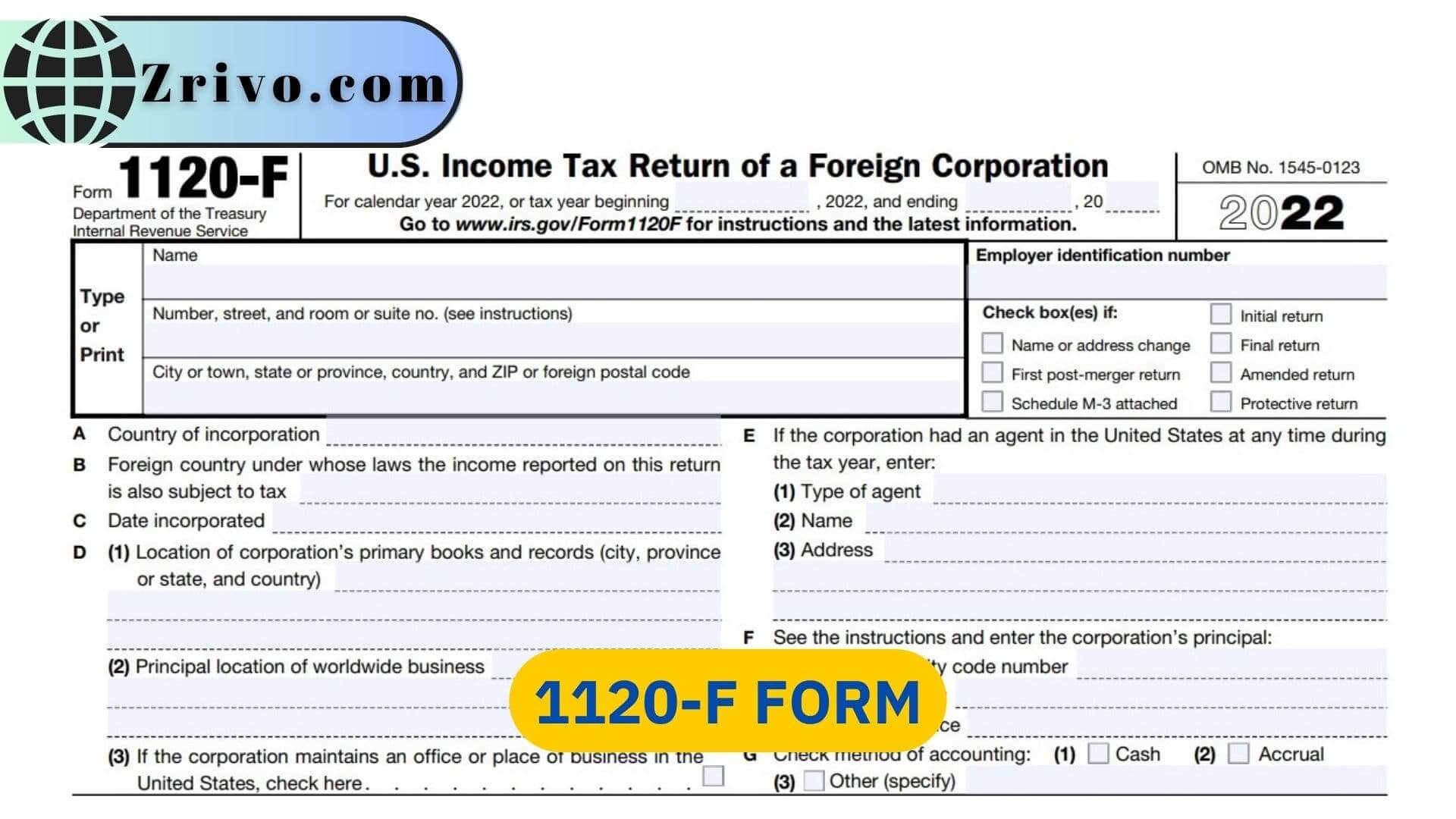

1120-F Form

Form 1120-F is a federal tax form corporations use to report their income, gains, and losses. It is also known as the U.S. Corporation Income Tax Return. This article covers the purpose of Form 1120-F.

Form 1120-F is a tax return used by foreign corporations that conduct business in the United States. The tax return is similar to a domestic corporation’s tax return. Still, it requires detailed information about the company’s income, expenses, and other financial information.

A foreign corporation must file Form 1120-F if it has gross receipts from U.S. sources of $500,000 or more during a tax year. It must also file if its foreign-source income was not exempted from U.S. tax by a treaty or by the Internal Revenue Code. If you fail to file, you may be subject to a penalty of 5% of the amount of tax owed up to 25% of the total unpaid tax.

Who Must File Form 1120-F?

Whether your corporation has to file a 1120-F Form depends on several factors, including its “effectively connected income,” the type of trade or business it is engaged in, and whether it is a controlled foreign corporation. A qualified tax professional can help you determine if you must file Form 1120-F and how much your corporation must pay in taxes.

Most foreign corporations engaged in a U.S. trade or business must file Form 1120-F. However, there are certain exceptions to this rule. For example, a foreign corporation does not need to file Form 1120-F if it does not have “effectively connected income.” It can also claim certain benefits under a U.S. income tax treaty to minimize its tax liability.

The average time to file Form 1120-F is more than 70 hours, but that does not include the time you need to learn about the law or gather the necessary records. It is always a good idea to consult with an ex-pat tax professional before you start filling out Form 1120-F.

How to file Form 1120-F?

Typically, Form 1120-F is filed by a corporate officer with the authority to sign it. However, it is also possible to sign it by a fiduciary who acts on behalf of a foreign corporation. As a result, it is important to consider who the person signing the return will be before you begin filing. It is also good to check with the IRS to see if any other people are authorized to sign the return. If you are an ex-pat with a foreign corporation with business in the United States, having a qualified tax preparer help you complete your Form 1120-F. The form is highly complex and requires detailed knowledge of both U.S. and foreign tax laws.