Pennsylvania Sales Tax Exemption Form

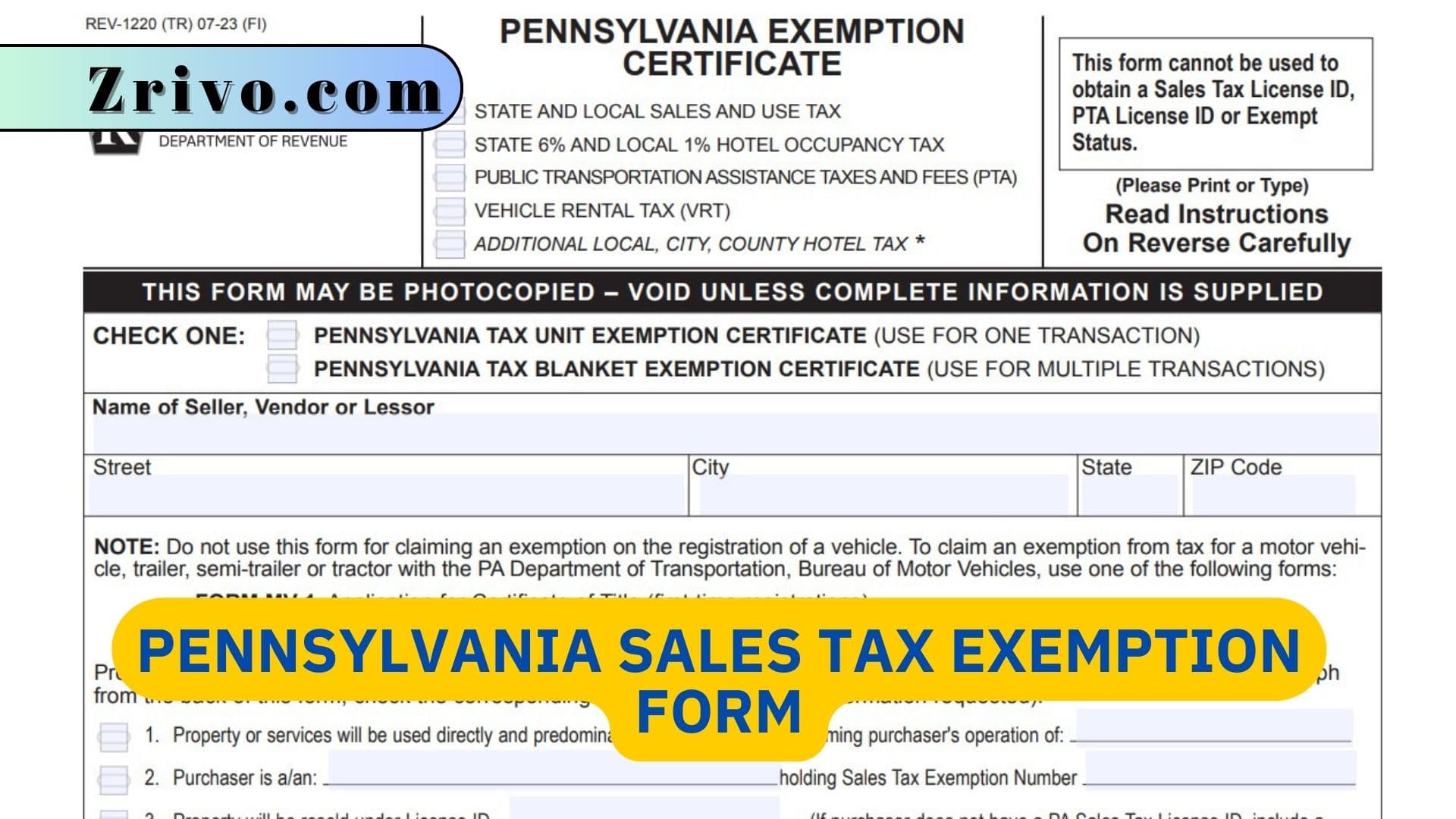

Pennsylvania Exemption Certificate (REV-1220) is presented to the seller to claim a sales tax exemption during a purchase.

