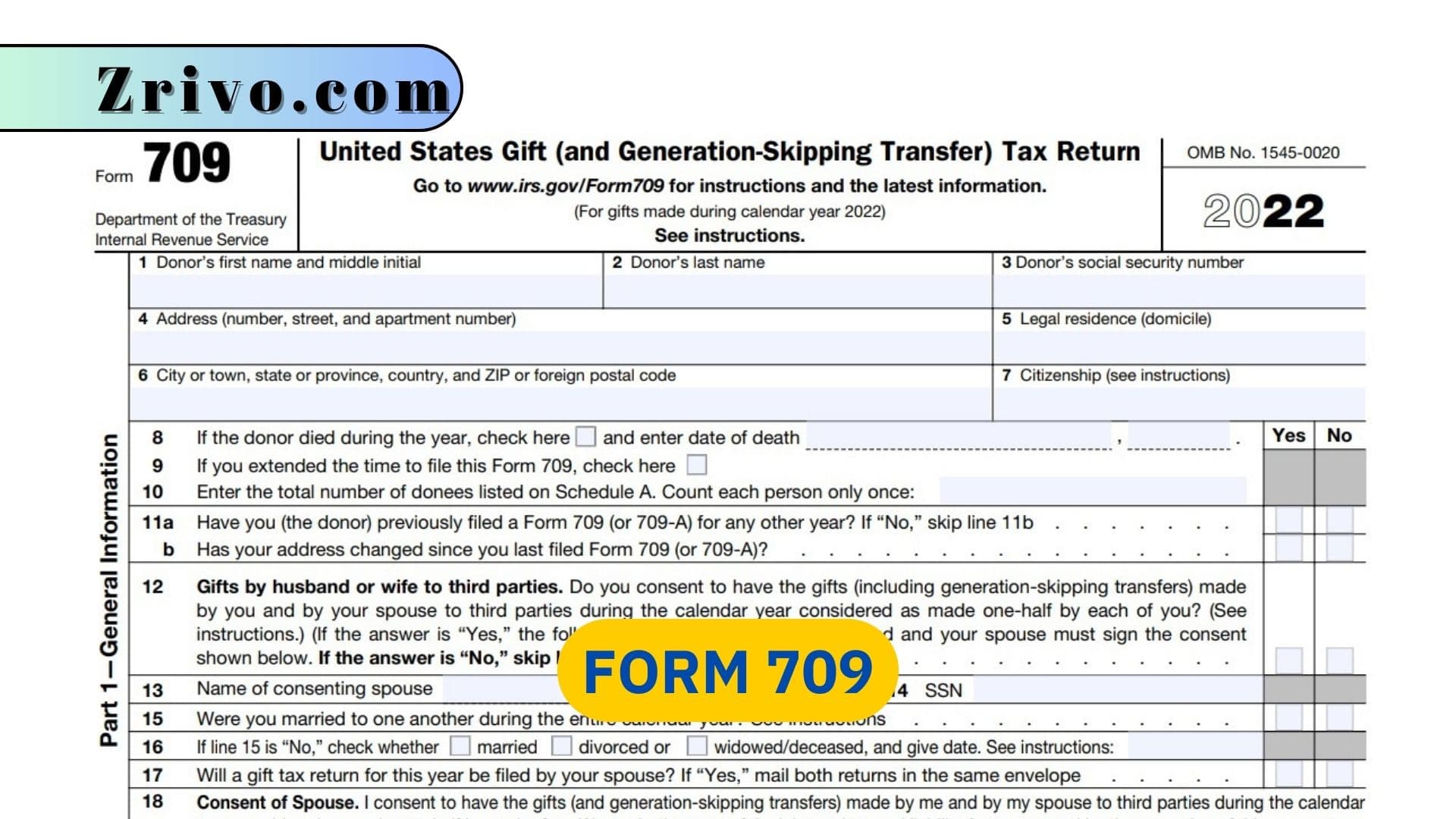

As its name suggests, Form 709 is a tax form that donors use to report gifts that may be subject to gift and generation-skipping transfer (GST) taxes. Most people will never have to pay these taxes. Gifts are generally anything you give to another individual or entity without expecting something of equal value in return, including cash, property, and other assets. Some specific types of financial gifts, like medical care payments and certain investment accounts, count toward the gift tax, and you must report these on Form 709.

When to File Form 709?

You only have to file Form 709 if your gifts exceed an annual exclusion amount. This exclusion is currently $16,000 per person and is indexed for inflation. Most ordinary birthday and holiday gifts from friends and family are exempt from the gift tax, but if Grandma writes you a check for $16,000 for your birthday this year, she must report this on Form 709 even though it’s less than the annual exclusion.

In addition to reporting taxable gifts, Form 709 is also used to report lifetime exemption allocations for GST tax purposes. This includes claiming unused exemption amounts that would otherwise be forfeited and allocating GST exemption between trusts in which you own interests. It’s important to file Form 709 and complete the appropriate sections of the form to avoid penalties and interest.

If you’re giving away a significant amount of money, you might be required to file a federal estate and gift tax return, too. However, the IRS typically only finds out about missed returns during an estate audit and then assesses fines and interest.

The good news is that you can get an extension to file your 1040 by filing Form 4868, and this same form can be used to extend the time to submit your 709 return as well. Remember that the extensions apply to both the tax and the return, so don’t file your 709 before the extension expires. You can also consult a professional to determine whether you should file Form 709 for your situation.

How to File Form 709?

You must file Form 709 by Tax Day, which is usually on or around April 15 of the year following the tax year in which you made taxable gifts. Each year, the IRS releases a new version of the form, and it’s important to keep track of the version you’re using as it changes every year.

Unless you are filing for an estate tax deduction, you should check the box at the bottom of page one to indicate that you’re filing Form 709. This is important because failing to make this election will result in your estate not benefiting from the QTIP marital gift tax marital deduction.

If you have multiple trusts that contain different assets, you’ll need to report the total value of those assets on line 4. You should also list any taxable gifts in section 2. Gifts not included in your taxable estate are not reported on this form. If you’re giving away money or property to charity, you should include those on line 12.

You may be able to avoid paying gift taxes by making certain types of gifts. For example, if you give money or property to your spouse that’s earmarked for education, medical care, or charitable purposes, you won’t need to file a gift tax return.