Arizona TPT Payment Plans

Arizona's state tax payment plan is available to all taxpayers who are delinquent on their taxes. However, some conditions must be met to qualify for the program.

Contents

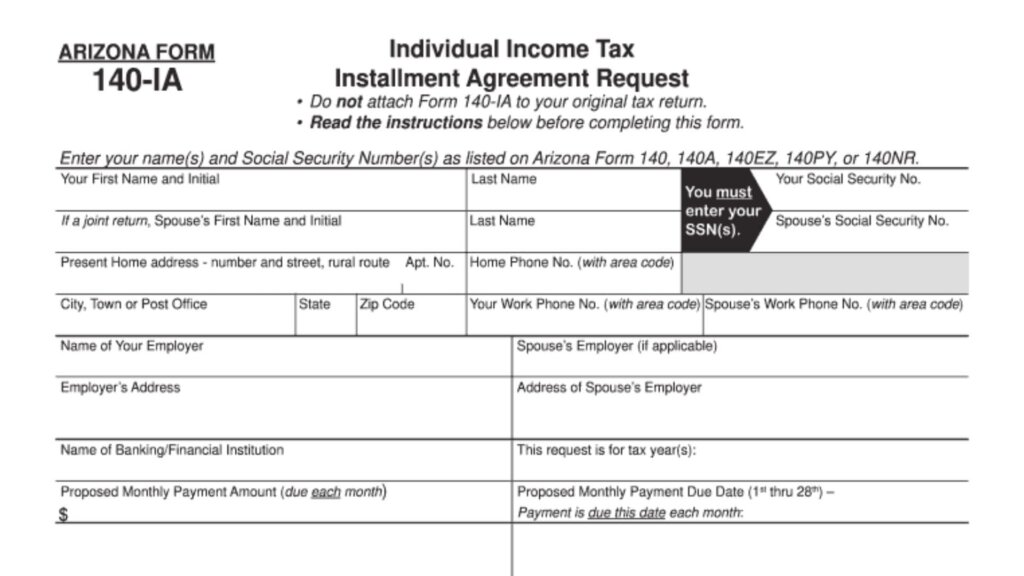

If you are unable to pay your Arizona state tax liability in full, the Department of Revenue may allow you to make payments on an installment basis. You can apply for a payment plan by filling out AZ Form 140-IA or contacting the department. In most cases, the payment plan will be based on your federal-adjusted gross income. You should include all the necessary documents with your application, such as financial information and pay stubs.

The main condition of an AZ state tax payment plan is that you must make your payments on time. The department will cancel your arrangement if you fail to pay the balance due on time or if you accrue new tax liabilities. If your AZ state tax payment plan is canceled, you can face a variety of enforcement actions, including wage garnishments and bank levies.

How To Apply for an Arizona State Tax Payment Plan?

The Arizona Department of Revenue (ADOR) offers a payment plan option for taxpayers who cannot afford to pay their state taxes in full. To apply for a payment plan, you must first complete an Arizona Individual Income Tax Installment Agreement Request form (Form 140-IA). You can download the form from the ADOR website or pick it up at any ADOR office.

Once you have completed the form, you must submit it to ADOR along with the following documentation:

- A copy of your most recent federal Form 1040 and Schedule A

- A copy of your most recent Arizona state tax return

- Proof of income (such as pay stubs, W-2s, or 1099s)

- A list of your assets and liabilities

- A completed Collection Information Statement (CIS) form, if applicable

You can submit your application by mail, in person, or online. If you submit your application by mail, send it to:

Arizona Department of Revenue

Payment Plan Unit

PO Box 27600

Phoenix, AZ 85042-7600

In-Person Application

If you submit your application in person, take it to any ADOR office. To find an ADOR office near you, visit the ADOR website or call 1-800-352-4050.

If you submit your application online, you must create an account on the AZTaxes.gov website. Once you have created an account, you can upload your completed Form 140-IA, CIS form (if applicable), and any other required documentation.

Once ADOR has received your application, it will be reviewed by a tax specialist. The tax specialist will determine whether you are eligible for a payment plan and, if so, what the terms of your payment plan will be. If ADOR approves your application, you will receive a letter with your payment plan information.

Key Tips

Here are some additional things to keep in mind about applying for an Arizona state tax payment plan:

- You must be able to pay at least 20% of your outstanding tax liability upfront.

- Your monthly payments must be at least $50.

- Your payment plan cannot exceed six months.

- You may be charged interest and penalties on your outstanding tax liability.

- If you do not make your payments on time, your payment plan may be revoked and subject to collection action.

If you have any questions about applying for an Arizona state tax payment plan, you can contact ADOR at 1-800-352-4050.

What is Arizona Form 140IA?

The Arizona Department of Revenue requires individuals to file Form 140-IA in order to request an installment payment plan. The form requires personal information such as the person’s name and Social Security number. If filing jointly, the spouse’s information should also be included. The taxpayer must agree to a proposed monthly payment amount and date. Applicants must also attach their most recent tax return and any supporting documents.

Getting the Arizona form 140ia executed electronically is essential in ensuring that the document is legally binding and safe to submit. The use of a trustworthy digital signing platform will help you complete the form faster and more efficiently.

Is Arizona TPT the same as sales tax?

Yes, Arizona Transaction Privilege Tax (TPT) is the same as sales tax. The state of Arizona does not have a separate sales tax, but rather collects a TPT on the sale of goods and services. The TPT rate is 5.6%, and it is applied to the retail sale of tangible personal property and certain services.

Businesses that are required to collect TPT must register with the Arizona Department of Revenue (ADOR) and file TPT returns on a quarterly basis. They must also remit the collected TPT to ADOR. Individuals who purchase goods or services in Arizona are also subject to TPT and are responsible for paying the tax directly to the seller.

Here is a table that summarizes the key differences between sales tax and TPT:

| Feature | Sales Tax | Transaction Privilege Tax (TPT) |

| Definition | A tax levied on the sale of goods and services | A tax levied on the privilege of doing business in a state |

| Imposed by | States and local governments | States |

| Rate | Varies by state and locality | Varies by state |

| Collected by | Businesses | Businesses |

| Remitted to | State or local government | State government |

| Paid by | Consumers | Businesses or consumers, depending on the state |