Does Alabama Income Tax Have a Standard Deduction?

Alabama offers a number of tax deductions and credits. The Federal standard deduction and alimony paid are among the other common deductions in Alabama.

The state of Alabama has a standard deduction that is based on your filing status and income. The deduction amount decreases as your income increases. You can also choose to itemize your deductions. The state of Alabama also allows taxpayers to deduct certain expenses, such as alimony payments and moving costs. In addition to the standard deduction, Alabama allows taxpayers to itemize their deductions. However, the amount that is deductible will decrease as a person’s income increases. Similarly, the state’s standard exemption for married couples filing separately is lower than the amount for married couples filing jointly.

The Cotton State—home to the U.S. Space & Rocket Center and the church of civil rights leader Martin Luther King Jr.—tries to make filing taxes easy on its residents. It has just three income tax rates and only a few brackets, making it one of the most straightforward states to file for. It also offers several deductions to help offset the cost of living in Alabama.

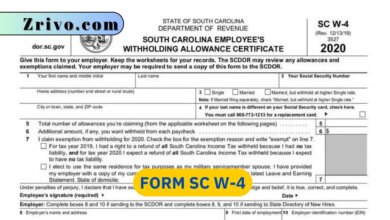

Alabama Standard Deduction

The Alabama standard deduction is based on your filing status and adjusted gross income. The state also allows you to itemize your deductions. You can use a software solution to calculate your Alabama taxes. If you choose to itemize, ensure you have all your information ready. The state requires a lot of information to complete your return, including the amount you paid in federal income taxes.

Alabama Itemized Deduction

If you itemize, you can deduct medical and dental expenses, which must exceed 4% of your Alabama-adjusted gross income. You can also deduct federal Social Security and Medicare taxes that were withheld from your paycheck. You can claim a tax credit for contributions to economic development organizations approved by the Innovative Alabama Authority. The credit is worth up to $500.

Alabama Personal Property Deduction

You can also deduct losses on personal property. These include casualty and theft losses and progressive damage to furniture, clothing, and similar items. You must report these losses on Form 40, page 1, line 10. Special rules apply to property not connected with a business’s conduct or entered into for profit. For more information, see the federal instructions and publications. You can also deduct alimony and child support payments. You must report the name of the payer and the amount you received on Schedule B, Line 4. You must also list exempt interest on Line A and taxable interest on Line B.