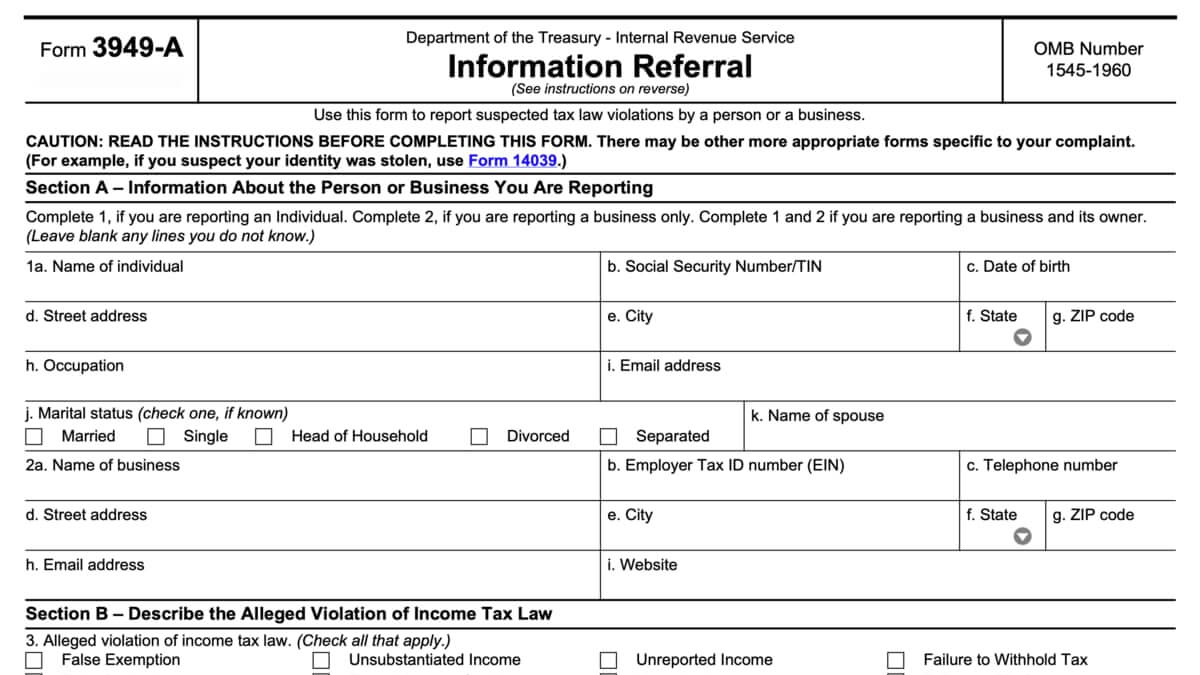

3949-A Form 2024

Form 3949-A, Information Referral, is the tax form used for reporting a person or business for tax evasion. It’s a simple tax form that everyone in the United States or outside can file to report such allegations. If you suspect that someone or a business is evading taxes, use Form 3949-A to report it to the Internal Revenue Service.

Fill out Form 3949-A online

File Form 3949-A online below and print out a paper copy once you file. After it’s done, you need to submit it to the Internal Revenue Service by mail.

Form 3949-A fillable PDF

Where to mail Form 3949-A

Mail Form 3949-A to the Internal Revenue Service address below. Know that your personal information is confidential and kept a secret. The person or the business you’re alleging won’t know your identity unless you want it to.

The Internal Revenue Service will likely inspect the person or the business you’re reporting with Form 3949-A after looking at their tax history. However, note that just because you’re reporting them on Form 3949-A doesn’t mean it will trigger an IRS audit. With that in mind, we recommend trusting the process and being patient before seeing any results.