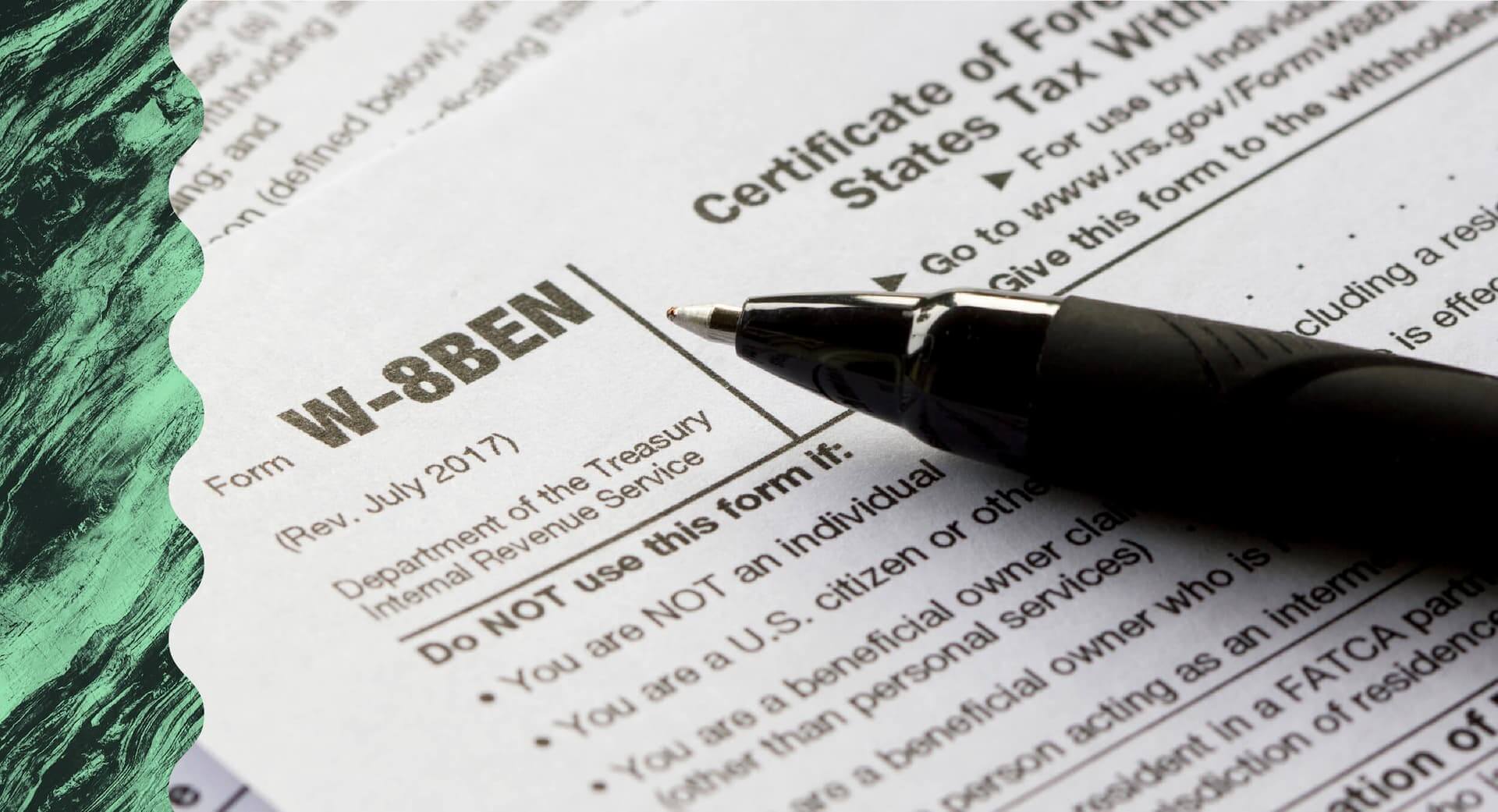

W-8 BEN Form Full Guide 2023 - 2024

W-8 BEN Form lets foreign individuals and businesses in the United States verify their residence country for taxing. In this way, they can declare that they qualify for a lower tax. What makes W-8 BEN Form unique is that it is issued by and provided by the IRS but submitted to withholding agents or payers. If you will not submit this form, then you will have to pay the full rate as a foreign entity, which is 30%.