The Pennsylvania Department of Revenue recently launched an online application for nonprofit organizations seeking tax-exempt status. The tool is designed to streamline the process, which has been encumbered by lengthy turnaround times and incomplete applications. However, the new tool does not remove the need for applicants to demonstrate their qualification for exemption with the support and documents ordinarily required.

In order to qualify for a sales tax exemption, your organization must be recognized as a 501c3 nonprofit by the Internal Revenue Service (IRS). This guide provides an overview of the process of applying for this recognition and how it can benefit your organization. It also outlines the special tax-exempt language that a 501c3 nonprofit must include in its articles of incorporation to be eligible for the IRS’s sales and use tax exemption.

When you make purchases for resale, you must provide the vendor with a REV-1220 form to show that you are exempt from state sales tax. The form must include the date, the buyer’s name and address, the legal basis of the exemption, and the vendor’s eight-digit sales and use tax number.

Pitt is a member of the Streamlined Sales and Use Tax Agreement, which makes it possible to buy items from other states that are not subject to PA sales tax. You can also use your OneCard, which has the University’s sales tax exemption number printed on it, to avoid paying state taxes when you are traveling.

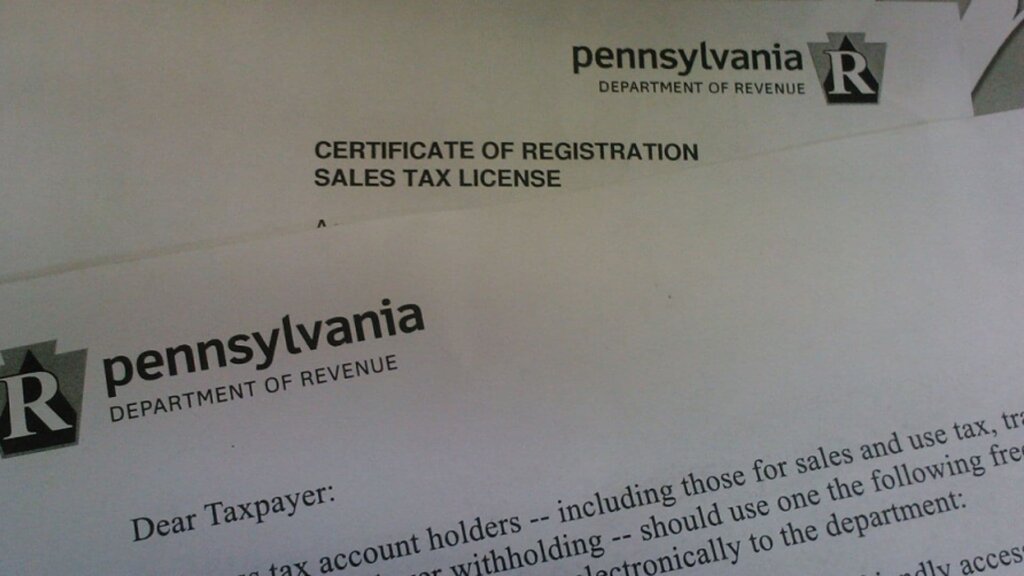

Pennsylvania Sales Tax Registration

A business must register for sales tax in Pennsylvania if it has a significant connection to the state, which is known as having nexus. Nexus is established if the business has a physical presence in the state, sells goods and/or services in the state, or stores inventory in the state. In addition, if the business has affiliate nexus in the state or it sells through marketplaces, such as Amazon, it must register for sales tax.

Generally, all sales tax in the state of Pennsylvania is collected on taxable goods and services. However, some goods are exempt from sales tax, including most non-prepared food items, prescription drugs, and most clothing. Businesses should keep up to date on changes in sales tax laws in the state of Pennsylvania and be sure to register with all relevant agencies, such as the Department of Labor & Industry, local city or county offices, and any zoning boards or health departments.