TurboTax W2 Finder

TurboTax offers various tax prep programs tiers based on your tax situation's complexity. TurboTax W-2 Finder is one of them.

Whether you’re filing your taxes yourself or using a tax preparer, you may need to get a copy of your W-2. The IRS uses these forms to determine how much tax is due on your income. Turbotax w2 finder is a free tool that allows you to download a free copy of your employer’s W2 form. The W2 is a crucial document in the tax world, it contains key information about your earnings and taxes owed. You can even use it to verify your identity. It’s also an easy-to-use tool. Just enter your zip code or city to find out if there are any tax-related employers in your area.

W2 is a very important form for workers because it tells them how much tax is owed on their earnings. Most employees receive a W-2 form every pay period in the United States. The Internal Revenue Service (IRS) uses this information to calculate taxes due on your wages.

How to Use TurboTax W-2 Finder?

TurboTax W2 Finder has a good track record for making it easy to upload documents and create W-2 tax forms. It is very user-friendly and has minimal tax jargon, which is important for many who may be intimidated by taxes. Using the W2 Finder is easy:

- enter your employer’s name

- Enter your password

- enter your zip code or city

- The W2 Finder then takes care of the rest. Once you’ve downloaded your W2s, you can start filling out your tax forms.

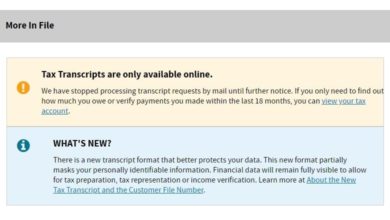

In addition to the W2 Finder, TurboTax also offers a suite of other tools that make filing your taxes easier than ever. They’re available as a full package or as individual services. One of the best things about TurboTax is that they have a free version, which is a boon to low-income families. They have a basic online edition for the simplest of tax situations and a Deluxe tier that includes deduction-finding software, help with charitable donations, and access to tax financial experts via online chat.