Contents

If you have questions about the W-8BEN form’s purpose or how to complete it, continue reading. I’ll tell you what you need to know about the form and where to download it. You’ll also find out what information you’ll need, what it means, and what it looks like. In addition, I’ll provide you with instructions and a free generator to make it easier to fill out the form.

Instructions

Suppose you are a foreign individual or business. In that case, you will need to fill out a W-8BEN form before receiving payment in the U.S. This is an IRS form that establishes the status of the person or entity making the payment and the available benefits. You can find more information on these forms on the IRS website.

The first thing you need to do is determine whether you are a nonresident alien. These individuals may be required to withhold 30% of the income they receive from sources in the U.S. They can also claim a reduced rate if they live in a country that has a tax treaty with the U.S.

You can use Form W-8BEN to claim an exemption from withholding if you are a foreign individual. However, you must check with your attorney to ensure everything is correct. It is important to note that this form is not a tax return, so you can’t file it with your tax return.

You will also need to identify your tax home. This can be a post office box, permanent residence, or a financial institution. Make sure you include the postal code in the address.

Download

If a non-US citizen is receiving payments from a U.S. entity, you must complete and submit a W8 BEN Form. This form is also known as the Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding & Reporting.

The W8-BEN is a tax document designed to ensure that individuals are not double taxed on their income. It is similar to the W9 form used by American businesses to identify employees. There are three main parts to this form.

To fill out the W8-BEN, you will need to have accurate information. This includes the beneficial owner’s name, address, nationality, and other essential data. You may have to consult with a tax adviser to ensure you are filling out the form correctly.

Aside from the most expensive item on the list, you will want to fill out the least costly. Accurate information on the W-8BEN is essential, as it will help you avoid getting penalized for false claims.

The W-8-BEN can be completed and returned to the company that pays you before you make your first payment. Failure to do so could result in paying an excessive amount of withholding taxes.

Who needs to fill out form w-8ben

The W-8BEN form is an Internal Revenue Service (IRS) form for foreign individuals and businesses. It is used to determine whether an individual or company qualifies for a reduced withholding tax rate on income from the United States.

To determine whether an individual or business qualifies, it is necessary to identify the source of income. The source of income includes royalty payments, interest, and rental income.

Foreign individuals usually must withhold 30 percent of their income from U.S. sources. However, this amount may be reduced or exempted under certain tax treaties. Therefore, it is crucial to identify these individuals’ country of origin and permanent residence address.

Foreign individuals must fill out a Form W-8BEN before the first payment is made to claim the reduced withholding rate. It is also necessary to collect this form from foreign workers and contractors for business purposes.

A withholding agent collects the information on the form. This agent then withholds 30% of the total amount of the payment. Withholding agents are typically individuals, companies, or groups from whom the payment was received.

If you are an employer, you should request a W-8BEN form from your international employees or contractors. This ensures that the right amount of taxes is withheld.

Meaning

W-8 BEN form is a certificate of foreign status of the beneficial owner for United States tax withholding and reporting. It is a one-page document. The form contains critical information, such as the owner’s name, country of origin, and tax home. You should read the instructions carefully and consult a tax professional before filling out the form.

The United States has numerous tax treaties with countries. These treaties reduce or eliminate the tax on income earned by foreigners. However, if the United States has no treaty with a particular country, the rate is set at 30%.

Before filling out the W-8 BEN form, you should know which countries have tax treaties with the United States. Having a pact with a particular country will provide benefits for the company. The IRS offers a complete list of tax treaties.

