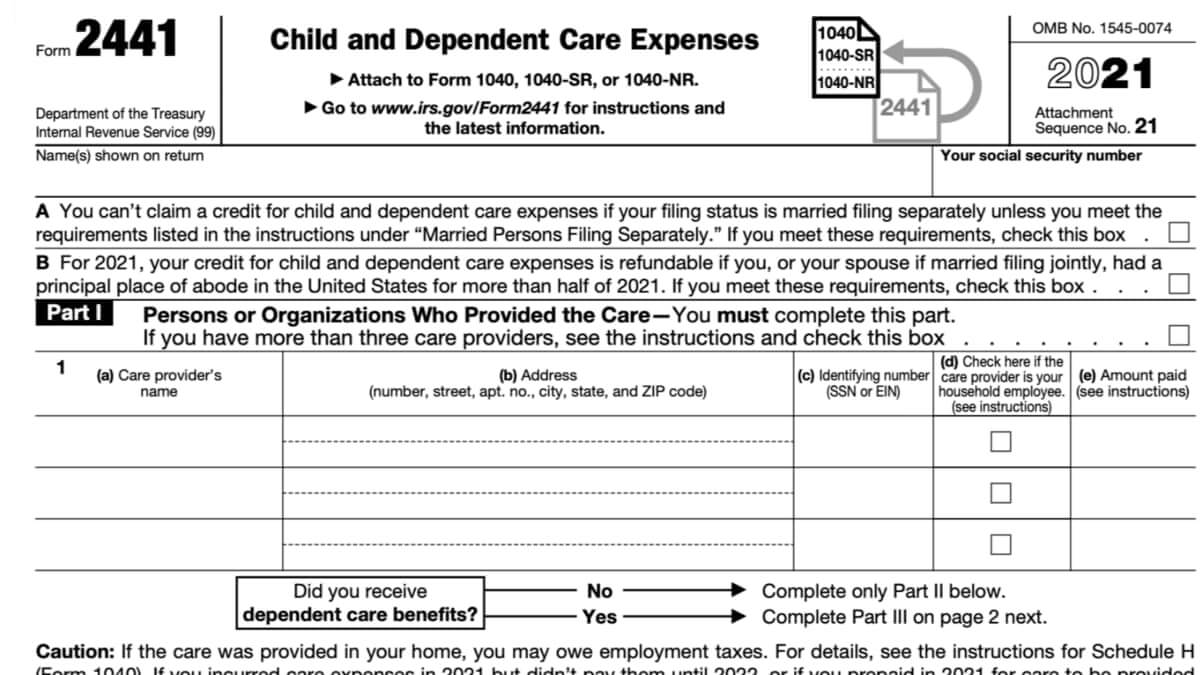

Form 2441—Child and Dependent Care Expenses. There is a tax credit for the expenses of the child and other qualifying persons. Those who file taxes as married filing separately cannot claim this credit though. Your filing status must be other than married filing separately.

Form 2441 is used for figuring out the child and dependent care expenses as well as the credit amount. The Child and Dependent Care Credit can be worth up to 35% of some or all of the expenses. What portion of the expenses you can claim as part of this tax credit depends on your income.

For every $2,000, the Child and Dependent Care Credit get smaller by 1% for income over $43,000. There is also a limit on the expenses as well. For every qualifying child or dependent, the maximum expenses is $3,000. With that said, you can only claim 35% of these expenses at maximum and this would equal roughly $1,000.

If you’ve paid the expenses of more than one qualifying child or dependent, the Child and Dependent Care Credit you’re eligible to claim will be more than the maximum $1,000 or so.

File 2024 Form 2441 Online

Form 2441 can be filed with any e-file provider that the IRS accepts tax returns from. It’s also available on IRS Free File Fillable Forms. Click here to go to the Free File Fillable Forms to start filing 2441.

Those who are planning on filing a paper tax return can file Form 2441 on their computer and print out a paper copy. Start filling out Form 2441 below. Click the boxes you need to enter your information.

As soon as everything you need to enter on Form 2441 is done, click the download button on the upper right corner to save it as PDF. You can then print out Form 2441 you filed. You also have the option to print out without downloading it. Since filling out Form 2441 may take some time, we suggest saving it in case you lose your 2441.

Note: The IRS hasn’t updated the Form 2441 for use in the 2023 tax season. As soon as the agency releases it along with other related tax forms, we will keep you updated.

The credit for child and dependent care expenses is one of the most commonly claimed tax credits. Taxpayers can claim the child and dependent care expenses credit if they pay someone who is a qualifying person so that they or their spouse (if filing jointly) could work or look for work.

The credit amount is 20 to 35 percent of the qualified expenses. However, the maximum amount for the credit is $3,000 per qualifying person. Read more about the child and dependent care expenses credit.

This article will provide you with an online fillable PDF copy of the 2441 Form for the 2022 tax year you’ll file for the 2021 taxes.

Form 2441 PDF 2023 - 2024

File Form 2441 Child and Dependent Care Expenses to offset the cost of child care – at least a part of it. Since you need to figure out the credit amount yourself, unlike the child tax credit, as it doesn’t have a fixed amount, attach Form 2441 to your federal income tax return after filing it. Additionally, the child and dependent care expenses credit doesn’t have advanced payments like the CTC.

Form 2441 for e-filing

The above Form 2441 only works if you’re filing a paper tax return. Those that are electronically filing their tax returns can’t really use it aside from filing it and using it as a prep for when the e-filing time comes.

If you’re anticipating to e-file your tax return, whether on TurboTax or through any other tax preparation service, this PDF won’t be of any help. However, if you’re going to prepare a paper tax return, you can file it online, print out a paper copy, and attach it to your return.

Don’t confuse this credit with CTC

There is a significant difference between the child tax credit and child and dependent care expenses credit. Any taxpayer with a qualifying child can claim the child tax credit, whereas the child and dependent care expenses credit isn’t. There are rules that every taxpayer must meet in order to claim this credit.

Paired with the child tax credit, simply having a child can reduce your tax bill by a huge margin, especially considering that the child tax credit has seen huge improvements over the last couple of years.