Form 3903 2023 - 2024

The Internal Revenue Service offers a variety of tax deductions for moving expenses. Form 3903 is one of the forms used to document such expenses.

Form 3903 is a tax form created by the Internal Revenue Service to help people write off moving expenses related to a new job. It’s been eliminated by the Tax Cuts and Jobs Act of 2017, which means that many people can no longer deduct moving expenses from their federal taxes unless they are members of the military who move as part of a permanent change of station.

For members of the United States military, you can claim moving expenses without meeting any distance or employment requirements if you’re making a permanent change in your status, such as retirement or termination of service. If you’re not a military member, you can only use Form 3903 to deduct the costs of your move if your new job is at least 50 miles further from your previous home than your old one was.

Another requirement is that you must have worked at your new workplace for at least 39 weeks out of the first 12 months following your move. If you didn’t meet this test, you can still file Form 3903 if you expected to pass the time test during your first year at your new job.

In addition, the IRS allows you to deduct reasonable moving costs, such as hiring professional movers or traveling to your new home. Those who have made several job-related moves can fill out multiple forms to claim deductions for these expenses.

Non-Military Filers Eligibility

For non-military filers, you’ll have to pass a time test to prove that your move was necessary for your new job. Now that you’ve met the distance and employment requirements, it’s time to figure out how much of your moving expenses you can deduct on your income taxes. The best way to do this is to look at your employer’s W-2 for the year you made your move.

Ideally, you should see a number in box 12 that says “Moving expense” or something similar. If it does, subtract your total moving expenses from this number and add it to the amount on line 3 of Form 3903. Then you’ll know how much of your deductible moving expenses to report on your 1040. Once you’ve completed the form, attach it to your Form 1040 and submit it to the IRS.

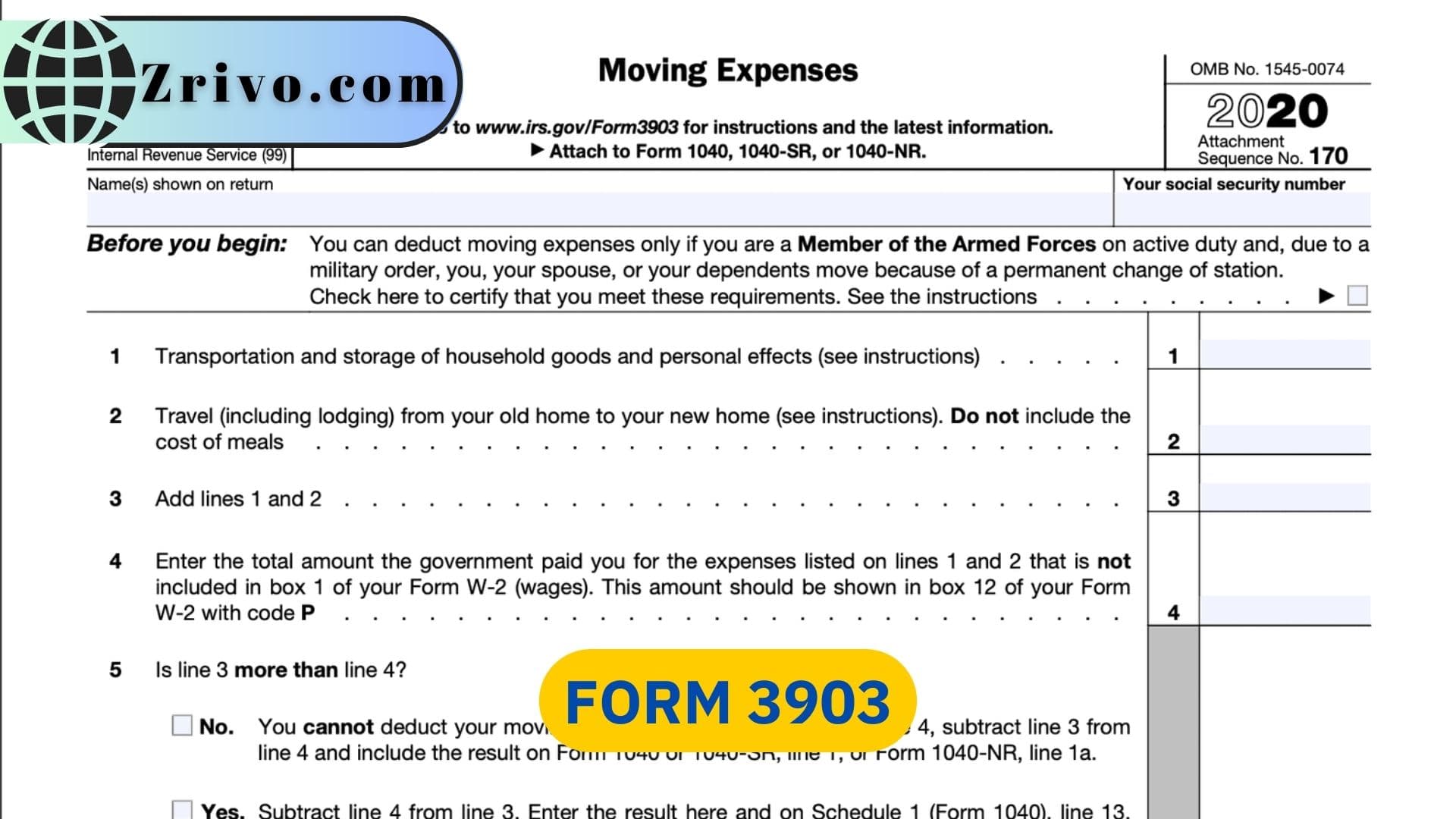

How to fill out Form 3903?

Once you’ve determined how much of your move is deductible, you can start the process of filling out Form 3903:

- First, grab a copy of your recent W-2 to determine what the government paid for your moving expenses.

- Then, enter that amount in line 4 on Form 3903.

- On the next page, you’ll see a table showing how much of your moving expenses were reimbursed by your employer. This number should be lower than your total deductible moving expenses, so you can subtract that from the amount in line 4 and put it on your 1040.

- To complete the form, you’ll have to fill in all of the applicable lines. Also, you’ll have to note whether you’re a military member or not.