Filling out the W-8 BEN is a good idea for anyone who is not a U.S. citizen, but not all of these benefits apply to you. For example, you may qualify for reduced rates if you are a foreign researcher.

It is a good idea to ask a tax professional to avoid being accused of filing an incorrect form. Your CPA can help you find the answers you need.

Generator

The W-8 BEN form is a certificate of foreign status for United States tax withholding and reporting. It’s a helpful tax document, especially for businesses outside the U.S.

The W-8BEN is a cinch to fill out, thanks to Jotform’s online form builder. You can save the document to your computer or share it in various ways. Check out the Jotform app for iOS or Android if you’re using a mobile device.

One of the perks of using Jotform’s online W-8BEN Form is that you can view the official records of your business or government agency. Besides, the software will automatically turn your answer into a secure PDF.

As far as the W-8BEN Form generator is concerned, it is a good idea to start with the best information before making a decision. For example, consider contacting a CPA for advice. Or, you could go ahead and fill out the form yourself.

A little more effort is required to verify your W-8BEN-E form, however. This is a great time to leverage digital tools and automation technologies to reduce your chances of getting it wrong. Also, keep track of the latest tax laws and regulations.

Tax information

When you do business with a foreign country, you may be required to fill out a W-8 BEN form. This form determines your tax status, which will affect the amount of withholding you must pay.

Generally, 30 percent of income is subject to withholding. This percentage can be reduced or eliminated through tax treaties with a foreign country. To find out more, you can visit the IRS website to see the list of countries with treaties with the U.S.

You should fill out the W-8 BEN form before you make a payment. A withholding agent will determine how much you should withhold from your expenses. The rate depends on your tax home and the country you are from.

If you are a non-US citizen, you should not fill out Form W-8BEN. You should, however, fill out Form W-8BEN-E. It is a foreign entity tax form that the Internal Revenue Service issues.

W-8BEN-E forms are available to download from the IRS website. It requires a signature and contains instructions. You must complete the form before making any payment to a foreign vendor.

Why did I receive a w-8ben

The W-8BEN form is a certificate that the Internal Revenue Service issues. It serves as a guide for the taxation of foreign individuals and entities. Among the persons who fill out this form are freelancers, contractors, consultants, and nonresident aliens.

The W-8BEN form is also used to report information to withhold agents. If you are a non-US individual, you must complete this form before making any payment. This form will determine your tax status and the amount of tax you must pay to the IRS.

When you receive payment from a U.S. client, you must fill out the W-8BEN form. You must include the recipient’s address, the payment’s source, and your foreign tax identification number.

The W-8BEN form should be filled out to comply with the regulations before the first payment is made. You can download the form from the IRS website. Alternatively, you can have a tax accountant prepare the form for you. However, it would be best if you were sure to update your information as needed.

Non-US individuals who are not exempt from withholding taxes may be subject to a 30% tax rate on payments they make to a U.S. client. Regardless of whether a tax treaty exists between the United States and the country of origin, this tax must be withheld.

Who Should You File W-8 BEN Form?

W-8 BEN Form can be filled and submitted by foreign people who worked in the United States or earned income in any way without being a citizen or resident in the country. Any foreign business or individual needs to pay 30% tax depending on their income type. However, you can enjoy discounts or other benefits by stating your country of residence, and the type of income.

When to File W-8 BEN Form?

As we previously mentioned, if you had any source of income in the United States without being a citizen or resident, then you will have to pay a 30% tax on your earnings. However, by filing W-8 BEN Form, you can minimize the rate depending on your country of residence or other elements.

If you have earned income due to one or more of the following ways, you need to file the W-8 BEN Form:

- Interest (including OID (original issue discount))

- Determinable or fixed periodical or annual income, profit, or gain

- Any substitute payments for securities lending

- Compensation for services

- Annuities

- Premiums

- Loyalties

- Rents

- Dividends

It is worth noting that the W-8 BEN Form can only be filed by individuals but not businesses.