8615 form

Contents

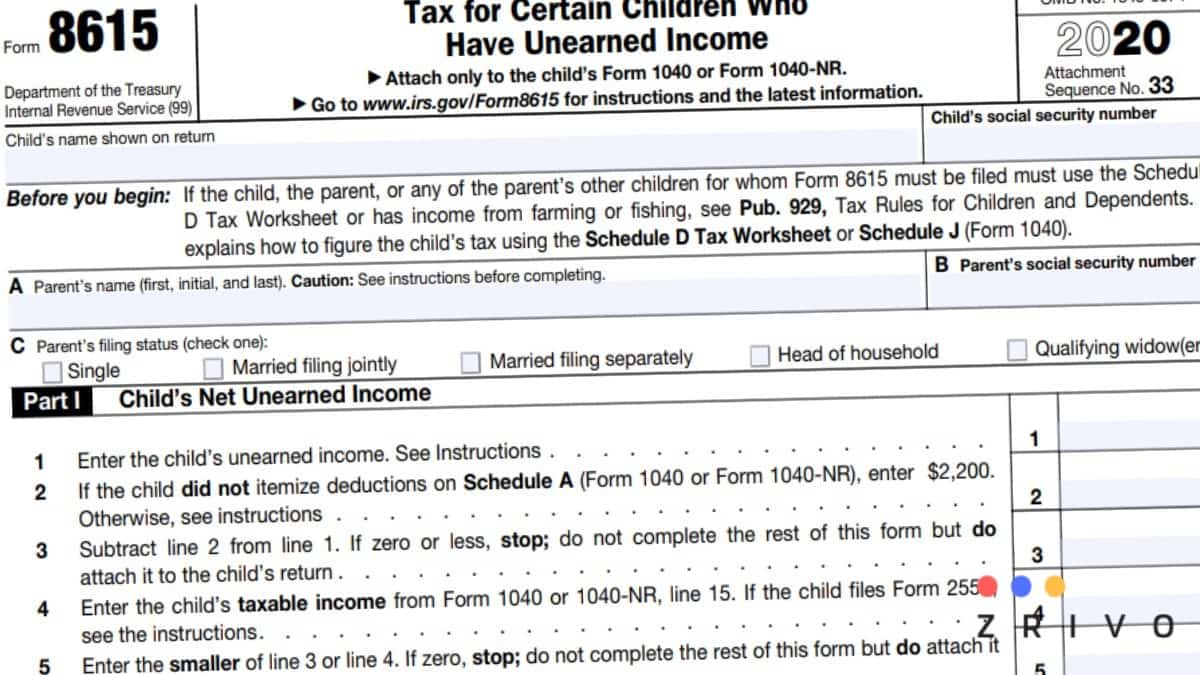

Form 8615–Tax for Certain Children Who Have Unearned Income is the tax form to figure out the tax on unearned income of over $2,100 for children under the age of 18 and for adults in certain circumstances. Form 8615 is a fairly straightforward tax form that parents or legal guardians of the child who’s subject to tax for the unearned income that exceeds $2,100. There are three parts to the 8615 where the parent or the legal guardian of the child needs to complete on the form. These are as follows.

- Child’s net unearned income

- Tentative tax based on the tax rate of the parent

- Child’s tax

Part 1 – Child’s net unearned income

Report the child’s unearned income and the taxable income on Form 1040 (of the child) on this part of Form 8615. This will determine how much of the unearned income of the child is taxable.

Part 2 – Tentative tax based on the tax rate of the parent

Because parents’ taxable income also matters, the filer will need to account his or her taxable income on Form 1040 so that the taxes owed from the unearned income of the child can be accounted.

Part 3 – Child’s tax

Once everything comes together – both the child’s taxable income from the unearned income and the parents’ taxes owed with the taxable income of the parent from Form 1040, the total taxes owed by the child can be figured out. This is perhaps the most important part of Form 8615 as making any errors in calculations will make it near impossible to come up with the right amount of tax owed. So make sure you don’t make any errors on Form 8615. Otherwise, you might have to amend the return if there are errors on the 8615 which will lead to incorrect tax liability.

2024 Form 8615 PDF

Below Form 8615 for the 2024 tax season is fillable, meaning you can fill out a copy online and print out a paper copy later on or save it as a PDF document to keep for your records.