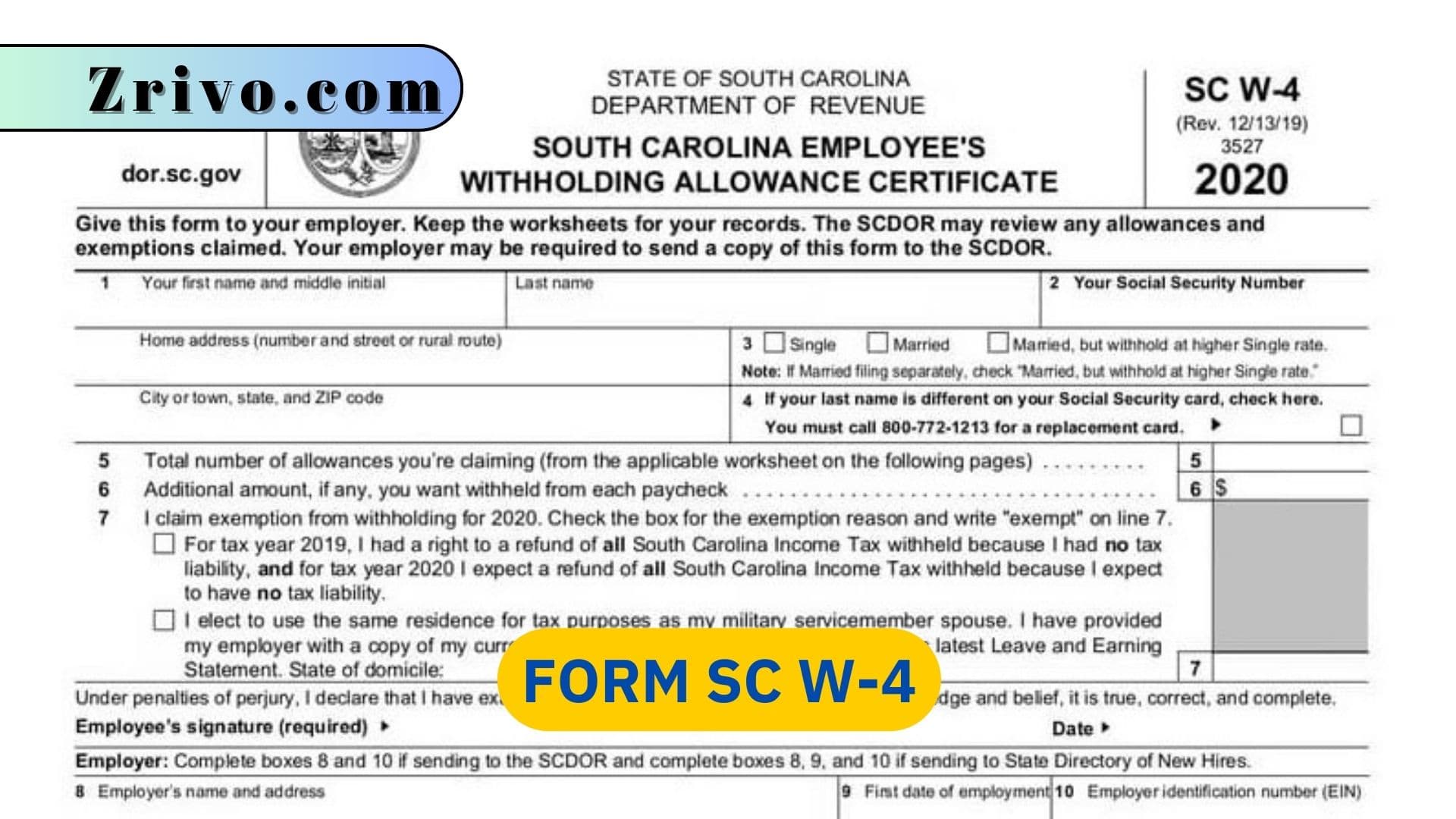

Form SC W-4 2023 - 2024

The information an employee provides on Form SC W-4 determines how much tax is withheld from each paycheck. Employees may want to change their entries on this form when their personal or financial situation changes.

Form SC W-4 is a document that employees fill out to tell employers how much federal income tax to withhold from their paychecks throughout the year. It also collects information about the employee’s state income taxes (and city, county, and local taxes, where applicable).

The purpose of the form is to help ensure that enough tax is withheld for an employee’s needs. For example, if an employee claims too few allowances, it could result in too little tax being withheld, and they may end up owing a significant amount when they file their annual return.

If an employee’s personal or financial situation changes, they should submit a new W-4 to reflect the change. This is especially true if their filing status has changed or they have new sources of taxable income, such as capital gains, rental properties, or freelancing.

While you can’t provide tax advice to your employees or dictate how many allowances they should claim, you can help them complete the form. Provide them with all pages of the IRS form, including the instructions, and make sure they understand what information they need to provide for each question.

Who Must File Form SC W-4?

As an employer, you must have your employees complete Federal Forms W-4, Employee’s Withholding Allowance Certificate. An employee’s filing status, number of dependents, additional withholding amounts, multiple job adjustments, and credits claimed are all recorded on the form. A Form W-4 is invalid if it includes unauthorized additions, deletions or changes, material defacing or writing on other than the requested entries, or if the language by which the employee certifies that the information on the form is correct is removed.

An employee must provide you with a new Form SC W-4 any time their personal circumstances change, such as when they get married, have a child, or experience another major life event. The IRS also recommends that you have your employees update their W-4 if they are unsure about their tax situation or experienced a significant change in income or tax liability for the year. Employers should keep copies of completed forms in their records for four years (see Publication 15 and Topic no. 305, Recordkeeping). If you have more than 250 forms to file, you can file electronically using the Department’s MyDORWAY system.

How to Fill out Form SC W-4?

The first step in filling out a state W-4 is to enter personal information such as name, address, and social security number. The next step is to select the correct filing status (single, married filing jointly or head of household). The last two steps ask for a calculation regarding the number of children and dependents in one’s household. These calculations are based on the standard deduction amounts by filing status and do not factor in allowances, which were eliminated in 2020 by the TCJA.

In step 4, the taxpayer records any adjustments to their withholding based on their specific circumstances. This is usually where people record information such as a second job or, income from freelance work, or itemized deductions that may exceed the standard deduction.