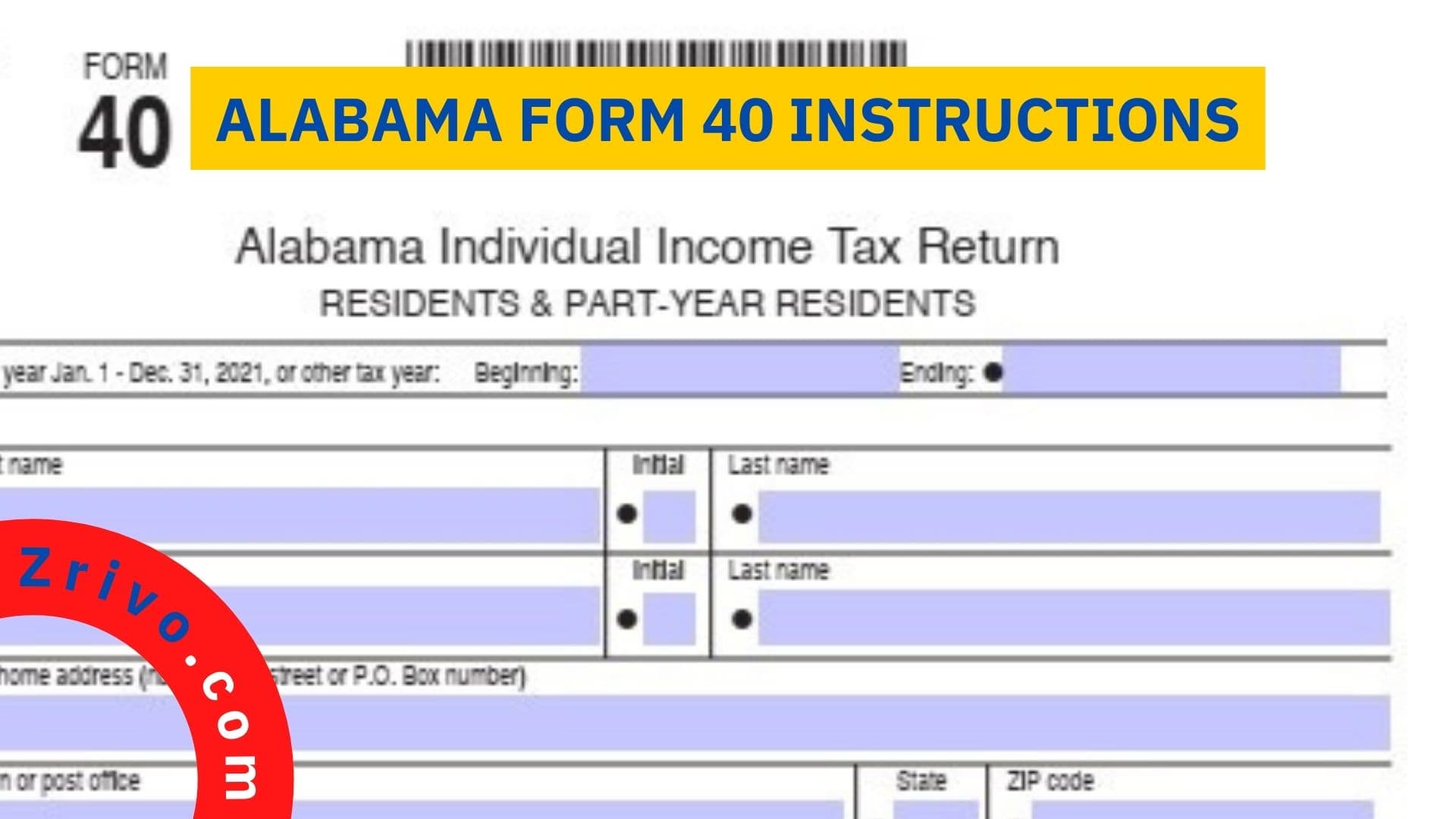

Alabama Form 40 Instructions

All Alabama residents and those who had income from any Alabama source during the year must file Form 40. Nonresidents with Alabama income must also file Form 40NR; this article covers everything about Alabama Form 40.

Alabama Form 40 is a state income tax return for individuals who are residents of Alabama. You must file this form if your total Alabama income exceeds the prorated exemption amount for full-year residents or if you earned any part of your income outside of Alabama during the taxable year. In addition to Form 40, you may need other forms and schedules. These include Form 4952A, Schedules A, B, C, CR, D, E, and OC.

All income is subject to Alabama income tax, including wages, salaries, bonuses, commissions, alimony, rents, royalties, investments, and dividends. Interest on bank deposits, bonds, notes, and Federal income tax refunds is also taxable. If you own a pass-through entity (for example, an S corporation or partnership) and are an individual, report your share of the business’s taxable income on Schedule E. This is the same form used for partnerships, S corporations, and trusts.

Your share of this taxable income can be claimed as an itemized deduction. The amount on line 12 must be prorated based on your percentage of your Alabama adjusted gross income minus the percentage of your Federal adjusted gross income earned while you were a resident of Alabama.

Alabama Tax Deduction

Alternatively, you may claim the standard deduction as allowed on your 2013 federal income tax return without regard to your IRA. To do this, check box b on line 11 and use the chart below to determine how much you can deduct. In addition to the standard deduction, you can also claim a portion of the health insurance deduction available for small employers with Alabama employees. To claim this deduction, enter your employer’s name and address on line 2.

If you are married, file a joint return to save on taxes. Most married couples pay less tax when they file a joint return. You can also make a voluntary contribution to the Alabama Election Fund on this form. You can contribute up to $2 per person; each spouse who files a return may contribute $1. This money will reduce your refund but is not refundable in the future.

The Alabama oil and gas depletion law differs from the federal law, so care must be exercised in claiming this deduction. If you have any questions regarding this tax, you can call the Revenue Department at 1-866-ALABAMA-8

How to Fill out Alabama Form 40?

Alabama residents are responsible for paying the tax due on their returns only if they meet all of the requirements to file the form.

- The main thing to remember is that you must have enough income to qualify for filing the form.

- If you do not have enough income to qualify, you may want to consider filing an amended return. The amount of income you must report on Form 40 depends on your status as a resident of Alabama or not.

- If you are a resident of Alabama for the entire year, you should enter your gross income in column B.

- If you are a non-resident of Alabama, your gross income must be prorated to reflect your gross income during your part-year resident of Alabama.

- In addition to the income you must report on Form 40, you must also complete Schedule D. This worksheet will help you determine the number of gains or losses from the sale of real estate, stocks, bonds, mutual funds, and other investment property. In this line, you must include any distributions you received from profit-sharing plans, retirement plans, employee savings plans, or other individual retirement arrangements.

- If you receive a 1099-R that shows the taxable amount of your distribution, you do not need to complete this worksheet.

- If you received a distribution from an IRA (or other types of account) that you had previously contributed to before your residency in Alabama, you must report the total and taxable amount on this line. You may also claim a deduction for this amount on your Federal income tax return.

- If you are a statutory employee, you should check the box labeled “Statutory Employee” on your W-2 form and enter the percentage of your earnings attributable to state or local taxes on this line.

- You should also report your contribution to the state or local retirement system on this line if you have any contributions to it that were deducted from your wages.