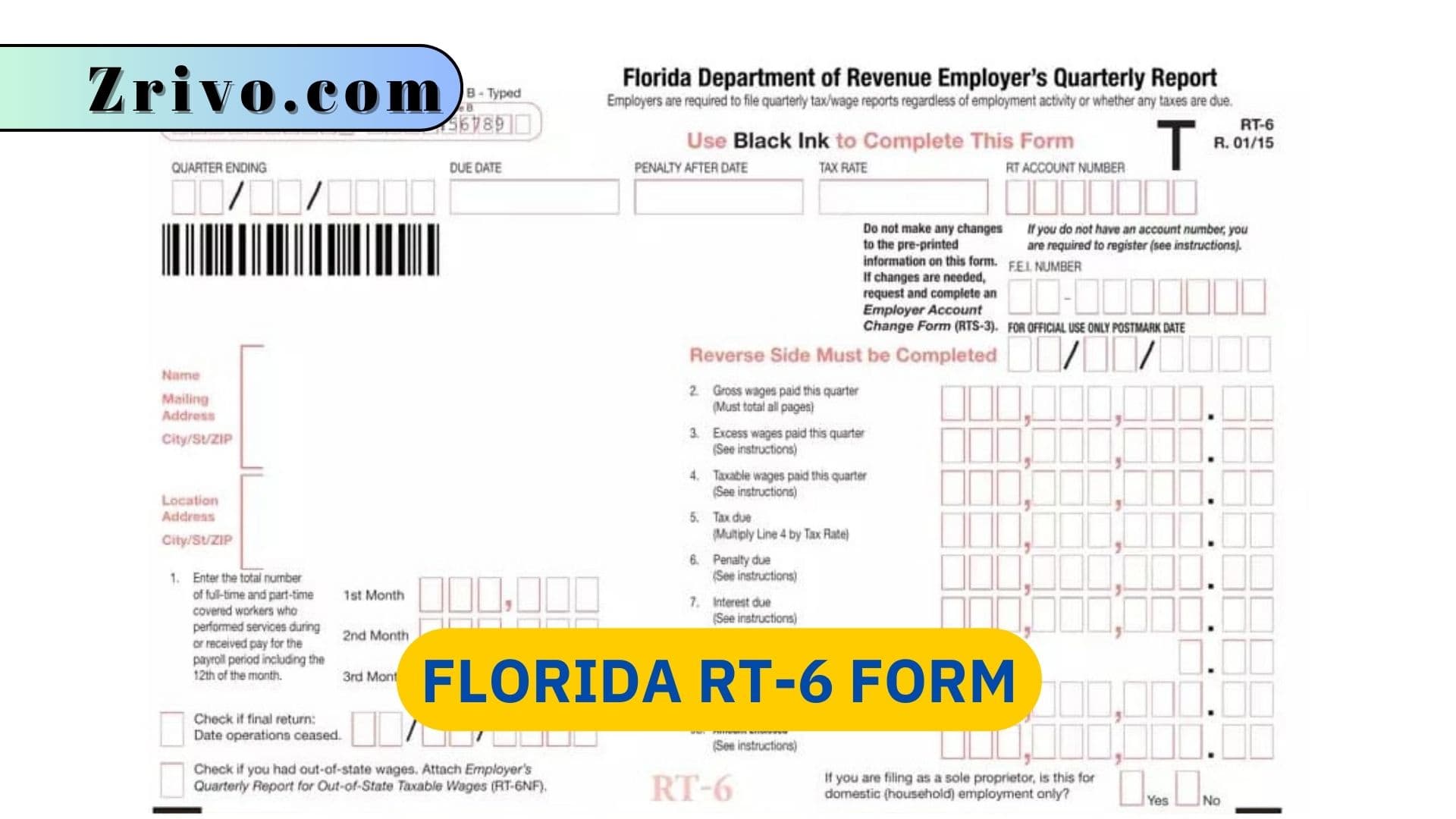

Florida RT-6 Form

Every Floridian employer liable for paying reemployment tax must file a report. This report is called Form RT-6. It is due each quarter.

As the world moves further away from traditional in-office working conditions, completing forms and paperwork is more often done online. The Florida RT-6 form is no exception; many people are now filing their tax documents online. However, it is important to be aware that there are a number of steps that must be taken in order to ensure that the forms you file are accurate and legally binding. One of these steps is to use an eSignature solution. This will allow you to verify the legitimacy of your signature and ensure that your document meets federal government requirements and IRS form specifications.

How to File RT-6 Form?

The Florida Department of Revenue requires employers to file the Employer’s Quarterly Report (RT-6) each quarter. This report is used to calculate payment of the state’s reemployment tax. Each taxable employer is required to file electronically or by paper. In addition to the reporting requirements, the RT-6 also requires detailed information about each employee’s wages and social security numbers.

To file File RT-6 Form electronically:

- Use the RT-6 Electronic Filing screen.

- Select the appropriate filing quarter from the list of options. The system will automatically create a data file for you to upload into the Florida DOR e-services website.

- Print the completed RT-6 from the Utilities menu if you choose to file manually.

You must also include a signed copy of the RT-6 in your submission to DOR.

If you are an employer who owes reemployment tax, filing your reports on time is important. Failure to file a report may result in interest charges. Fortunately, you can avoid this by submitting your reports on time each quarter. You must register for an employer account with the Department of Revenue to do so. Once registered, you will receive a seven-digit reemployment tax account number.

How to Fill out the Florida RT-6 Form?

Filing an RT-6 can be tedious for most business owners and accountants, as it requires a significant amount of employee and business data to complete. Moreover, it is due each quarter, regardless of whether the employer owes reemployment tax or not. This can cause a lot of stress for small businesses that are already struggling to manage daily operations.

The RT-6 can be filled out in an online software program, saving hours (if not days or weeks) of time and eliminating extra filing costs. The software will automatically prepare a file for electronic submission to the Florida Department of Revenue (DOR) via BSWA, an external third-party vendor contracted by DOR to handle e-services. Once the file has been created, it will be saved to the Utilities menu, and the file path and name can then be copied to the Windows clipboard for uploading via BSWA’s browser-based e-services site.