Form 4136 2023 - 2024

In some cases, fuel purchased for a specific use may be taxed less than the full federal excise tax rate. A fuel user can recoup these reduced taxes by claiming credits on IRS Form 4136.

If a taxpayer incurs an excise tax liability for the quarter in which it performs activities eligible for the alternative fuel mixture credit, it should file Form 4136, Credit for Federal Tax Paid on Fuels, as an attachment to its income tax return. For the purposes of filing this form, a “claim for credit” is defined as an amount of gasoline that is either on hand at the end of a taxable year or calendar quarter (such as in fuel supply tanks or drums) or used during that taxable year or quarter in a nontaxable use, such as agriculture, mining, manufacturing, mowing, aviation, and home heating.

The credit claimed on this form is in addition to the excise tax credits that may be claimed on Form 720, Quarterly Federal Excise Tax Return, and on Form 8849, Claim for Refund of Excise Taxes. Generally, a taxpayer must make semimonthly deposits of the excise taxes it is liable for using EFT, and the excise tax payments are due by the 14th day following the semimonthly period in which the tax liabilities are determined.

How to File Form 4136?

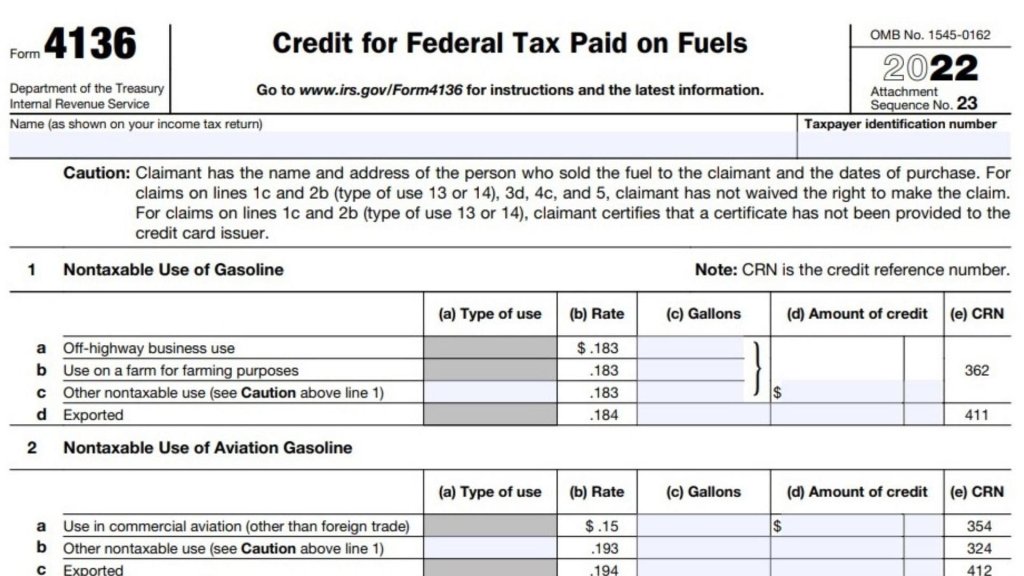

Dozens of specific fuels and uses qualify for reduced or even tax-free federal excise taxes. Form 4136 lists these qualifying fuels and the per-gallon credit rates for each. Unlike tax deductions, which only reduce the amount of your company’s taxable income, tax credits directly cut your tax obligations. If you’re in the 25% tax bracket and get $243 worth of credits, your total tax bill will be cut by $243.

Individuals must file a claim for a fuel tax credit on their income tax return. This includes individuals who own or operate a business that uses taxable fuel for mining, manufacturing, farming, mowing, aviation, home heating, and power generation. The credit can also be claimed for the purchase of alternative fuels and for registration as a fuel distributor or gasohol blender.

A special rule applies to partnerships. Partnerships (except electing large partnerships) cannot use Form 4136, but they can include a statement on Schedule K-1 (Form 1065) showing the number of gallons allocated to each partner and the fuel types and nontaxable use or sale for which the credit is claimed.

The IRS has seen an increase in the promotion of fraudulent claims for refundable credit filings using Form 4136. This is a scam that takes advantage of the taxpayer with inflated fees and refund fraud.

The deadline to file a tax return is usually three years from the date you filed your original income tax return or two years from the date you paid the tax, whichever is later. If you need more time to finish preparing your return, you may be eligible for an extension of up to 12 months.

How to Fill out Form 4136?

To claim a credit for fuel taxes paid, you must attach Form 4136 to your income tax return. The form must be executed in accordance with the instructions for preparing the form. In addition to the instructions, you must provide information for each group of fuels claimed (other than for the alternative fuel mixture or taxable biodiesel).

Each section of the form provides a chart and instructions. If you use a diesel fuel that is used for mining, manufacturing, agricultural, mowing, aviation, or home heating, describe the usage in one of the charts. For all other types of fuel, use the second chart. If you have a certificate or statement of registration, add it to the first chart. For example, a fuel producer who sells biodiesel must submit a certificate for the biodiesel and a statement of biodiesel reseller.

The instructions for Form 4136 explain that the credits for these groups must be combined to calculate the total amount of credit claimed. For more information on these credits, see IRS Publication 510, Excise Taxes (Including Fuel Tax Credits and Refunds).