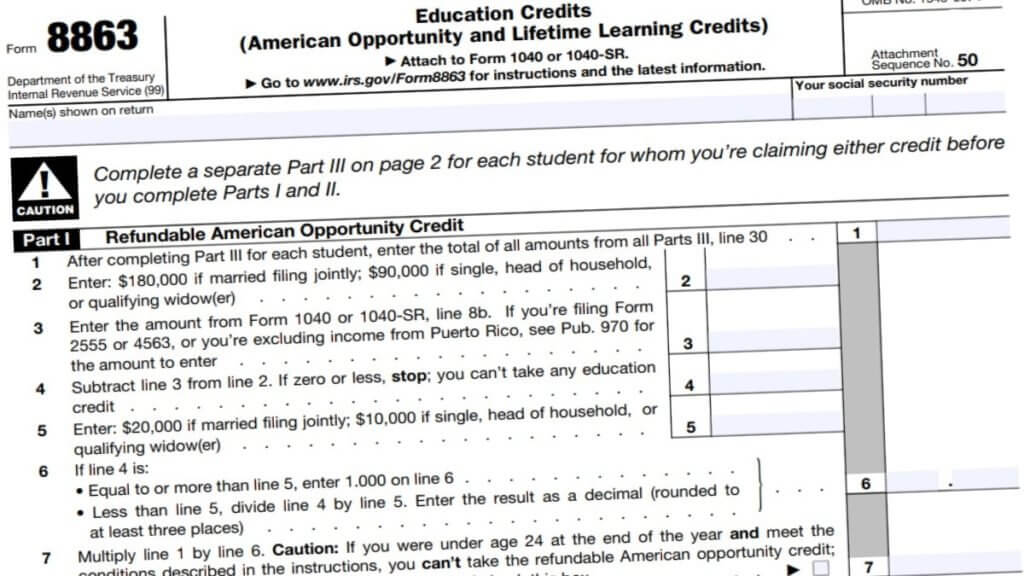

Form 8863 Instructions 2024

Before you start filling out and filing your Form 8863, it's essential to understand what this form is for. In this article, you'll learn what this form is for, how to fill it out, and where to find form 8863 instructions.

If you are a student in an educational institution, you need to know how to fill out IRS Form 8863. This form asks for basic information about the student and the institution. The information on this form should be accurate to avoid penalties. However, there are a few things you must keep in mind. Here are the instructions for Form 8863.

Form 8863 is a document that you fill out to claim educational expenses. It is generally filed along with the 1040 Form and is used to claim certain tax credits. These credits are given to students who are pursuing post-secondary education. It is important to fill out the 8863 Form accurately because you need to provide all the necessary information.

Form 8863 Filing Instructions

You should know that the American Opportunity Tax Credit (AOTC) and Lifetime Learning Credit (LLC) are tax credits that you may qualify for. You can claim them using the 8863 Form but make sure to attach your Form 1098-T Tuition Statement for your education expenses. These two credits can be worth up to $2,000 for certain types of education. Individuals wishing to claim either of these credits must complete Part 3 of the form.

Filing Form 8863 is essential to receive Education Credits. However, the instructions on the form are only sometimes clear. The instructions also require Form 1098-T, a tuition statement you can find on the school’s website, or it may be emailed to you. You should include the form to avoid problems with the IRS. Another important form to include is your W2 Form or 1099 Form.

How to Fill Out Form 8863?

To complete an IRS Form 8863 correctly, you must read and understand the Instructions for IRS Form 8863:

- Complete the form by starting from Part 3, starting with Line 20

- Enter the student’s name

- Enter the student’s Social Security Number (SSN)

- Enter other pertinent information

- Fill in any details about the educational institution.

- The address, street, and town of the institution must be included, as well as the zip code.