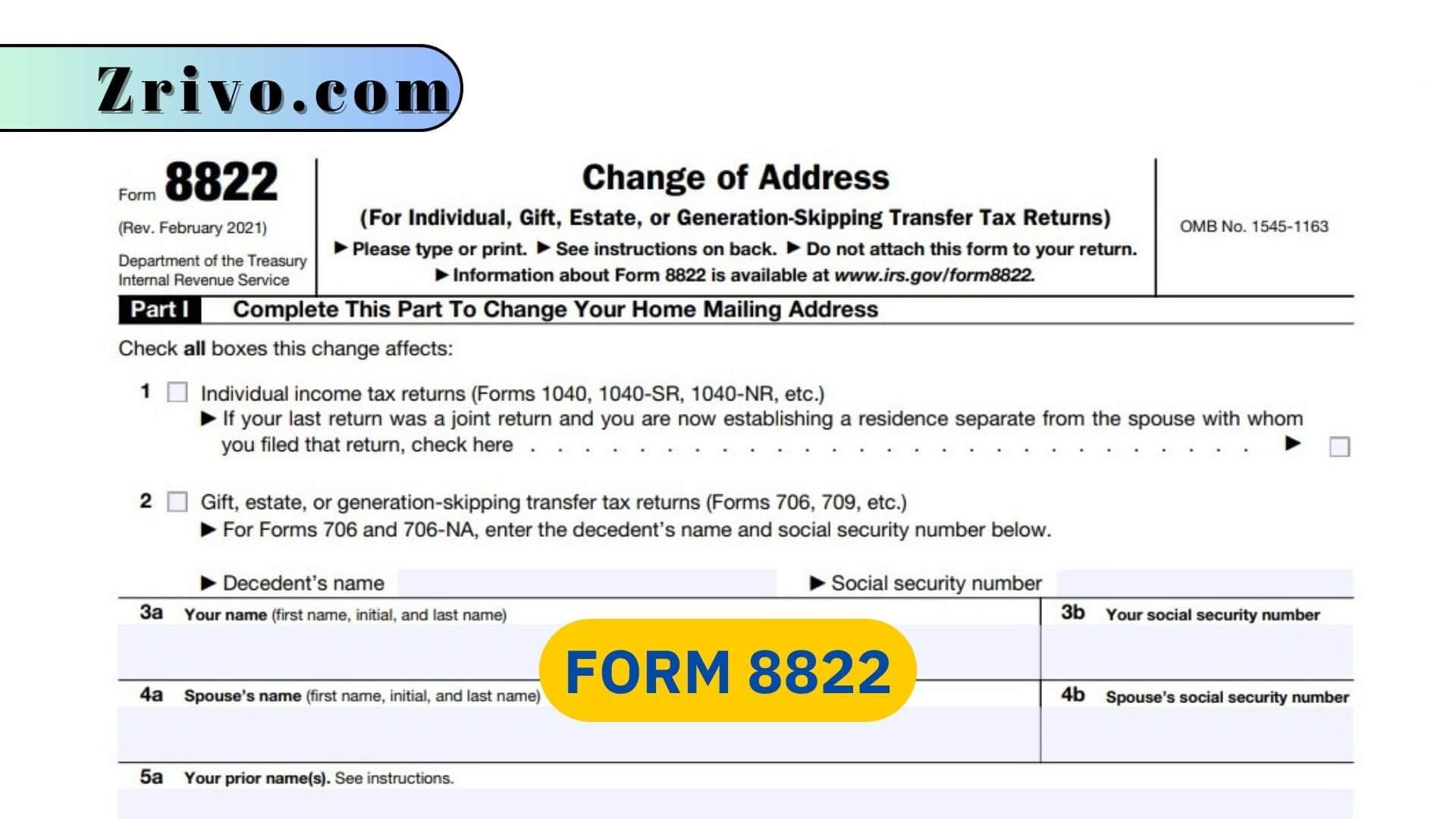

Form 8822

If you recently moved to a new home, you must inform the IRS about your change of address. The easiest way to do this is by filling out Form 8822, the “Change of Address” form. This article will cover what Form 8822 is and its filing instructions.

If an entity’s address or responsible party changes, the entity should file Form 8822 to notify the IRS of the change. Entities that fail to file this form may not receive notices of deficiency or notices of demand for tax, and penalties and interest will continue to accrue on any outstanding tax deficiencies. Whether you’re updating your own address or that of a business, this is an important step to make sure the IRS has accurate contact information. It should only take 4-6 weeks for the IRS to process this form, and it can help ensure that you get your taxes filed on time. If you have questions about how to fill out this form, a tax professional can assist you.

How to Fill out Form 8822?

In the top part of this form, write your name and address. If you are married and file joint returns, your spouse’s name should be included as well. If you want your tax-related correspondence sent to a third party, such as your attorney, you can do that by entering “c/o” (which stands for “in care of”) before the person’s name and mailing address.

If you are filing this form on behalf of a business, put the company’s full legal name in the first box and its employer identification number (EIN) in the second. If you’re changing the responsible party of a business, include the old person’s SSN or ITIN in line 4. In line 5, write the new responsible party’s full name, date of birth, and Social Security number (SSN) or individual taxpayer identification number (ITIN). Then sign and write the date in the space provided. If you’re filing this form to update the address of a fiduciary tax matter, include a copy of your power of attorney in the space provided.

You should file the form as soon as possible after changing your address. Otherwise, you may miss important tax documents. You can submit the form in person or by mail. If you’re changing both your home and business address, use a separate form for each change. If you’re a business with an EIN, you must file the form within 60 days of the change to your responsible party or address. The IRS will use the address on file to send you notices, refund checks, and other items. If you don’t tell them your new address, you might miss important documents or even find yourself receiving late payment penalties.